To reach financially independent (FI) is to not have any need of financial assistance from anyone else. Ideally you’ll be able to support yourself, any dependents, and still have enough money left over for emergencies. Achieving FI does not necessarily mean that you then have to retire. Some choose to pursue a passion project, start a business, or switch to part time work.

In short, financial independence entails having an amount of money large enough to last you for the rest of your life, no matter how long that may be.

Want to learn how to FI? Continue reading this article and you’ll learn all about financial independence!

Table of Contents

What Is FI?

FI stands for Financial Independence. It is often times referenced as FI, FIRE or FI/RE. FIRE stands for Financial Independence Retire Early. FI/RE is a combination of the two and simply means Financial Independence, Retire Early.

Are You Able to Achieve Financial Independence?

For most people, the answer is yes absolutely, you will be able to reach financial independence! Unless you have a disability or inability to work, everyone is able to achieve FI. What holds most people back is lack of knowledge or discipline.

Related article: The Paths to FIRE

What Does Financial Independence Look Like?

Before achieving financial independence: you develop a plan to reach your goal. You live life like you normally would. If you’re just discovering FI, You may be struggling to stay afloat. But know that there’s hope!

Once you’ve paid off your debts and are able to invest a large portion of your income, the rest is pretty boring, and that’s perfectly normal.

It’s just becomes a math equation. How much money do you need invested, to be able to reach your goals in a timely manner.

Example: Saving 50% of your income will enable you to reach FI in approximately 15 years.

Check out our free FIRE Guide to develop a financial plan to get your finances in order so you can start working towards achieving FIRE!

After achieving financial independence: the options are endless. You can do whatever you’d like. Travel the world, spend more time with family, have a business, have free time to pursue hobbies. Or just sit back and watch Netflix all day. If you’re working, you can work less hours or switch to a job that is more meaningful/fulfilling. The third option is spend your time in non-profit work

Remember: personal finance is personal. Everyone will have a different FI number, different safe withdrawal rate, and varying thoughts on retiring early. Focus on your own FI goal, and calculate your own numbers.

What Is a FI Number?

The FI number is the amount of money you need to have saved and invested so that you can live off of it for the rest of your life, no matter how long that may be. Calculating your financial independence number helps you project when your nest egg grows large enough for you to be financially free.

Considerations Before Calculating Your FI Number

There are many things to take into consideration before you determine your financial independence number. Think about the what if scenarios, and how you would plan for them such as:

- How much of a cushion do you want to have?

- How many years of living expenses do you need saved up for?

- If you had a medical emergency, would your savings cover the costs or would that put you into more debt?

- What is your desired annual spending once you reach retirement age?

- Are there any long term care costs associated with a disability?

- Would a disability prevent you from working and what kind of income could you expect if this happened?

- How much money do you need to enjoy life once reaching financial freedom?

Bear in mind that FI calculations are only as good as the information given and the assumptions given. Generally, people assume an average life expectancy of around 80-100 years old. Keep in mind that your current spending habits don’t mean you’ll be spending money the same way during early retirement (if you wish to do so).

Current Total Monthly Expenses (Not Monthly Income)

First, list out all of your usual expenses. One of the biggest mistakes we’ve seen is people forgetting about things like car insurance or home insurance, which can be thousands per year. Make sure you also look at your yearly expenses, such as an annual insurance payment.

After looking through your expenses, note how many of them are fixed costs vs variable costs. Fixed costs are the ones that stay roughly constant regardless of income changes, such as a mortgage, credit card payments, or auto-loans. Variable costs increase and decrease with income changes, such as groceries, recreational activities or entertainment expenses.

In order to estimate your expenses accurately, you will want to know how much these fixed and variable costs tend to change from month to month. If you have a budget spreadsheet with historical data – now is the time to bust that out!

Overall Savings Rate

The savings rate is determined by how much you’re able to save, compared to how much you make.

Savings Rate = Total Monthly Savings / Monthly Gross Income

Example: 25% Savings Rate = $1,250 Saved / $5,000 Gross Income

If you have any other financial goals, such as funding an IRA or 529 plan, try to estimate how much you need to save per month and include this in your calculation.

Income Growth Rate

In order to get a good estimate of your FI number, you need to pick a reasonable income growth rate assumption.

One common assumption is that your income will grow 1-2% every year. This could be based on historical averages or estimated future performance.

