VTSAX vs VTI is a hot topic in the FIRE community. They are a great way to diversify portfolios but also have vast differences. While they are both Vanguard funds, VTSAX is a Vanguard mutual fund, whereas VTI is a Vanguard ETF, but the differences don’t end there.

If you’re wondering how to set up your brokerage account best or how to save for retirement, considering VTI and VTSAX can provide the diversified portfolio you want with much less work than finding individual stocks and alternative investments.

In this post, we’ll cover VTI vs VTSAX, the similarities and differences, and what you should consider when adding either one to your investment portfolio.

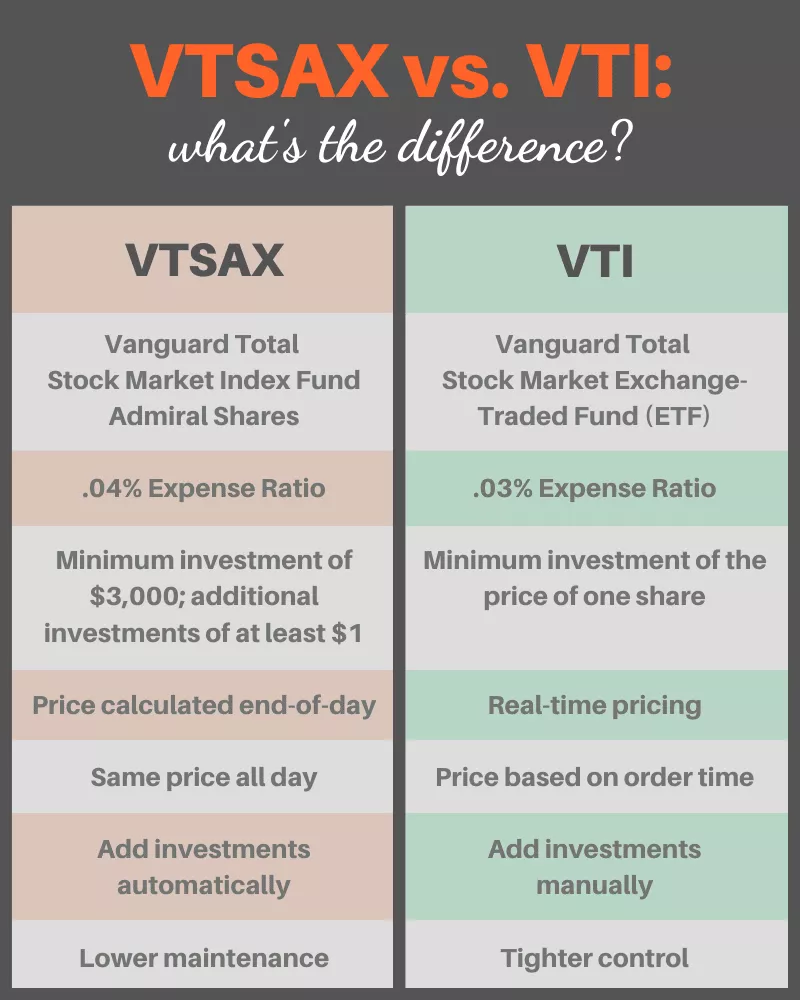

VTSAX vs VTI – Side-by-Side Comparison

What Is VTSAX?

VTSAX stands for Vanguard Total Stock Market Index Fund Admiral Shares. It provides low-cost but broad exposure to the stock market. The fund’s inception date was 11/13/2000, includes small, mid, and large-cap stocks, and has had an average return of 7.30% since inception.

The VTSAX mutual fund has a $3,000 minimum investment and a 0.04% expense ratio, whereas the average expense ratio of similar funds is 0.78%. Actively managed mutual funds usually have higher expense ratios than passively managed ETFs, but that’s not necessarily the case with the Vanguard mutual funds.

Pros

- Passively managed: VTSAX doesn’t try to beat the market but instead mimics its returns. This helps with the low expense ratios, keeping more money in your pocket.

- Well-diversified: VTSAX invests in all market caps, so you don’t have to choose between small, mid, or large-cap stocks; you get them all with this fund.

- Additional investments allowed: After meeting the initial $3,000 investment requirement, you can invest in increments of $1 in the mutual fund.

Cons

- Large minimum investment: You can’t invest in VTSAX until you have $3,000 to invest. This makes it challenging or risky for new investors and is a much higher minimum investment than VTI.

