Are you worried about how you’ll manage your money? You may have the perfect budget but then come up short every month.

If you aren’t the type to use a budgeting app, consider free budget printables. They help you stay on track with your finances, see where your money goes, and track the progress of your financial goals. Best of all – they are free!

Table of Contents

What Is a Budget Template

A budget template helps you monitor your spending habits, learn to save money, and reach your financial goals. Think of it like a map for your money. You are a lot more efficient when you have a roadmap, right?

The same is true of your money; it needs a map or a guide to tell it where to go.

Don’t worry; a personal budget doesn’t mean you can’t ever spend money or that someone will yell at you if you splurge. Instead, it’s a way to keep track of your monthly expenses, to know what you spend every month, and to keep better track of your finances.

Whether you have goals to save an emergency fund, pay for a vacation, or want to pay off your credit card debt, a budget template can help.

Why You Should Use a Budget Template

There are hundreds of reasons to use a budget planner, but the most important is to reach financial freedom.

If you feel like money stresses you out, causes fights in your marriage, or you never know where your money goes, a budget template can help.

Simple templates help you understand your finances today and what you’ll have in the future. Imagine having all the money you need for your monthly and variable expenses and big-ticket items like vacations or buying a house. That’s what free budget templates can do for you.

Creating a Budget That Works for You

Of course, you will need more than a free budget worksheet to solve your money problems. But a budgeting template is a great tool to help you solve your money problems and adequately spend your money.

The key is to create a budget that works for you. A printable budget planner should point you in the right direction so you make a budget that works for you and your family.

For example, if you have a family of five, your expenses will look much different than a single person. Even compared to another family of five, you’ll have different needs and financial goals.

Create a template with the budget categories that make sense for your family, and create a budget you can adhere to without putting yourself under too much stress.

How to Use a Budget Template or Planner

It’s easy to use a budget template or planner using these steps:

Add up your monthly income – Determine your total monthly income from all sources, including your full-time job, side hustles, and passive income, such as rent, dividends, or monthly cash flow.

Categorize your bills – Go through your bank statements and determine your monthly and less frequent bills. Monthly bills may include housing, utility bills, medical insurance, food, clothing, and medical expenses.

Less frequent expenses may include real estate taxes, home and life insurance, holiday and birthday gifts, and vacations.

Use a budget planner to see how your monthly expenses fit into your income – As you complete your personal budget planner, you might find that your spending habits are more than you realized or that you need to save more to reach your savings goals. If you use a personal budget template correctly, you’ll learn where to tweak your spending habits to meet your financial goals.

Budget Planning With Low Income

You can still work with a budget planner if you have a low income. In fact, it’s even more vital that you do.

You can determine where to prioritize your funds using printable budget sheets, especially if you’re having trouble making ends meet. For example, if you struggle to pay for the basics, you should look closely at what you can eliminate immediately. You may also consider not contributing to your savings goals or retirement until you work things out.

During times of low income, ensure the following are taken care of:

Basic food

Housing

Household expenses, such as utilities

Transportation

Rules of Budgeting (50/30/20 Rule)

When you can see the light at the end of the tunnel and feel like you have more money to work with, consider using the 50/30/20 rule to keep yourself on track.

With the 50/30/20 budget rule, you allocate your funds as follows:

50% of your fixed expenses

30% to your variable or unnecessary expenses

20% to savings and debt payments

This rule makes keeping track of your income, spending, and financial goals easier by setting spending limits for each.

