When considering getting life insurance, opting in is the easiest part. More than 54 percent of Americans are covered by at least one life insurance policy, with some even having multiple policies.

The tricky part is in knowing how much insurance to take out. Typically, your life insurance needs are going to change as you grow older. Although the insurer dictates the premiums you pay, there’s still plenty you can do to ensure you get the maximum amount of life insurance over your lifetime while paying the best rates for it. One of these methods is called laddering. It’s not a new concept but is somewhat rarely used.

Shop for term life insurance policies starting at just $5/month. No medical exams, no waiting. Qualified ages 18 to 65 years old can choose from various term lengths to meet their individual life insurance needs. Bestow specializes in instant life insurance, meaning you can be covered right away if you qualify!

- Instant Coverage

- Wide Variety of Term Lengths

- Unable to add additional riders

- Policies unavailable to New York residents

Table of Contents

What Is a Term Life Insurance Ladder Strategy?

The term life insurance ladder strategy is a way of carefully stacking life insurance policies to ensure you have the most coverage when you need it. Using this strategy, you can time the policy depending on changes in your life, responsibilities, and debts like student loans.

Some people will buy several policies at once and time them to end when they need less coverage, like paying off their home. Others prefer to stagger the start dates. They will have more coverage when adding children to the household.

The primary reason for using the ladder strategy is to avoid the high premiums that come with long-term permanent term life insurance coverage. Ladder strategy offers great online term life insurance coverage with competitive rates, particularly if you want a policy with a face value of over $1 million.

The downside of the ladder strategy is that many life insurance companies will not allow you to purchase multiple life insurance policies at one time, and it could require a little more work to put the policies in place.

Who Should Consider the Life Insurance Ladder Strategy?

The ladder strategy can indeed benefit people taking out life insurance, but it is not suitable for everyone. However, you can save thousands of dollars using this strategy if you’re in the following situations:

- If you expect that your life insurance needs will decrease as you grow older.

- If you don’t mind keeping track and organizing payments for multiple term life insurance policies.

- If you believe finding enough life insurance coverage would be a struggle.

On the flip side, there are people who wouldn’t benefit from the laddering strategy or even find it appealing. These include:

- People looking for a simple, straightforward life insurance option.

- Those looking to buy a second home later and those that have other fluctuating coverage needs.

- Those uncertain of what the future holds are unsure whether they will have kids or buy a home, etc.

The laddering strategy could get you the coverage you need at almost half the cost for strategic life insurance policy buyers who can overlap several inexpensive term policies. You just need to plan well and stay organized.

Why Create a Life Insurance Ladder?

Ideally, expenses are higher when you’re younger. Therefore, you want life insurance to cover the most important expenses. For example, if you have kids, you might wish that the life insurance helps in covering:

- The cost of a full-time nanny if your spouse continues to work.

- Daily expenses to allow your spouse to stay home and focus on the kids for some time after your demise.

- College expenses for your children

- Wedding expenses for your children

- Various debts like mortgage, student loans, and credit cards.

Some of the reasons why you should consider adopting a life insurance ladder strategy include:

Lower Premium Costs

The primary purpose of using a laddering strategy is to lower costs and increase flexibility. On average, you can save up to 50 percent of premium payment costs using the laddering strategy. Although the actual premium will depend on various factors like your age, health status, and policy term, the cumulative premium for using a term life insurance ladder is often significantly lower.

Laddering reduces the amount of coverage paid when you’re older and more likely to die, allowing you to focus on building your capital.

Assign a Purpose to Each Life Insurance Policy

With a multi-policy ladder, you can easily stay on top of multiple life insurance needs. If you’re applying for life insurance to protect your children from more than one financial burden, it makes sense to associate a specific policy with each financial burden.

Using the laddering approach also allows you to prioritize the policy depending on the severity of the financial burden in question. This way, you can provide adequate financial protection for your family.

Mitigate the Cost of an Underlying Habit or Health Condition

With all other factors constant, policyholders with underlying health conditions pay more the same amount of life insurance coverage—also, the cost of your life insurance increases in proportion to the death benefits. So if your life insurance needs are about $2 million, you’re likely to pay more, especially if you have health issues or you’re a tobacco smoker.

Laddering will not eliminate what is considered a ‘tax’ on ill health or poor habits. But it will reduce coverage towards the end of term when you’re more likely to succumb, which can help you save money.

Preserve Flexibility

With a life insurance ladder, you can always add more life insurance at a later date if the need arises. This flexibility is what makes laddering so enticing for those that consider it.

Shop for term life insurance policies starting at just $5/month. No medical exams, no waiting. Qualified ages 18 to 65 years old can choose from various term lengths to meet their individual life insurance needs. Bestow specializes in instant life insurance, meaning you can be covered right away if you qualify!