- Only domestic funds: VTSAX only invests in domestic funds. No international funds are included in the fund.

- Won’t outperform the market: VTSAX was built to track the market, not beat it.

Top Portfolio Holdings

| Company | Ticker |

| Apple | AAPL |

| Microsoft | MSFT |

| Amazon | AMZN |

| NVIDIA Corp | NVDA |

| Alphabet Inc. Class A | GOOGL |

| Tesla Inc. | TSLA |

| Facebook Inc. Class A | META |

| Alphabet Inc. Class C | GOOG |

| Berkshire Hathaway Inc. Class B | BRK.B |

| Exxon Mobil Corp | XOM |

| UnitedHealth Group Inc | UNH |

| Eli Lilly & Co | LLY |

| JPMorgan Chase & Co | JPM |

| Johnson & Johnson | JNJ |

| Visa Inc. Class A | V |

Historical Performance

VTSAX has had stable returns since its inception despite the economy’s rocky road during the 2000 dot.com crash, housing recession, and, most recently, the 2020 pandemic. Its 10-year return is 10.47%, 5-year 10.15%, and current YTD is 9.39%, which is good for index investing.

What Is VTI?

The Vanguard Total Stock Market ETF is the exchange-traded fund version of VTSAX. When comparing VTI and VTSAX, you’ll see that they both track the US stock market. Like VTSAX, it includes small, mid, and large-cap stocks and uses a passive investment strategy. Since its inception on May 24, 2001, VTI has had an average 7.66% return.

Pros

- Low expense ratio: VTI has a slightly lower expense ratio of 0.03% than the VTSAX expense ratio because it is an exchange-traded fund.

- Tracks the entire market: VIT is a diversified portfolio that’s comprised of all the market’s stocks from small to large.

- Low minimum initial investment: Only requires a $1 minimum initial investment or the equivalent of one share.

Cons

- It tracks but doesn’t beat the market: VTI isn’t an aggressively traded fund, so it will only mimic the market’s returns, not beat them.

- A lot of weight in top ten stocks: Most of the fund’s weight is in the top ten stocks, skewing the investment funds slightly.

- Must wait for funds to settle to reinvest: You can’t reinvest settled funds on the same day; you must wait two days after order execution.

Top Portfolio Holdings

| Company | Ticker |

| Apple | AAPL |

| Microsoft | MSFT |

| Amazon | AMZN |

| NVIDIA Corp | NVDA |

| Alphabet Inc. Class A | GOOGL |

| Tesla Inc. | TSLA |

| Facebook Inc. Class A | META |

| Alphabet Inc. Class C | GOOG |

| Berkshire Hathaway Inc. Class B | BRK.B |

| Exxon Mobil Corp | XOM |

| UnitedHealth Group Inc | UNH |

| Eli Lilly & Co | LLY |

| JPMorgan Chase & Co | JPM |

| Johnson & Johnson | JNJ |

| Visa Inc. Class A | V |

Historical Performance

VTI has also had stable returns since its inception. VTI has average returns of 7.66% and a 10-year average of 10.46%. Its most recent 1-year return was 8.34%, and current YTD is 9.41%.

VTSAX vs VTI – Key Differences

With a basic understanding of how the funds work, let’s look at the difference between Vanguard VTI vs VTSAX.

Investment Type

The largest difference between VTI vs VTSAX is that VTI is an ETF, and VTSAX is a mutual fund. This means VTI shares trade throughout the trading day, like stocks. VTSAX, on the other hand, only trades at the end of the day based on its net asset value (NAV), or the average of all buy and sell orders since its last settlement. So you don’t get real-time pricing; you get the same price as any other trader, no matter the time of day they placed their order.

Expense Ratio

When comparing the VTI vs VTSAX expense ratio, you’ll find that they are different but not that much different. The VTI expense ratio is 0.03%, and the VTSAX expense ratio is 0.04%. Both are vastly below the average expense ratios for other investments of 0.78%.

Tax Efficiency

An investment’s tax efficiency is just as important as its performance and returns. High tax liabilities can reduce your earnings and retirement income. Generally, ETFs are more tax efficient than mutual funds, but the way Vanguard has both investments set up, they tend to be somewhat similar.

Typically, ETFs distribute fewer capital gains than mutual funds and have a closed-end setup that doesn’t allow for limitless shares, keeping the capital gains and, therefore, the capital gains tax to a minimum. In contrast, mutual funds are limitless and usually incur higher capital gains taxes.

