What if we told you a 9-5 grind till you’re 65 doesn’t need to be your reality? The FIRE movement is about careful money management so you can leave the workforce early. Imagine ditching the life-sucking commute and endless unproductive meetings ten to thirty years sooner than expected. That’s what this movement can offer.

Regardless of how much you may or may not have saved for retirement, in the stock market, student loan debt, credit card debt, or how high your current monthly expenses are – there is a light at the end of the tunnel.

You can begin to create financial security, get out of debt, and redefine when you want to retire. Learning to spend less, practice frugality, reducing your annual expenses, and building new income streams will help you achieve financial independence.

Table of Contents

What Is the FIRE Movement?

FIRE is an acronym that stands for Financial Independence, Retire Early. You’ve probably seen the headlines of people with extreme savings rates. Other headlines have talked about extreme frugality who have cut their annual living expenses down to practically zero. Some of the more positive articles have talked about how people are breaking free from traditional retirement age, and are retiring decades before what is considered “normal.”

The reality is, you don’t have to be that extreme – you just have to be intentional with your life choices. Let’s breakdown the FI and RE components:

Financial Independence

Financial Independence (FI) is a term with several definitions depending on who you ask. The most devout followers say that Financial Independence is the ability to pay all living expenses for the rest of your life without having to be employed. This is done through passive income sources and strategically tapping into investments.

Others believe that FI allows you to live without an immediate need for a paycheck, not necessarily the absence of employment. This takes two major financial moves:

- Paying off all debt so you’re financially free

- Building an emergency fund to cover several months of expenses

For many individuals, financial independence gives them a choice to take risks in their careers like asking for reduced hours, launching a new business, or starting a second career.

Retire Early

The U.S. has perpetuated a myth that major milestones, like retirement, fall at specific points in time. This simply isn’t true. Those who subscribe to the movement are pushing back on the norm by choosing to leave traditional forms of work and Retire Early.

Retiring early doesn’t mean you sit in a lawn chair on the beach sipping a cocktail. While this may be true for some, many individuals in the movement retire early and pursue a passion project like writing a book or nomadic living. Early retirees love being able to redefine their retirement age because that gives them so much freedom and flexibility to live the life they want.

Everyone’s FI and FIRE recipes vary. Not everyone subscribes to all of FIRE; retire early isn’t always the goal. The truly inspiring take away from this movement is the way people are choosing to harness their finances so they can live life on their own terms.

You May Also Like: The Best FIRE Podcasts to Help You Reach Your Financial Goals

Who Started the FIRE: Financial Independence Retire Early Movement?

Retiring early is no easy feat. It’s a calculated process that a few key figures pioneered.

Vicki Robin was the first to popularize the idea of Financial Independence with Your Money or Your Life, a 1992 bestselling book. This book directly confronts the exchange of energy for money during the best years of your life.

Pete Adney, also known as Mr. Money Mustache, wrote a cornerstone article in 2012 titled The Shockingly Simple Math Behind Early Retirement. His blog gave millions of burnt out career men and women easy access to understanding the numbers behind this lifestyle.

Since the Mr. Money Mustache blog, there was a boom in FIRE movement blogs and podcasts that sought to spread the idea of financial freedom and security. Most notable among these is the ChooseFI podcast hosted by Brad Barrett and Jonathan Mendosa. ChooseFI has become a media empire with a blog, books, and multiple active Facebook communities.

Related: Check out the FIRE movement reddit thread for daily discussion on Financial Independence and Early Retirement.

7 Steps to Reaching FIRE

FIRE is a combination of financial decisions and time. If you’ve read any of the FIRE stories in the New York Times or The Wall Street Journal, you’ll notice that a high savings rate and index fund investing are key ingredients.

But, there are a few essential steps everyone reaching financial independence does before saving and investing. Below are the 7 steps to reaching financial independence and retiring early:

1. Understand Your Why

FIRE is a long road. You will need to confront your money mindset, spending habits, and debt. Trust me, this is hard and emotional. You should know your why before embarking on your path to FIRE.

Our why: We want to pursue our passions outside of a 9-to-5. We want to live a fulfilling life traveling the world together, and enjoy more time with family & friends. Most importantly, we don’t want to worry about money!

Knowing our why has given us a resting place when things are tough. It’s a reminder for the future, and we strongly suggest you make this your first step to FIRE.

2. Reduce Your Expenses

You need to reduce your expenses to free up money for debt pay off, invest and save. There are so many ways to do this! You can start simply by canceling subscriptions you don’t use and eating at home more often. As you adjust to a more frugal lifestyle, you might consider lowering some of your major expenses like housing and utilities.