- Instant Coverage

- Wide Variety of Term Lengths

- Unable to add additional riders

- Policies unavailable to New York residents

How to Ladder Your Life Insurance

Laddering life insurance is a way to tackle life insurance needs that change over time. By buying different life insurance policies, you can create a peak amount of coverage when you need it. There are two ways you can use the ladder strategy:

- You can buy several policies simultaneously, but with different term lengths (one 20-year term and one 30-year term).

- Alternatively, you can buy one term life policy and purchase an additional term life policy later. The first policy can be a 30-year policy, and the second one a 10-year policy.

Example:

A young and healthy 28-year-old woman can purchase three term life insurance policies with varying term lengths.

- Policy 1 – $500,000 for 10-years at $26/month

- Policy 2 – $300,000 for 20-years at $22/month

- Policy 3 – $200,000 for 30-years $28/month

The subject has three policies that provide her with $1 million in coverage over 30 years using this approach. The policies will taper off, and she’ll pay less money in premium after each policy expires.

Supposing the same person takes out one term life policy with $1 million coverage for 30 years, she would pay $95/month for the entire 30 years.

Using this model, if the policyholder were to die within the first 10 years, the death benefit would be $1million. After the first 10 years, the first policy would have expired, and the benefit would be $500,000.

Consider How Much Life Insurance Coverage You Need

To make the most out of ladder life insurance policies, you need to have a firm grasp of your current and future financial needs and determine how much life insurance coverage you need, which is one of the life insurance basics. You can do so by seeking advice from a financial advisor. There are several methods available that you can use to determine how much insurance you should get.

Multiply Your Income by 10

This is the simplest method you can use to determine how much life insurance you need. Most financial experts recommend purchasing a life insurance policy that is 10 to 15 times your annual income n coverage. Of course, your personal number might be higher or lower depending on your responsibilities, but you can use 10 as a general rule of thumb.

Basic Life Insurance Need Calculation

If you want to be more critical and come down to a more accurate figure, you can use the basic life insurance need calculation using the following equation:

[Financial obligations you want to cover] – [Existing assets that can be used towards the bills] = the life insurance you need.

Your financial obligations can include:

- Income replacement – Consider the salary you want to replace and for how long you want to replace it. This will help to cover current and future expenses.

- Mortgage – Include the mortgage balance, so your family doesn’t have to worry about losing their income. If you have factored the mortgage payments in the income replacement above, there’s no need to add more mortgage money.

- Other debts – Consider other large debts that the family would struggle with if you passed away unexpectedly, like student loans or personal loans.

- College tuition – Tuition money will ensure your kids can pay for college even after your demise.

Your existing assets can include:

- Existing life insurance – If there’s another life insurance in place to provide a financial cushion, deduct that amount.

- Savings – Subtract savings your family would use to pay any expenses. You can include retirement savings like 401K. You can leave this out if the beneficiaries would like to preserve that amount for retirement years.

- College 529 savings – You can deduct any money held in a 529 account for your children from your insurance needs.

- Funeral expenses – You can buy burial insurance if you don’t want the life insurance to cover the funeral and final expenses.

The DIME Method

DIME stands for Debt, Income, Mortgage, Education. This method requires you to add up these amounts to determine how much life insurance you need.

- Debt – The total cost of debt you would leave to other people. This includes student loans that aren’t forgiven at death and credit card debt.

- Income – Consider your income and multiply it by the number of years you want to provide income replacement for your family.

- Mortgage – Add the mortgage balance to your running total

- Education – The amount that will cover tuition, room, and board for each of your children.

Using these methods, you can accurately determine what a good life insurance cover for you would look like.

Shop for term life insurance policies starting at just $5/month. No medical exams, no waiting. Qualified ages 18 to 65 years old can choose from various term lengths to meet their individual life insurance needs. Bestow specializes in instant life insurance, meaning you can be covered right away if you qualify!

- Instant Coverage

- Wide Variety of Term Lengths

- Unable to add additional riders

- Policies unavailable to New York residents

How the Life Insurance Ladder Strategy Works to Save Money

Laddering short-term policies do more than bulk up coverage during crucial times of your life. It also saves on premium.

Compared to one permanent policy with a 30-year term, the annual premiums on 20 year and 10-year policies would be lower. That is because the coverage on the 10 and 20-year policies will end while the policyholder is still younger and in better health.

From our previous example of the 28-year-old woman, the staggered policies accumulate to $912 annually while the 30-year policy translates to $1140 annually.

You don’t just save money on the premiums. As the shorter policies expire, you make smarter financial decisions and save even more because you will no longer pay those premiums. So although you would have less coverage, you would also not be paying for excess coverage.

