Money-saving charts are a great way to start saving money in a simple and fun way. You can make your money saving chart or search for them pre-made from stores such as Etsy and Amazon to track progress by week, month, or year.

A money saving chart is a great way to track your progress as you work towards a specific savings goal, and the visuals are helpful to stay motivated. In this article, we’ll discuss what a money-saving chart is and when to use one so you can decide if it’s right for you.

Table of Contents

What Is a Money-Saving Chart And How Does It Work?

A money saving chart is created in many ways, including on the computer or with pen and paper. You can track your savings goals by week, month, or year for fun visual motivation. Many people have found that the visual aspect of charts is helpful when trying to save money instead of a list of savings goals easily. Some people have found that they have been more successful at saving by looking at a chart on the wall every day.

You can easily create your money saving chart by printing one out from the computer or drawing one with pen and paper. If you want to be more creative about your saving strategy, people have found success using journals and planners. Many pre-made charts are available online for purchase.

Gain access to all of our free resources!

- eBooks

- Spreadsheets

- Printables

- Other great Freebies!

Best Money Saving Chart to Download Now

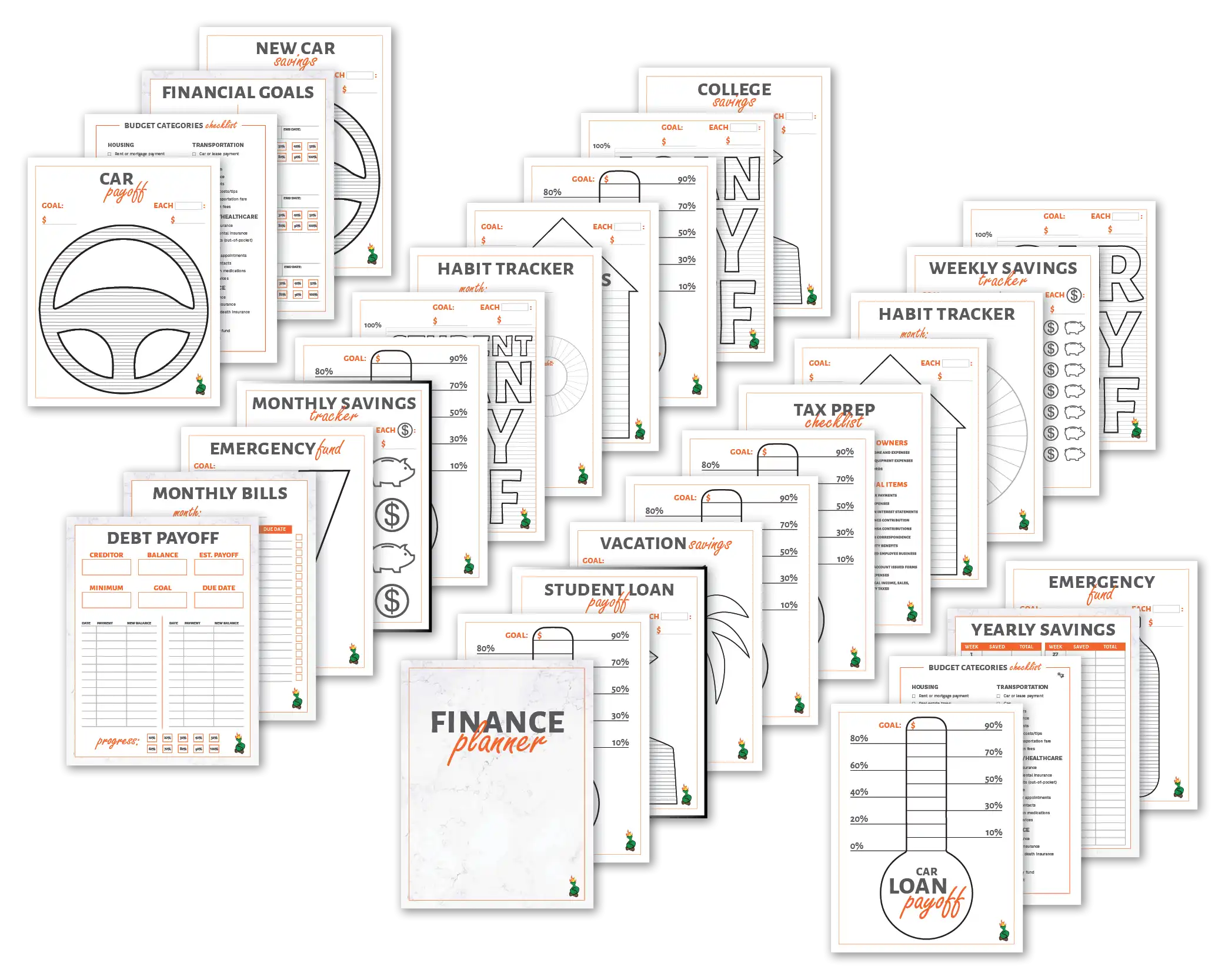

When considering the best money-saving chart to buy on the market, Etsy is a great platform to find what works for you. We’ve produced tons of downloadable and printable savings charts that are fun and interactive.

This weekly savings goal tracker chart is a fantastic tool to track weekly savings goals and allows you to color in the financial icons once a goal is reached. Customizable to individual goals, users will enjoy the savings process and look forward to reaching weekly goals. The top of the chart includes a key so each user can decide their unique goal per week.

Use this weekly savings colorable tracker as an interactive way to track your progress towards saving up for one of your financial goals on the way to financial independence!