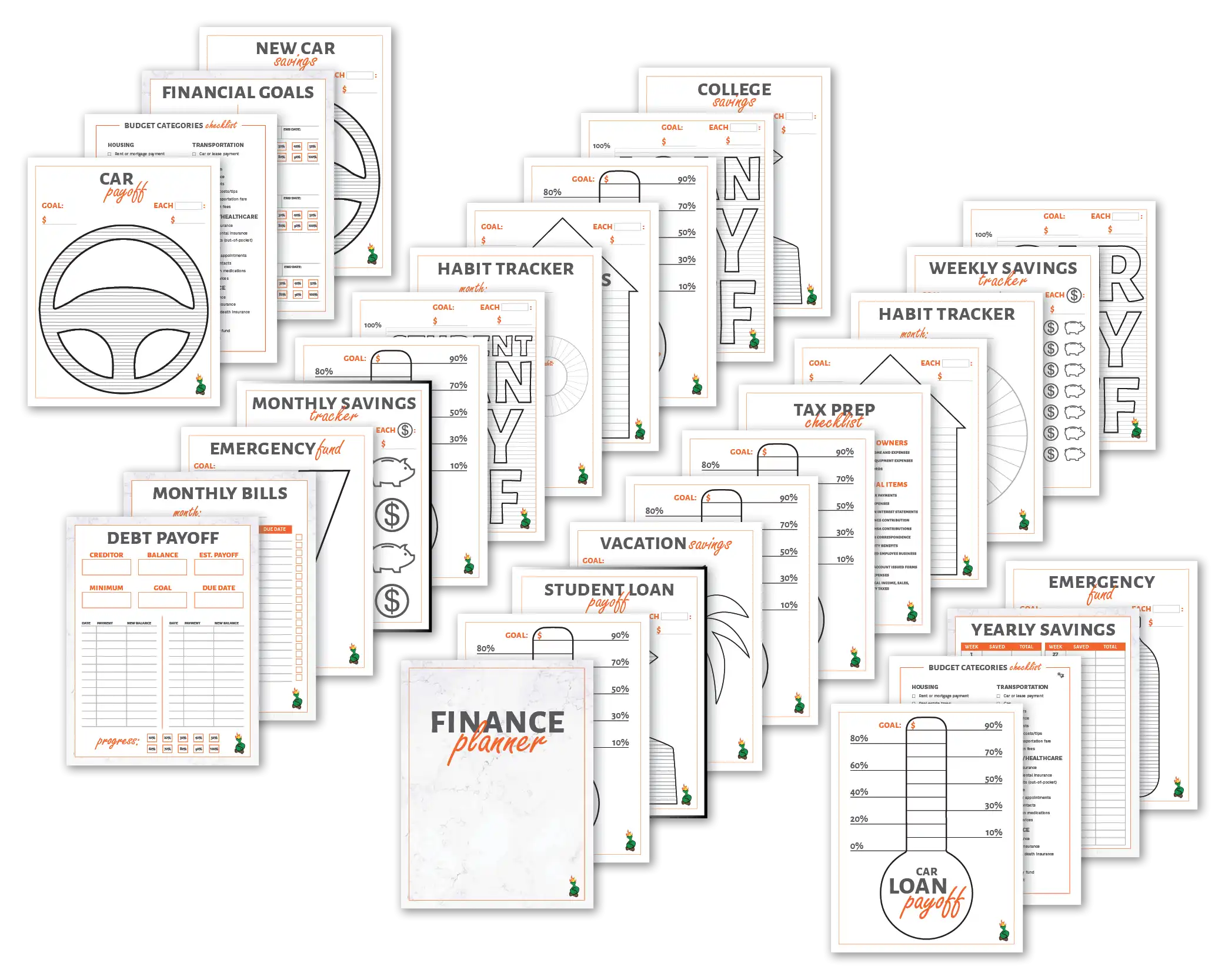

How To Fire’s Budgeting Course and Printables Bundle

Take control of your finances! Grab our bundle of colorable printables to help you pay off debt, save more money and manage your finances more efficiently.

If you’re looking for the complete budgeting package that provides budgeting tips and every monthly budget planner template you could think of, check out our Ultimate Finance Printable Bundle.

You get everything you need and more in this bundle because we thought of everything!

You can:

Track financial goals

Track your monthly budget

Track bills and income

Monitor your annual savings

Check your debt payments and progress

Monitor your retirement savings

Track donations and tax write-offs

Color thermometers for student loans, mortgages, auto loans, credit cards, and other debt payoffs

Track savings weekly, monthly, annually, or for individual events like buying a car or house

Why You Should Consider Using Our Bundle and Course

We provide 77 budget printables for any scenario, timeframe, and financial goal. So you can track all your financial accounts, set goals, track your progress, and ensure you stick to your budget plan.

Who Our Course and Bundle Is For

Our course and financial planning template bundle is for everyone, from beginners to those experienced with a personal budget. If you have financial goals, such as getting out of debt, saving money for an important goal, or making sure you live within your means, our budget printables are for you.

19 Other Free Budget Printables for Any Budgeter

The sky’s the limit when looking for a free printable budget planner. However, there are options for everyone; whether you’re a single mom, a large family, looking to be frugal, or want to use the zero-based budget, there’s a free printable budget worksheet for you!

1. Single Mom Income – Free Budget Template

Check out the Single Mom Income free printable budget binder if you like pen and paper budgets. She offers a budget sheet and expense tracker, goals sheet, menu plan, and monthly to-do list too!

2. Frugal Fanatic – Free Monthly Budget Template

If you’re new to budgeting, the Frugal Fanatic offers an excellent starter budget template. It covers all the bases regarding budgeting categories and provides a visual regarding how well you stick to your budget.

If you set a budget but don’t monitor how much you spend, you might not follow the budget as well as you think. This monthly budget worksheet helps you see how you’re doing and what changes you should make.