3. Increase Your Income

Being frugal might get you to FIRE, but the combination of reduced expenses and increased income can expedite your journey. Those pursuing FIRE are no stranger to the side hustle or a second job. You can also try to increase your income at your current place of work by asking for a raise or working overtime.

4. Track Your Money

You need to know where your money goes so you can put it to work. The best way to track your money is with a budget. Budgets take time to figure out and implement. Go easy on yourself as you figure it out. Keep making adjustments until you find one that works for you.

We put a list of free google sheet budget templates together for this very purpose.

Track all of your account balances and your net worth in one place. Get access to a Retirement Planner, Fee Analyzer, Portfolio Checkup, Contribution Calculators, and so much more with, Empower!

- Early pay and cash advances

- Easy account linking

- Earn cash back

- Budgeting tools to monitor spending and expenses

- An inexpensive way to borrow funds

- The amount borrowed is non-customizable

- Requires a subscription

- Low APY

- Need an Empower card to receive free and instant cash advances

5. Pay off Debt

Financial independence requires that you rid yourself of debt so your money isn’t tied down. We paid off over $35,000 of debt while we were still in college, so we know how overwhelming and anxiety-inducing debt can be.

This is when you lean on step 1, your why, while you tackle your debt. If you’re not sure how to get started with debt-pay off, check out our debt guide for strategies.

6. Save and Invest

The only way to achieve FIRE: invest and save. Utilize your retirement accounts to their fullest potential, that would include a 401k, 403b, 457, Traditional or Roth IRA, HSA, and even a brokerage account. Compound interest is the momentum that fuels the fire community. Creating a large enough nest egg to live on, rather than following a traditional retirement plan.

You will need to have a strong emergency fund and you need to invest in your retirement every single month. On your path to FIRE, you will probably be working on both of these financial goals at the same time.

To start your research in both of these FIRE pillars, read:

- The strategy to FIRE Investing

- The general rule of thumb for emergency funds

7. Reflect and Adjust

While money plays a major role in FIRE, it’s about so much more than this. Financial Independence, Retire Early is about freedom, control, and flexibility. It’s a journey with lots of ups and downs.

Taking the time to reflect and adjust your financial plan each month is essential. You can make this happen by scheduling a money date with your budget. This kind of check-in allows you to celebrate your wins and get back on track towards progress if you were derailed.

There’s no sweeter feeling than reflecting on how you were able to make serious progress in your financial journey.

Related: How FIRE has impacted our Mindset and Lifestyle

The Best Financial Independence and Early Retirement Resources

Are you ready to FIRE? We’ve got you covered with some of the best financial independence retire early resources.

1. FIRE eBook: How to Prepare for Your Fire Journey

Start your FIRE journey out strong with this free resource.

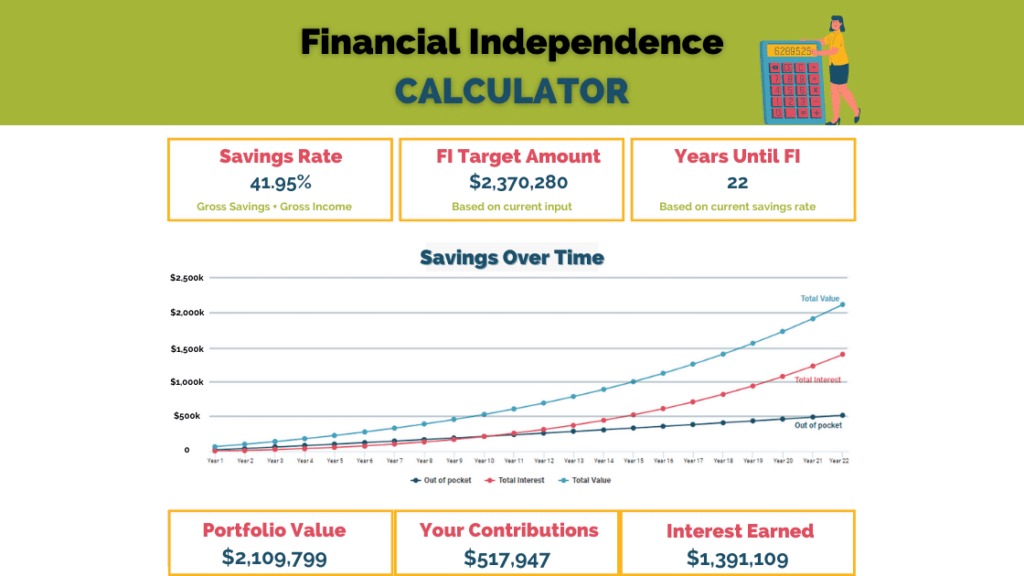

2. FIRE Calculator: What’s Your FI Number?

Not sure how much you should have to FIRE? Run your numbers through our FIRE calculator to find your FI number.