Example of the Ladder Strategy in Action

A ladder strategy doesn’t just look good on paper but also works in real life. Take the example of 31-year-old Mike, a husband, and dad out to protect his family if he isn’t around anymore.

He and his spouse have a plan to reach financial independence by the time they are 50 years old. But, he is worried that if he succumbs, these plans might never become a reality. So Mike is looking to give his family members a lump sum of money to help them reach financial independence if he succumbs.

If he goes for a laddering policy:

- He will take out a total coverage of $1.5 million.

- Purchase three policies for $500,000 that will mature in 10, 20, and 30-year increments.

- He will use a single carrier for each of the policies.

- He will pay about $64.02 per month in premiums initially

- The lifetime premium outlay is about $17,295.60.

If Mike takes the same life insurance as a single policy:

- He will take out the same $1.5 million total coverage

- A single 30-year term policy

- The carrier will allow him to lower the death benefit during the coverage period.

- He will pay an estimated premium of $76.94 per month

- The lifetime outlay if he follows the same schedule as the ladder strategy is $19,324.00.

With a carefully planned and well-executed term life insurance ladder strategy, you can get the coverage you need when you need it and save money down the line.

Additional Laddering Life Insurance Examples

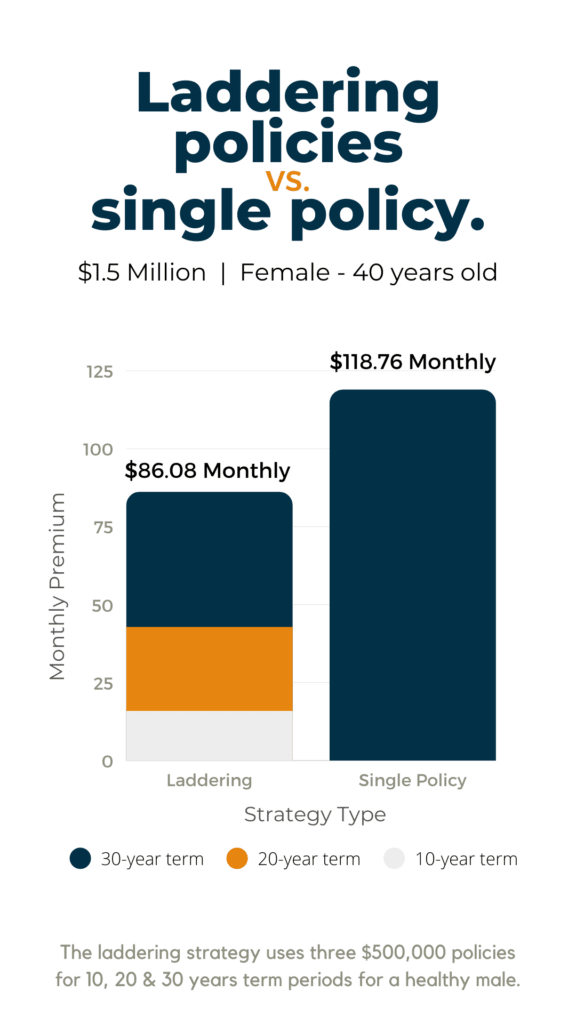

The following images were provided courtesy of SureLI.co.

Frequently Asked Questions

At What Age Should You Drop Term Life Insurance?

The best age to drop term life insurance is a personal decision often influenced by your current responsibilities and commitments. Some people might opt to drop life insurance earlier, while others might carry on. However, most life insurance policies don’t expire until you reach 95 years. The terms cannot be renewed past a certain age, usually set by the insurance company, typically around 80 years.

What Does Life Insurance Cover, and When Does It Pay Off?

Life insurance can cover the financial obligations you set it to. These can include but are not limited to mortgage, burial expenses, loans, debts, and tuition. Ideally, the life insurance cover will pay off when the insured party dies. The beneficiary must file a death claim with the insurance company by submitting a certified copy of the death certificate.

What Is the Difference Between Whole Life and Term Life Insurance?

Term life insurance is ‘purely’ insurance. Whole life insurance allows the insured party to add a cash value that you can access during your lifetime. Also, term life insurance only covers you for a limited period, while whole life, which is permanent insurance, provides lifelong protection as long as you can keep up with the premium payments.

The Bottom Line

The best life insurance company may be different for everyone and is based on your needs. First, determine what is most important, like life insurance companies that allow you to convert term insurance to permanent life insurance or a company with multiple policy options. Then, compare a few different companies to find the one that fits your needs the best. Like auto insurance, the right life insurance strategy allows changes over time as your financial goals and needs change.