3. Clean and Scentsible – Printable Family Budget Template

Clean and Scentsible offers a free printable budget binder that includes the following:

Budget at a Glance: This budget worksheet breaks your budget down into specific categories so you can see where every dollar goes

Monthly Budget Tracker: If you wonder how you’re doing compared to the budget you set, the Monthly Budget Tracker will tell you

Budget Overview: If you want a quick overview of your budget without specific categories, this simple budget worksheet will help

Debt Tracker: Everyone should know where they stand on their debts, and the debt tracker makes it easy without being overwhelming

4. Just a Girl and Her Blog – Full Budget Planner

Just a Girl and Her Blog offers a comprehensive money-saving binder process that promises to help you achieve your financial goals.

It includes the following:

A goal-setting sheet to set your goals for the year

A recurring expense worksheet

A monthly expenses worksheet

A monthly check-in page to help you see your progress and what you should change

5. Pinch a Little Save a Lot – Essential Money Management Worksheets

If you’re looking for a family budget worksheet, look no further than Pinch a Little Save a Lot’s Money Management Essentials.

The free printable budget worksheets include everything you need to create and use a budget. A few of the standout worksheets included are:

Household Account Numbers – If you’ve ever lost an account number, you know how helpful this can be.

Bill Payment Checklist – If you have a lot of bills and need to keep track, this can be helpful!

Debt Repayment Plan – Staying on top of your debt payments is essential to get out of debt.

6. Blooming Homestead – Free Printable Budget Templates

Blooming Homestead offers free budget worksheets that you can print in three styles. So if you’re looking for pretty budget binder printables, you’ll find them here! They include everything you need, including month and week-at-a-glance printable budget planners.

7. A Mom’s Take – Family Budgeting Free Printable

A Mom’s Take offers a free family budget printable for beginners. The blog owner Janel created this budget worksheet when she realized she and her new husband were not handling money properly.

She wanted simple templates to help them take control of their budget, and now she is sharing the free printable budget worksheet with you!

8. A Spectacled Owl – Free Printable Family Budget

If you want a budget with a column for budgeted and actual spending created in pretty colors, check out the family budget printable from A Spectacled Owl. You can track your income, expenses, and goals (including progress) to help you get on track with your finances.

9. Frugal Mom(eh!) – Free Monthly Budget Sheet and Envelopes

If you love the cash envelope budget, check out the free monthly budget printables from Frugal Mom(eh!). Not only do you get free printable budget worksheets, but you also get pretty cash envelopes to print to stay on track with your budget.

10. Printable Crush – Free and Printable Budget Worksheet

Get your free family budget printable from Printable Crush and enjoy these great budget worksheets’ clean lines and ease of use. But, if you want a version you can edit, you can pay a little bit and get the same worksheets but with the rights to edit to make it all yours!

11. Wendaful – Printable Paycheck Budgeting Template

If you love a colorful budget planner or binder, check out the printable budget planner from Wendaful. You can print your pages in various sizes, making it easy to get the best budget tracker that suits your style.

12. Penny Pinchin’ Mom – Printable Budget Template

Tracie, the Penny Pinchin’ Mom, is a pro at budgeting, and her free budget planner includes 50+ budget categories to ensure you have everything you need to create your budget. You can make it as simple or complex as you want using this free budget tracker to keep you on track.

13. Sugar Spice and Glitter – Budget Planning Worksheets

You’ll love the Sugar Spice and Glitter free family budget printable if you love journaling and coloring. It’s color-coded to make it easy for beginners to create a budget and fun for even those experienced in budgeting.

The budget planner worksheets are also available as free online budget planners.

14. My Frugal Home – Printable Monthly Budget Worksheet

If you’re like us and don’t want to miss one tiny detail, My Frugal Home offers a comprehensive free family budget printable. It covers EVERY base you could think of and then some, so you’re sure not to miss any categories.

15. Pretty Providence – Free Basic Budgeting Worksheets

The free basic budget worksheet from Pretty Providence is perfect for people who like to keep things simple but be sure they’re tracking their budget. It’s not elaborate, but it gets the job done, and for some, simple is better.

16. BobbiPrintable – Monthly Budget Planner

Sticking with the simple theme, BobbiPrintable offers a simple monthly budget template that’s easy to understand and fill out. You don’t have to worry about getting overwhelmed or not having enough time to budget with this free budget planner.

17. Moritz Fine – Zero-Base Budget Template

The zero-based budget is a popular budgeting method, and Moritz Fine offers a great budget planner to go along with the budgeting method. It’s pretty and simple; what more could you ask for from a free budget planner?