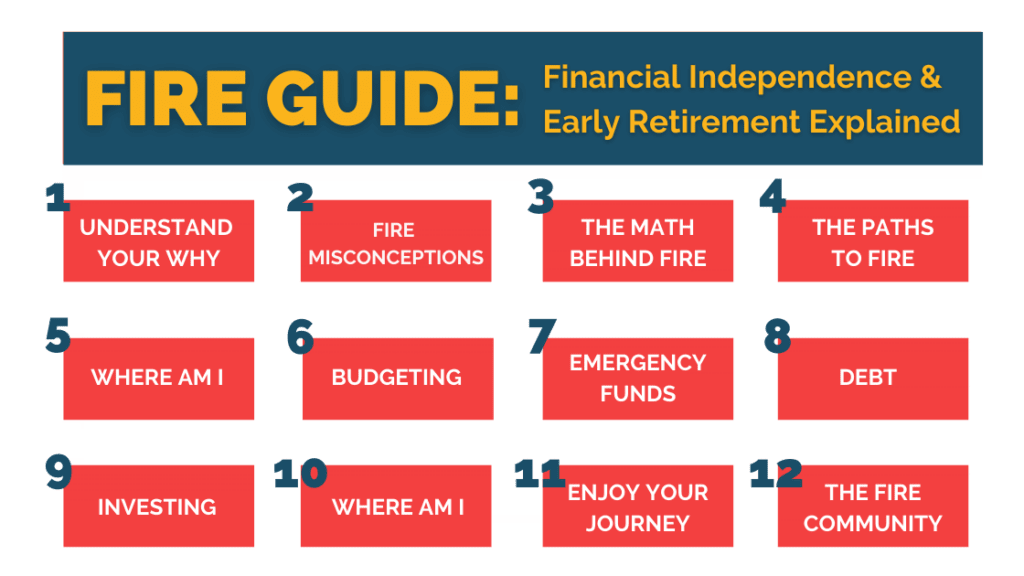

3. FIRE Guide: 12 Chapters to Understanding FIRE

If this article sparked your curiosity and you’re ready for a deep dive into FIRE, check out our free FIRE Guide. It has 12 chapters that walk you through all the FIRE basics.

4. Financial Independence Retire Early (FIRE) For Beginners Facebook Group

If you’re looking for a community that can support you on your FIRE journey, and help to answer your questions, check out this Facebook group.

Best FIRE Books

Not only are these personal finance books popular within the FIRE community, but they have been instrumental on our own FIRE journey. Continue reading to see our recommendations for the best financial independence books!

The Simple Path to Wealth

JL Collins breaks down investing into one simple strategy that works in his book The Simple Path to Wealth. We will give you a hint, Index Funds is where it’s at!

ChooseFI: Your Blueprint to Financial Independence

Playing with FIRE

Financial Freedom

Grant Sabatier shares with readers how he managed to become a millionaire before 30 and retired at 34-years-old.

FIRE Movement Frequently Asked Questions

How Does the FIRE Movement Work?

They’re a group of people set out to break free from societal norms and live the life they want to. The goal is usually to save over 50% of your income so you can reach financial independence. This unlocks the ability to retire even earlier – sometimes in your 30s and 40s.

Is the FIRE Movement Legit?

Yes, the F.I.R.E. movement is 100% legit. This isn’t a get rich quick scheme, it’s more of a get rich slowly and intentionally plan. There are no sales pitches, rip off investment scams or products you need to purchase for this movement. It can be done at all income levels, for all people from every background. There isn’t any secret sauce that you can’t already learn for free online, such as in our FIRE guide.

What Does FIRE Stand For?

The FIRE acronym or F.I.R.E stands for Financial Independence Retire Early. For many once they reach FIRE, the retiring early part is an option they have but not one they choose right away. This is especially true for those who love their job, or want to pursue passion projects.

