The 4 Percent Rule outlines how much you can withdraw from your investments to cover your expenses during retirement. Using the 4 Percent Rule for your withdrawal rate is common advice from those in the FIRE community.

Understanding the math behind the 4 percent rule is important for those starting their FIRE journey. It provides insight so you know what to work towards as you get closer to retirement. The math is flexible, and should adjust based on your needs and comfort level.

How Does The Math Work?

Many people in the FIRE community use The Rule of Twenty-five to determine the amount of investments they need to retire.

Annual Expenses in Retirement x 25 = Portfolio Needs

For example, a household spending $40,000 in per year needs $1,000,000 invested to retire.

The 4 Percent Rule determines how much they could withdraw from this amount once they retire.

100 ÷ Multiple of Expenses = Desired Withdraw Rate

This means you would need 25 times your annual expenses to withdraw 4 percent, and have it be equal to your Annual Expenses in Retirement.

100 ÷ 25 = 4%

For those looking to be in retirement for 35+ years you may consider an even lower withdraw rate such as 3 percent. Especially those who want added security and reduced risk, or are hoping to leave a large legacy for their heirs. The math behind this rate would be:

100 ÷ 33 = 3%

Annual Expenses in Retirement x 33 = Portfolio Needs

40,000 x 33 = $1,320,000

The math works both ways. Divide your current Portfolio by current expenses. This allows you to calculate what your withdraw rate would currently be.

2,000,000 ÷ 70,000 = 28.6

100 ÷ 28.6 = 3.5%

The lower your withdrawal rate, the greater your investments will need to be. Remember, these calculations DO take inflation into consideration.

Where Did the 4 Percent Rule Originate?

Before the 90’s many financial experts believed that 5 percent was a good amount for retirees to withdraw each year. Many people attribute the 4 percent rule to the Trinity Study, but the 4 percent rule became known before this study.

Fearing this amount was inaccurate, a financial advisor named William Bengen conducted a study in 1994 which analyzed historical data on stock and bond returns over a fifty year period from 1926 to 1976. Bengen’s study concluded that a 4 percent withdrawal rate was more successful than prior findings. Bengen also found that no historical data existed in which a 4 percent withdrawal rate could exhaust a portfolio in less than 33 years.

Defining a Successful Withdraw Rate

A 4 percent withdrawal rate still produces a high success rate due to social security benefits or pensions plans.

For those retiring in their late 20s and early 30s, they should consider aiming for a lower withdrawal rate. This is due to the amount of time they need their funds to last. It is especially true if you expect to never work again. Pensions are also not very common anymore, and social security is being depleted faster than its being replenished.

Calculating a successful withdraw rate means identifying how long you need your money to last compared to your withdraw rate.

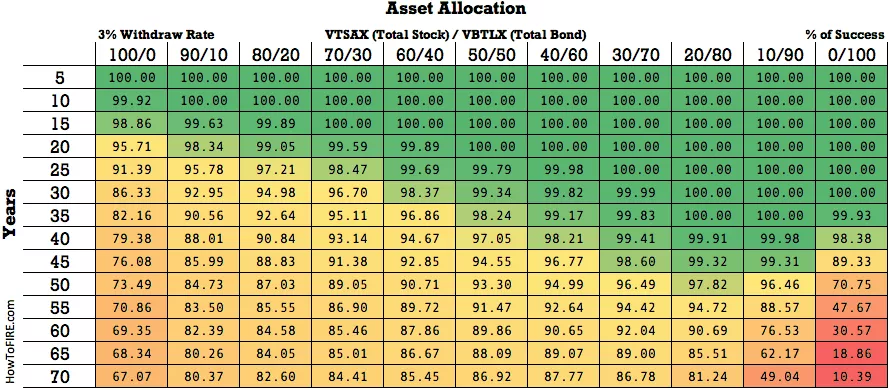

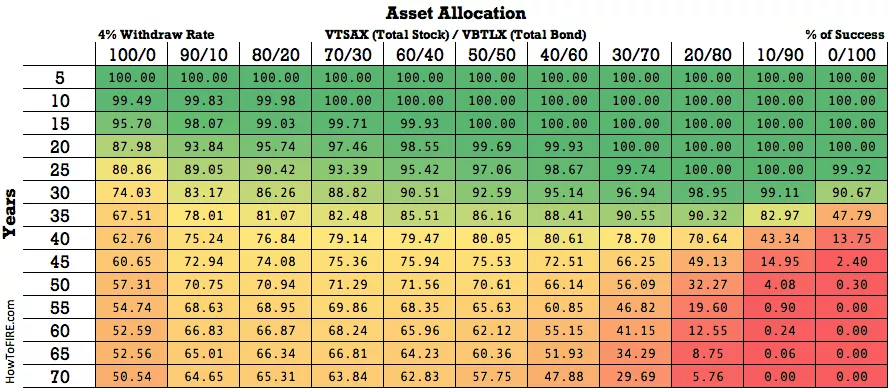

We performed our own research to analyze similar findings and determined the success scenarios for given time periods, with 3 & 4 percent withdraw rates based on different asset allocations. See our data below.

100% means that no historical scenario has shown that you would run out of money for the given time period and asset allocation. 50% would mean that using historical data, you have a 50% chance of running out of money before the duration is up.

It’s important to note, this does not take into consideration the ability to have flexible income years, meaning years that the market performs poorly you flex your withdraw amount, rather than continuing to withdraw your fixed percentage. It also does not include extra income potentials, such as social security or passive income. This is strictly for consistent drawdown from your investments.

Some people choose to save a year or two worth of living expenses in savings/taxable brokerage accounts to help hedge their risk against years the market is down.

How Do I Know When I Can Actually Retire?

What you’re really asking is “Do I have enough money to last through retirement?”

By understanding your drawdown strategy, investment returns, your own withdraw rate, and your expenses you can calculate the answer to this question.

An extra year or two in the workforce could be the difference between having a comfortable and secure retirement versus a tight-budgeted one.

The problem is that many people get “one more year” syndrome for half a decade when they get close to pulling the trigger to retire. Financial Samurai has a great article titled “Overcoming The One More Year Syndrome To Do Something New” that discusses this in depth.

Be sure to check out our FIRE calculator to also get an idea for how close you are to your FIRE goals!

Final Notes

Ask yourself the following questions:

- How much do I spend each year?

- How long do I need the money to last?

- What other income will I have in retirement? (Social security, Pension, Rentals, etc)

- What is my strategy during negative returning years? (Flexible income/lower withdraw, cash reserves, part-time work, etc)

- Am I planning to leave a legacy?

Taking the plunge into early retirement is a huge decision, so make sure you understand the math behind what you are doing. For many, the 4 percent rule will be sufficient.

WantFI

Friday 18th of December 2020

The 4% rule is harder to maintain these days with bond yields sub 1%. It's probably prudent to puff up the portfolio 20% before making the FIRE plunge.

John Hawrylack

Tuesday 22nd of December 2020

Couldn't agree more! Thanks for your input