Are you looking for a monthly savings goal tracker? Our monthly savings goal tracker offers users a similar goal tracker sheet based on savings per month. This chart is also customizable and provides the same satisfaction when reaching monthly goals. Consider using this product for larger savings goals such as a wedding, Christmas, or vacation fund.

Benefits of Using a Money Chart

A saving money chart is a great way to keep track of your spending and save money while developing healthy financial habits. Using a money saving chart provides a visual reminder of your current savings and the future of your goals. Staying motivated is a problem many people have when saving money and reducing debt, so adding a visual is the perfect way to stay on track. Another benefit to using money-saving charts is the versatility. Money charts can be used to save for any occasion and budget, such as funds for weddings, a new house, vacations, etc.

Check out our post on the envelop saving challenge!

When to Use a Money Savings Chart

Money-saving charts can be used to reach many financial goals. Whether the user wants to set financial goals for large or small sums, many charts are available to meet individual needs. These charts allow users to have fun and get excited about reaching their unique goals. Christmas, birthdays, weddings, debt payoff, car loans, and house funds are examples of events or purchases for which people can use a money-saving chart. Here are some ideas and tips for using this saving method to best suit your needs, whether you are a first-time user or a seasoned savings veteran.

Debt Payoff

Whether it be a car, house, or loan payment, debt affects many and can be intimidating to tackle. Using money-saving charts can be helpful to achieve debt payoff goals while keeping a budget. As you reach each goal by week, month, or year, track the progress on the chart to stay motivated in reaching that goal. As debt goes down, the extra money can fund other projects, and savings goals as debt go down.

Take control of your finances! Grab our bundle of colorable printables to help you pay off debt, save more money and manage your finances more efficiently.

House Down Payment

Saving money for buying a house can feel impossible when looking at a large money sum. Breaking down this down payment into manageable money chunks on your money saving chart can help keep the focus on the goal at hand. For example, if one needs to save $10,000 for a down payment, create a money-saving chart that can be filled in at different saving intervals. Using a chart can make the saving process more fun as each goal is met.

Emergency Fund

Saving for a rainy day or unexpected event is essential. Without an emergency fund or bank account, people are more likely to rely on credit cards or high-interest loans when faced with unexpected expenses. A money-saving chart can be used to track the progress of building up your emergency fund each week and avoid paying off these high-interest rate debts in the future. Paychecks and extra cash can be used to set aside extra money for this savings account and can be included in a budget.

Use this emergency fund colorable printable as an interactive way to track your progress towards saving in your journey to financial independence!

Car Fund

Like saving for a house, having a savings plan for a future car purchase is a great idea. By saving money for a down payment on a car, one will spend less on the car’s monthly payment and reduce extra costs. Coming up with this fund can seem like a challenge, but once again, money-saving charts can help visualize savings goals in a more manageable way.

House Payoff

House payoff timelines can be long, but using a money-saving chart can help homeowners stay on track with their goals. Create a money saving chart for the life of the loan either by weeks, months, or years and feel happier watching the debt decrease.

Use this house loan debt thermometer as an interactive way to track your progress towards paying off debt in your journey to financial independence!

Sinking Fund Savings

Life offers a variety of special events and occasions that require planning and focused finances. For example, saving for a wedding, Christmas fund, or vacation can seem like a tough task. To help save even more money and create a budget for these events, manage the process with money-saving charts. Creating savings goals will motivate you to move forward in reaching your goal and provide visual evidence of how far you have come and how long it will take you to save and achieve your goal.

Investments (401k, Roth IRA, etc.)

Investing in life and the future can seem impossible while tackling debt and savings challenges but can be made easier by using a saving chart. Starting savings early, and investment goals can be reached faster. Even starting small with investments can help save money later and help afford life after retirement.

Money-Saving Challenge

A fun way to save money is to stick to a money savings challenge. This method is a way to save money in various periods easily. The most common savings challenge is the 52-week money saving challenge. In 52 weeks, each week has a budget of how much cash is supposed to be saved. You can set the challenge to a specific date each week or just by the week of the year. At the end of each week, you can fill in your money savings chart to see the progress.

Check out our post on the penny saving challenge!

This savings chart is a great idea to start at the beginning of a new year, especially for those wanting to make financial goals. Similarly, a 26 week save money challenge exists for those looking to save on a smaller timeline. Other challenges exist to build up savings for those looking to save on a smaller scale.

For example, the spare change challenge encourages people to save spare change and cash each month or week in a jar until they reach a specific monetary goal. Some great tips to reach this goal include saving change and small value bills from cash purchases. Once the savings goal has been reached, the money can be placed into a savings account or be used to tackle debt areas.

How Much Should You Save With a Money Saving Chart?

Before you start saving, here are some tips and ideas to help make the process more efficient. On your money chart, be sure to know your total cost or total savings to work towards. It is also a good idea to label your chart based on the goal you are working for, such as wedding fund, car loan, or emergency savings. Once the total savings are identified, the saving process can begin based on individual needs. There is no limit to the amount of money saved using the money saving chart.

For first-time users wanting to start small, consider using the spare change challenge charts. For larger sums, the 52-week money challenge is a fun way to save larger amounts for large goals. Whether your goal can be reached in weeks or years, using a money saving chart can help save any amount of money and reduce unnecessary spending.

Is a Money Saving Chart Right for You?

Money-saving charts can help you save money on a more personal and exciting level. Charting this way can be done by anyone that wants to visualize their success and is easy to do. With the right mindset and focus on your savings, this charting method will become easier to maintain and encourage people on their path to financial stability. Reaching financial goals is exciting, and this tool can help anyone on their journey.