Here’s how VTSAX vs VTI tax efficiency stacks up.

VTI is an ETF, which means ETFs are sold to another authorized participant, not the general public. Because this isn’t a ‘sale,’ there aren’t any capital gains, which increases its tax efficiency.

VTSAX is a mutual fund that usually has higher capital gains. However, the Vanguard Group, Inc. patented a method called heartbeat trading, which eliminates taxable gains for mutual fund shareholders when money is rapidly pumped into and out of ETF portions of a mutual fund equivalent like VTSAX reduces them.

Minimum Investment

The minimum investment requirement is another large difference between Vanguard VTI and VTSAX. VTI, as an ETF, requires only a $1 minimum investment. However, VTSAX requires a much higher investment of $3,000. After your initial investment, you can add more investments in lower increments, but the initial investment is quite high.

Real-Time Pricing

Again, because VTI is an ETF, it has real-time pricing, trading during the regular trading day. VTSAX, as a mutual fund, doesn’t have real-time pricing. Traders get the end-of-the-day price or the NAV. VTI is best for active traders who want to trade often, whereas VTSAX often makes a good passive or hands-off investment for long-term investors.

Automatic Investments and Withdrawals

Mutual funds, like VTSAX, often allow automatic investments and withdrawals because you can hold fractional shares.

However, ETFs require manual investments and withdrawals because the price always changes throughout the day, and you cannot hold fractional shares (except at some brokers).

Liquidity

The liquidity of VTSAX vs VTI is somewhat similar, but the price you get when you place the order and the funds settle depends on the type of investment.

VTI provides real-time pricing, so you know the exact price you’ll get when you settle.

VTSAX, on the other hand, doesn’t settle until the end of the day, so your settled price is yet to be determined.

Investing Style

Your investing style plays an important role in choosing between VTI vs VTSAX. VTI is a better choice if you’re an active investor trading often. However, if you want something more passive that you could invest and forget, VTSAX is the better choice.

Transparency

ETFs, as a whole, are more transparent than mutual funds. Anyone can find information on ETFs, including VTI. Mutual funds only provide information quarterly, often with a 30-day lag.

VTSAX vs VTI – Similarities

As different as VTI and VTSAX are, they have some similarities, too.

Index Tracking

Both funds track all domestic funds, including small, mid, and large-cap stocks. They aren’t in it to beat the market. Instead, they track the market, providing similar returns with automatic diversification.

Volatility

VTI and VTSAX are highly volatile because they invest in the entire stock market. As you’ve likely seen, the stock market can be highly volatile, but if you’re in it for the long term, you can ride out the volatility and see high annual returns.

Diversification

Both VTSAX and VTI are highly diversified for you. Once you invest in one of the funds, you’re invested in all domestic funds without the need to diversify yourself.

Why Do Investors Choose One Over The Other?

The choice between VTSAX vs VTI relies on your investment strategy. If you’re an active investor who likes control over his investment fund, VTI is a better option because ETFs trade throughout the day with real-time pricing.

However, if you want something more passive that you can set and forget, VTSAX is the better option. It’s much lower maintenance, allowing you to reach your goals without worrying about its value daily.

Of course, the ultimate distinction is how much you must invest, as VTSAX requires a $3,000 minimum investment, and VTI requires only $1.

Where To Find VTSAX and VTI

While you can find VTSAX and VTI at brokers besides Vanguard, you’ll likely pay more fees, reducing your earnings by doing so. Your best bet is to purchase these funds through Vanguard to keep your expenses minimal.

Converting From VTI to VTSAX

If you have your eye on the passive nature of VTSAX but don’t have the $3,000 required investment, you can first invest in VTI. Once you have the $3,000 minimum investment, you can settle your VTI funds and purchase VTSAX funds.

Can I Transfer VTSAX to VTI?

You can transfer VTSAX to VTI by calling Vanguard to avoid triggering a taxable event. However, if you settle the shares yourself, you could face capital gains taxes.

FAQs

Are VTSAX and VTI The Same?

VTSAX and VTI are both index funds, but VTSAX is a mutual fund, and VTI is an ETF. They have similar funds but different minimum investment requirements and trading rules. VTI funds trade throughout the day at real-time prices, and VTSAX trades at the end of the trading day at a price dependent on the day’s buying and selling.

Which Is Better, VTI or VTSAX?