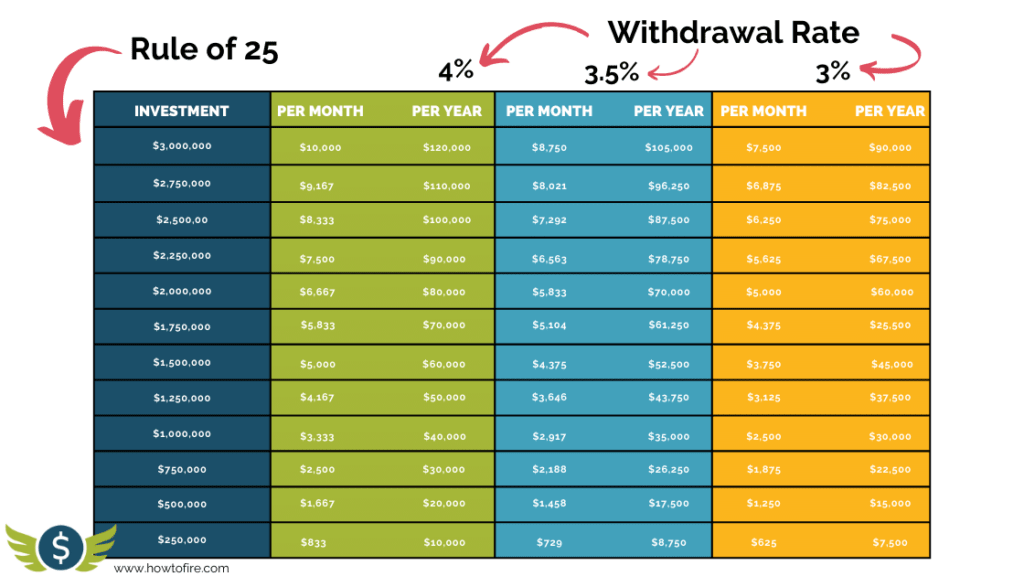

What Is the 4% Rule?

The 4% rule is a retirement withdrawal rate strategy that suggests you can safely withdraw 4% of your portfolio each year. To achieve this you need to have 25 times your yearly expenses to have enough money to satisfy the four percent rule. There has been research done to support this theory over multiple spans of time, with varying market performances.

What Is the FIRE Lifestyle?

The FIRE lifestyle is really no different than the movement itself. The theory of saving as much as you can so you can reach financial independence through saving and investing your money wisely. The lifestyle is one that you develop and build yourself there is no one way to pursue FIRE.

What Should I Invest in for FIRE?

What you invest in depends on several factors including your financial independence number (you can find your number through our FIRE calculator). The key to investing is understanding your financial goals and risk tolerance. There are FIRE followers who choose investments that would be considered risky hoping for a quick return on investment, and there are other followers that lean towards mutual funds and low-cost index funds that focus on mirroring the market which is more likely to bounce back from a market downturn.

Vanguard’s mutual fund VTSAX and Fidelity’s mutual fund FSKAX are investments that mirror the market and are worth looking into. Remember, you don’t have to be extreme, you just need to be intentional about your life AND investment choices.

Important Note: This means you can’t just let your money sit in a savings account and then rely on social security benefits. However, high yield savings accounts can be used for your emergency fund and more short-term savings needs.

Do I Need a Financial Advisor to Become Financially Independent?

The short answer is no. But many will sit down to do some retirement planning with a fee only financial planner at some point to get a professional opinion on their retirement savings plan. Financial planning is just one of the many important pieces of the FIRE process.

How Quickly Can I Achieve FIRE?

The answer to this lies with how much you’re able to save each year. For many, they’re able to achieve FIRE between 10 years and 20 years’ time. Achieving financial independence isn’t a sprint – it’s a marathon. Having high savings rates simply means you’ll be able to FIRE sooner.

How Much Money Do I Need to FIRE?

The amount you need to FIRE is entirely dependent on how much you spend each year and what your safe withdrawal rate is. For example, if you spend $40,000 per year, wanting a 4% withdrawal rate you need to have $1 million invested.

Financial Independence Is for Everyone. We Can Show You.

Does FIRE sound too good to be true? Are you nervous about investing? Is debt making you feel buried? No matter where you are at with your finances, we believe that financial independence is for everyone.

You do not need to be a genius to retire before your golden years. You can get to a place where you run your money and it doesn’t run you. With the resources above and our FIRE guide, we hope to show you.

If you have questions, please drop them in the comments below. We would love to answer them. Be sure to check out our other articles to learn more about FIRE and personal finance.

Samantha Hawrylack is a personal finance expert and full-time entrepreneur with a passion for writing and SEO. She holds a Bachelor’s in Finance and Master’s in Business Administration and previously worked for Vanguard, where she held Series 7 and 63 licenses. Her work has been featured in publications like Grow, MSN, CNBC, Ladders, Rocket Mortgage, Quicken Loans, Clever Girl Finance, Credit Donkey, Crediful, Investing Answers, Well Kept Wallet, AllCards, Mama and Money, and Concreit, among others. She writes in personal finance, real estate, credit, entrepreneurship, credit card, student loan, mortgage, personal loan, insurance, debt management, business, productivity, and career niches.

Akiva Shmalo

Thursday 24th of June 2021

This article forgot to mention the easiest way to retire early: not having kids. (Or at least waiting to have kids)