Investment Performance

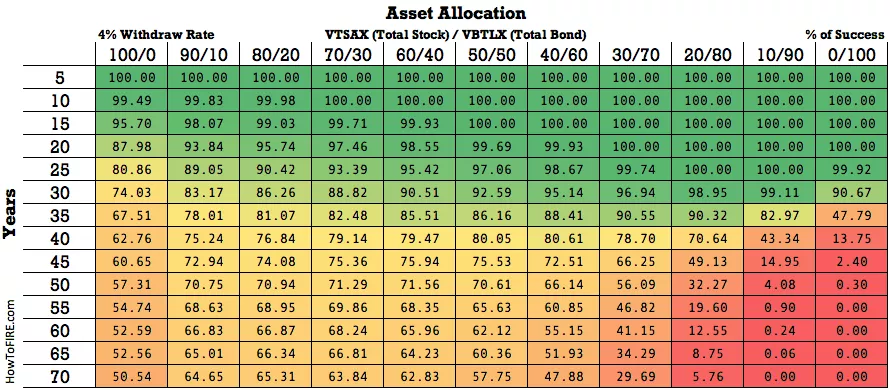

This is the big unknown when it comes to FI calculations. No one knows what the market will do in the future. It’s important to pick an assumption that you’re comfortable with, given your personal risk tolerance and financial situation.

Most people assume around a 6-8% annual return when running projections.

A good rule of thumb is keep a majority of your portfolio in index funds such as VTSAX or low cost ETF funds like VTI.

Once you have all this information, it’s time to get crunching! Keep in mind that the FI number is only an estimate. Be prepared to adjust your financial independence numbers if your assumptions are off or if your expenses are higher than expected.

3 Simple Steps to Calculate Your FI Number

There are several methods to calculating your FI number. Some people prefer spreadsheets, others prefer online tools like our FIRE Calculator.

1. Determine Your Expected Annual Expenses

With the assumptions you’ve chosen, how much do you need to be able to cover your expected annual expenses in the future? Do you plan to spend more or less than you’re spending now?

Consider if you want to travel often, start a business or have more luxuries in life – like going out to eat more. As you age, will you want or need to go into a retirement home or assisted living facility? These are all things to consider when running your projections.

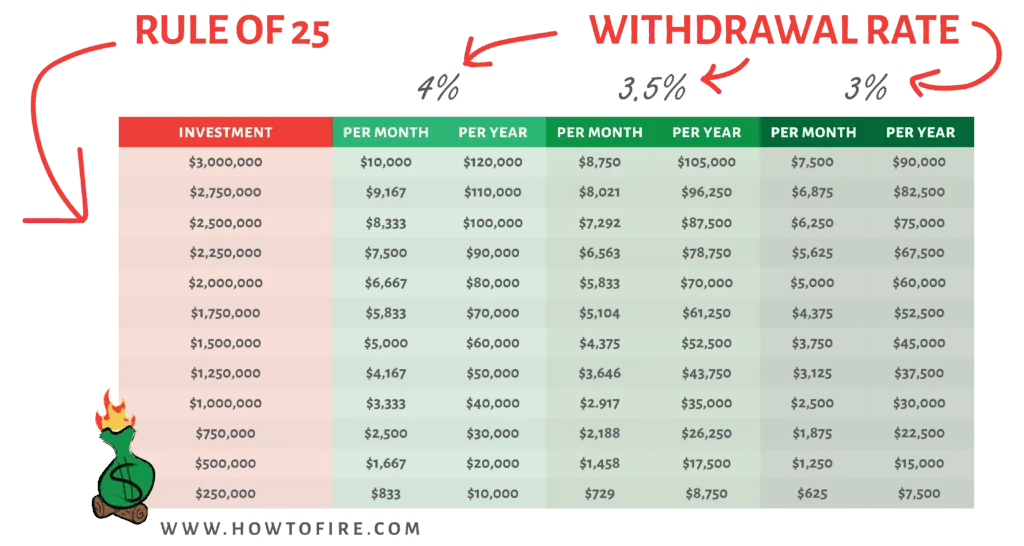

2. Multiply That Number by 25

A general rule of thumb when determining your FI number is to multiply your expected annual expenses by 25. This is where the term “4% rule” was coined from the trinity study.