When comparing VTI vs VTSAX, they are very similar and one isn’t better than the other per se. Instead, it depends on the investment options you prefer. For example, VTSAX requires a $3,000 minimum investment, whereas VTI requires only $1. VTSAX is also hands-off, whereas VTI requires more active investing, so the better option for you is the one that suits your investing needs.

Is It Easier to Invest in VTSAX or VTI?

VTSAX and VTI are easy to invest in; however, the minimum investment requirement may be a barrier to some. VTSAX requires a $3,000 investment, which may limit the opportunity for some investors.

Why Do People Love VTSAX?

VTSAX is popular because it spreads your funds across 3,000 investments with one investment. They also love that it’s a passive investment. You could purchase it and forget about it for years if you desire. The fun automatically diversifies your funds, making it easier to reach your retirement goals.

Is VTSAX Enough?

VTSAX can be enough, depending on your investment strategy. New investors or those who don’t want to be bothered with active investments do well investing all their money in VTSAX since it’s a well-diversified fund.

Is VTSAX A Good Retirement Fund?

VTSAX has a 10.47% 10-year average return, making it a good option for a retirement fund. Since the key to retirement is diversifying your investments, VTSAX does the work for you, making it a great option to capture the total stock market.

Is VTSAX Good For Beginners?

VTSAX is good when you begin investing if you have at least $3,000 to invest. Because it’s passively managed, you can set it and forget it. However, if you don’t have $3,000 yet, you can invest in VTI and transfer to VTAX once you accumulate $3,000, both offer a total market fund.

Is VTSAX Good For a Roth IRA?

VTSAX is good for traditional and Roth IRAs. Even though Roth IRAs are already tax efficient, VTSAX offers diversification needed for retirement funds.

Does VTI or VTSAX Have Better Returns?

The VTI vs VTSAX returns are quite similar, with VTI funds having a 10.46% 10-year return and VTSAX having a 10.47% 10-year return.

Is There a Penalty For Withdrawing From VTSAX or VTI?

There is no penalty for withdrawing from VTSAX or VTI. They are investment options, not the actual type of investment account. However, you may pay capital gains taxes if you realize a profit from the sale of either investment.

Does It Make Sense to Own Both VTSAX and VTI?

It usually doesn’t make sense to own both VTSAX and VTI since they are nearly identical investments, mimic the same market, and have similar investments. Instead, decide the investment style you prefer, ETF or mutual fund, and which is more affordable for you.

Does One Offer More Growth Than The Other?

When comparing average returns over time, VTI and VTSAX are almost identical.

What Is Better, VTI or VTSAX?

Choosing VTI vs VTSAX may feel like a tremendous decision, but don’t lose sleep over it. Both funds offer incredible diversification, which can help you reach your FIRE goals faster. The key is determining which investment style you prefer, and whether you want a more active or passive approach to your retirement funds.

If you’re looking for more information on how to invest to reach financial independence and eventually retire early, check out our guide to investing.

>> Want to see how investing could impact your retirement date? Check out our FIRE Calculator.

What investments have you chosen to optimize your portfolio? Have you ever invested in VTSAX or VTI? Let us know in the comments!

Samantha Hawrylack is a personal finance expert and full-time entrepreneur with a passion for writing and SEO. She holds a Bachelor’s in Finance and Master’s in Business Administration and previously worked for Vanguard, where she held Series 7 and 63 licenses. Her work has been featured in publications like Grow, MSN, CNBC, Ladders, Rocket Mortgage, Quicken Loans, Clever Girl Finance, Credit Donkey, Crediful, Investing Answers, Well Kept Wallet, AllCards, Mama and Money, and Concreit, among others. She writes in personal finance, real estate, credit, entrepreneurship, credit card, student loan, mortgage, personal loan, insurance, debt management, business, productivity, and career niches.

Camille

Monday 25th of September 2023

Thank you for the great article. What do you recommend investing in for an international fund and bond fund?

JB

Friday 21st of August 2020

These are excellent answers to all of my questions, I was trying to figure out the difference between the two funds and you nailed it. Thank you!

Chris@TTL

Thursday 16th of July 2020

Just a quick "thanks" -- I was doing some quick googling to identify VTSAX v VTI differences, primarily in expense ratios plus the automatic investing differences. I saw a familiar blog and boom you guys answered my questions.

Cheers!

Pauly

Sunday 21st of June 2020

Good article thank you! I just moved my wife's 401k out of an expensive TDF. Her company allows her to self direct but it charges $25 for each mutual fund transaction. We will def be gohe VTI route which is free.