18. Ladies Make Money – Monthly Budget Planner

Another simple budget template is from Ladies Make Money. It tracks your income, expenses, savings, debt, and goals on one page. So now there’s no excuse not to budget monthly.

19. Savor + Savvy – Monthly Budget Planner Printable

If you have only a few budgeting categories and want something simple, the monthly personal budget worksheet from Savor + Savvy is perfect. It’s a blank budget worksheet that’s easy for beginners or someone who likes basic budget worksheets.

Creating a Budget Binder

Creating a budget binder is the best way to stay on top of your finances. You have complete freedom over setting it up, but it should include budget binder printables that make sense for your family’s budgeting style.

What Is a Budget Binder

A budget binder is a binder or folder where you keep all of your financial documents. It’s a planner for your money. Just like you plan your day, a budget binder ensures you know where your money goes, how much debt you have, and if your family budget is working the way you set it up.

Supplies Needed to Create Your Binder

The supplies mentioned are ideal, but you can personalize your budget binder however you see fit.

Consider including the following.

A Cover – The cover is just for aesthetic appeal and to ensure you don’t lose your budget binder with weekly and monthly budget printables.

A Goal Sheet – Everyone should set goals for the month, year, and even long term. Your family budget planner should have a sheet that mentions the goals and allows you to track your progress.

Monthly Budget Tracker – A monthly budget worksheet sets your monthly budget and tracks your progress. When making a budget worksheet, think about what you want on it, such as your proposed budget and actual spending, as well as which budget categories you want.

Purchase Tracker – Tracking your purchases is just as important as monitoring your budget. Knowing where you spend your money is essential. This is a crucial financial worksheet to keep in your binder as a reminder of your financial goals.

Monthly Check-In Sheet – No matter how good the financial planning worksheet you use, it’s not helpful unless you follow through on your plan. A monthly check-in sheet is a good budgeting tool to help you see how your current budget is helping you reach your financial goals.

4 Best Budget Binders (Free!)

Just like there are many free printables for monthly budget templates, there are many free budget binder printables too.

1. Waylos – Printable Budget Binder

Waylos offers every home budget worksheet you could think of in your budget binder. Unfortunately, you must sign up for their email newsletter to get the free printable budget templates, but it’s worth it!

2. Freebie Finding Mom – Printable Budget Binder

Who said budgeting had to be boring? Freebie Finding Mom created fun binder worksheets that make budgeting seem less of a chore and more fun than you might want to admit.

3. Families for Financial Freedom – Printable Budget Binder

If you want more than one free family budget printable, check out the printable budget binder sheets from Families for Financial Freedom. They’ve covered every base, including debt payoff tracking, goals, expenses, and a monthly budget review template.

4. Simple Stacie – Printable Budget Binder

If you want to fill your binder with pretty pages, Simple Stacie offers a free personal budget template with 20+ worksheets, making tracking your budget easy.

Finding the Right Template for You

Remember, the right free household budget template for you may not be what your BFF uses, and that’s okay!

Think about how simple (or complicated) you want your household budget worksheet and what you want to track. For example, are you looking for a budget template, or do you want to track savings, debt payoff, and actual spending too?

FAQs

What Should I Do if I Don’t Know Which Recurring Payments I Have?

If you need help determining which bills come out of your account each month, gather your last 6 – 12 months of bank statements and go through them line by line. If you use credit cards, be sure to check them too.

How Do You Know the Right Amount to Budget in Each Category?

There is no right or wrong way to budget. If you want a method, consider the 50/30/20 rule that allows you to spend 50% of your income on fixed expenses, 30% on variable, and 20% on savings and debt payoff.

Of course, any budget you use should have a higher income than expenses, or you’ll spend more than you make.

Are There Free Budget Apps?

There are many free budget apps, but our favorite is Empower! You can do everything, including syncing your bank account to it, and don’t pay anything for it. However, you must be okay with dealing with many targeted ads.

The Bottom Line

No matter how you track your budget, the key is that you do it! A free printable budget worksheet is only good if you use it. Choose the budget worksheet template with all the categories and features you need and create the perfect monthly budget!

Samantha Hawrylack is a personal finance expert and full-time entrepreneur with a passion for writing and SEO. She holds a Bachelor’s in Finance and Master’s in Business Administration and previously worked for Vanguard, where she held Series 7 and 63 licenses. Her work has been featured in publications like Grow, MSN, CNBC, Ladders, Rocket Mortgage, Quicken Loans, Clever Girl Finance, Credit Donkey, Crediful, Investing Answers, Well Kept Wallet, AllCards, Mama and Money, and Concreit, among others. She writes in personal finance, real estate, credit, entrepreneurship, credit card, student loan, mortgage, personal loan, insurance, debt management, business, productivity, and career niches.