The 4% is approximately how much you can withdrawal from your portfolio without running out of money.

If your expected annual expenses will be $80,000 you’ll need $2 million dollars to call yourself financially independent.

For a more conservative approach, use 3% or multiply your expenses by 33. Then you’ll need $2.64 million dollars to draw $80,000 per year.

3. Adjust Your Equation as Needed

Find the math that makes you most comfortable and adjust the numbers to what you feel is best. There’s no right or wrong answer as long as you’re being reasonable with your expectations and assumptions.

Some people want to leave a legacy – if that’s you, reduce your draw down rate to a more conservative number. Others want to die with almost nothing, and are content with having a higher safe withdrawal rate.

How Much Money Is Needed to Achieve FI?

The answer to this question is going to vary drastically for everyone, because we don’t all spend the same amount. A general rule of thumb is to take your expected annual expenses and multiply it by 25.

Investments

Properly utilizing your retirement accounts and putting your money into the stock market, drives the entire FI plan. It determines whether you can safely withdraw the required amount of money to live. Most chose not to speak with a financial professional, preferring a DIY approach, but that isn’t for everyone.

Money left sitting in a savings account is not going to earn any money. Consider that an emergency fund, not an investment.

How Much Do I Need to Invest to Reach FI?

The amount you need to invest in order to reach FI is entirely up to you and your desire to do it faster. The more you’re able to invest each year, the sooner you’ll reach financial independence. Adjust how much you’re investing with your goals.

Where to Invest

There are plenty of great places to stash your cash. Here are two of our favorite!

M1 Finance

M1 Finance is a robo-advisor for Millennials, which means it manages your investments and injects discipline into an otherwise lackadaisical process. It’s designed to provide professional trading capabilities that are usually reserved for the elite trader. M1 provides its clients with personalized portfolios that can be tailored to their specific risk appetite, time horizon, and desired goal.

M1 Finance also includes “Pie” selections, which automatically invest your money the way you want. You can also choose from a selection of pre-made professionally crafted options as well.

Manage and grow your wealth with M1 FInance. Founded in 2015, M1 has brokerage accounts, checking accounts, and lines of credit. The site (and app) offer wealth building for today's long-term investors.

- Customizable portfolio management tools

- No fees for account management or trading

- Mix Funds - Stocks and ETFs

- Low minimum investments

- Partial Shares

- No Tax Loss Harvesting

- No financial planning or advisory services

What we like about M1 Finance:

- Easy to use interface

- Free tools to analyze your investment portfolio

- Ability to purchase fractional shares

- Ability to automate investments easily

- They also offer other services such as banking

Vanguard

Vanguard is an investment company that offers the most cost-effective way to invest. Vanguard’s low expense ratio means they pass on more of your investment profits to you, which means you’ll be able to reach your retirement goals sooner.

What we like about Vanguard:

- They’re owned by their customers

- They have a low-cost focus

- Lots of mutual funds with great historical returns

- Great customer support

Automate Investments

It’s always better to set up automated or recurring transactions so you don’t have to think about it anymore. You’re more likely to save money if it happens automatically for you each month too.

Reaching FI doesn’t have to be hard work, but it does require some discipline on your part. Focus on building this into your daily routine and eventually it will become second nature.

Rebalance Yearly

Don’t just set it and forget it. Set an annual calendar reminder to check your stock market allocations. If you’ve added or dropped money, you’ll need to reallocate your assets accordingly.

You can use pie selections like M1 Finance offers to do this for you automatically.

Track Your Progress To FI

Take the time to track your progress. It’s motivating, reassuring and validating.

Use a spreadsheet or an online program like Empower to see how close you are to financial independence. It will be motivating and give you great insight into where you’re at with saving.

Track all of your account balances and your net worth in one place. Get access to a Retirement Planner, Fee Analyzer, Portfolio Checkup, Contribution Calculators, and so much more with, Empower!

- Early pay and cash advances

- Easy account linking

- Earn cash back

- Budgeting tools to monitor spending and expenses

- An inexpensive way to borrow funds

- The amount borrowed is non-customizable

- Requires a subscription

- Low APY

- Need an Empower card to receive free and instant cash advances

Maximizing Income

If you’re able to keep your monthly expenses the same (avoid lifestyle creep!) while increasing your income – your savings rate explodes.

Increasing the Gap

Once you have your FI number, the next step is to increase the gap between what you spend and what you make.

This can be accomplished by increasing your savings rate or decreasing your yearly spending on luxury items.

One good option is focusing on saving more of your income rather than cutting expenses on luxuries, because there are only so many sacrifices you can make.

Your Main “Day” Job

Find opportunities for growth in your industry. If there aren’t options for you to move up at your existing company, consider changing companies. You’d be surprised how much more you can earn just from job hopping a couple of times.

Outside Jobs

If you’re in a position where you’re wanting or able to work additional hours, but work doesn’t offer any – consider a side hustle. Some side hustles, like DoorDash allow you to earn on your own schedule..

Get started delivering food for DoorDash. You choose your own schedule and delivery goals as your own boss. Earn base pay, tips, and promotions with DoorDash.

- Flexible schedule - pick your own hours

- Preview pick-up/drop-off locations - choose your own orders

- Fast Payment

- Maximize earning potential with tips, bonuses, peaks, and hotspots

- Wear and tear from vehicle usage

- Cost of Gas

You could also consider picking up a part time job, or freelancing on the side within your same industry.

Read our article on how to make an extra $1000 a month!

Passive Income

A bit off the beaten path, passive income is a perfect way to increase your earnings outside of the traditional 9-5 work schedule. Passive income can include everything from investing in real estate or rental property to earning royalties from music streaming.

The most common types of passive income streams are dividend stocks and bond interest, which generally do not produce significant amounts of money but offer a stable form of cash flow that doesn’t need much maintenance.

Selling Possessions

For those who have a lot of stuff, selling your possessions can be a great way to earn extra income. Consider selling items you no longer use on eBay or Craigslist. If you have an expensive car or boat, renting it out on Getaround or Turo is another excellent option if you don’t want to sell it.

Cutting Costs

Reducing your expenses is a great way to increase your savings rate. Finding ways to spend less money means more money in your savings account or current investments. This means more money working for you using the power of compound interest.

If you have student loans or high interest debt, those should be your starting point. Aggressively throw extra cash towards paying those off so you can reach FI faster!

Housing

Reducing your housing costs can sometimes be difficult if you’re not in a position to move, or desire to do so. If you are able to, consider house hacking. Here are some other ways to reduce your housing costs:

- Consider renting a room out on AirBNB

- Rent out your garage or parking space on Neighbor

- House hacking

Transportation

Driving a fancy, expensive car, won’t enable you to reach financial independence faster. It’s sole purpose is to get you from point A to B. Consider driving older, more affordable vehicles. If you already have a nicer car, you could rent it out on Turo or share it on Getaround. (https://www.howtofire.com/getaround)

Food

Eating at restaurants every night will really drain your wallet. Cook more meals at home, and you’ll notice a big difference in your bank account. If you’re not much of a cook, consider buying groceries to cook during the week or try meal prepping to save time and energy!

Shopping

Eliminating your retail therapy habit will really help you with reducing expenses, and save more money. This is often times a hard one to break.

Ask yourself: Would you rather work one year less of your life or always have the latest shoes?

We find ourselves being valuists more and more. Meaning we buy things we value, and cut out the rest.

Entertainment

Netflix and chill is great but so is going outside and enjoying nature! Consider canceling one of your streaming services to boost your savings rate even further.

The FIRE community generally enjoys cheaper alternative options, like the great outdoors!

Eliminate Debt

Pay off your debt as soon as possible.

Even if it’s just a credit card with a balance, pay it down. It will save you money in the long run. If you can afford to pay cash for everything, that’s even better!

You’ll have more peace of mind knowing that there aren’t bills hanging over your head. You’ll be able to travel more freely without worrying about fees and interest rates adding up every month.

Now You Know How To FI!

The FIRE movement is a community of people who have taken control over their life and finances to maximize savings. There’s no magic secret to achieving financial independence, it takes hard work and discipline.

FIRE requires you to make sacrifices today for rewards tomorrow. No matter how bad you want those new shoes, it would be best to put them off until a time where your future self will thank you!

Retiring before traditional retirement age is possible. Keep an eye on your annual spending, keep throwing money into index funds, and put those retirement accounts to good use.

I hope that this article has helped give insight into what steps can be taken to reach FI. Let us know in the comments what your FI goals are once you reach financial independence!