Do you feel in control of your financial situation? If not, using a budget template printable will strengthen your grip on your wallet.

So many Americans are living paycheck-to-paycheck. Even more struggle to come up with extra cash for essential funds like emergency and retirement savings. The thought of creating a budget is cringeworthy for some, and it doesn’t help that personal-finance is a taboo subject no-one wants to talk about.

While these circumstances are considered normal in our society, they are by no means necessary or ideal. Budgeting gives you the freedom to set goals and work toward the financial future you envision for yourself and your family. Learning to track your monthly expenses, developing a personal budget you can stick to, and having weekly budget meetings can change your life.

Living month-to-month, one expense to the next continuing to add-up to more and more. It is scary, difficult, and nerve racking and without a doubt, you will have setbacks somewhere along the line, and that’s perfectly normal.

Maybe you have never tracked your spending before, or you need extra motivation to stick to your financial plan. Either way, a budget template is the simple tool that will help you make the most of your money.

Table of Contents

What Is a Budget Template?

A budget template is an interactive tool that helps you organize and analyze your finances. It provides space to enter income and spending so you can visualize exactly where your money is going and how much you have left for the month.

Budget templates come in both digital and printable forms. They range from Microsoft Excel spreadsheets, Google sheets to editable or printable PDFs. There are many ways to organize and track expenses, track spending, net worth, and more.

Some of the best digital budget templates complete calculations automatically, while printables let you work with old-fashioned pencil on paper.

If you’re looking for a free money-management option to learn how to budget, consider checking out our free budgeting resources below. Included is a household budget spreadsheet, useful explanations and a free worksheet. We’re glad we’re able to share access to these resources with you, so you can get started making your first budget!

We've crafted our own unique budgeting resources for you. Grab a free copy of our worksheet and budgeting spreadsheet.

How Does a Budget Template Work?

A budget template guides you through the budgeting process. You can record every dollar you earn and spend on this single sheet to track your money properly and with ease.

The first step is to input your total take-home income for the month. Then, input all of your monthly bills, and add additional spending throughout the month.

Once you subtract your income from your spending, you will see how much money you have left (if any) and where it went.

In addition to tracking your spending, your budget template will show you important insights about how you can improve your monthly habits. You can use your first month or first few months to learn where your money goes and determine what you value before you create or revise your budget.

If you’re still unsure about budgeting, take a moment to learn why a budget is important and how it can help you reach your goals, both financially and in life. The best budget templates are the ones you actually use. Regardless of whether you use an excel budget template, the default google drive spreadsheets, or something else. The main take away is that you have to use it, and stick to it!

If free monthly budget template trackers don’t seem to help you – you may need to check out the best budgeting apps instead. There are other great budgeting tools like YNAB and Empower too. These help you identify spending habits and easily manage your bank account views. Another great free digital option to consider is Empower.

10 Best Budget Template Printables

We have created a variety of printable worksheets and trackers to make budgeting and financial planning a breeze. Our families and ourselves have really enjoyed using these printables, and we know you will too!

Here are some of our favorite printable budget sheets to help stay organized and motivated on your financial journey.

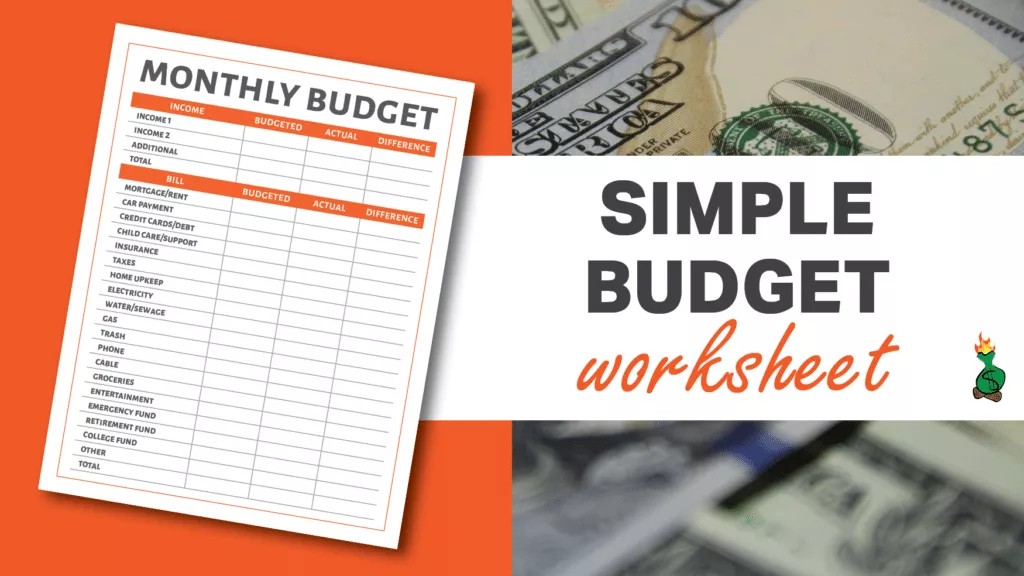

1. Monthly Budget Worksheet

Our original printable budget worksheet helps you track your cash flow throughout the month. Create a zero-based budget (read: Income = Expenses + Savings) and monitor your goal, actual, and different amounts as the month goes on.

There is ample space to write down your income, bills, and spending. The open-ended format of this budget printable makes it easy to accommodate a variety of income sources and expenses.

Use the bills section for recurring costs such as housing, groceries, insurance, and savings. The spending section helps you track more spontaneous or variable expenses like dinner-and-a-movie nights.

2. Monthly Budget Simple Worksheet

Another monthly budget worksheet provides more structure and guidance. This printable contains only two sections — income and bills — with specific categories listed on the left-hand side. This is perfect to help you see monthly cash flow all in one page.

If you’re not sure where to start with tracking your spending, this simple budget template is great for beginners. Many essential bills are already listed for you. Plus, the “total” rows will remind you to compare your income to your expenses.

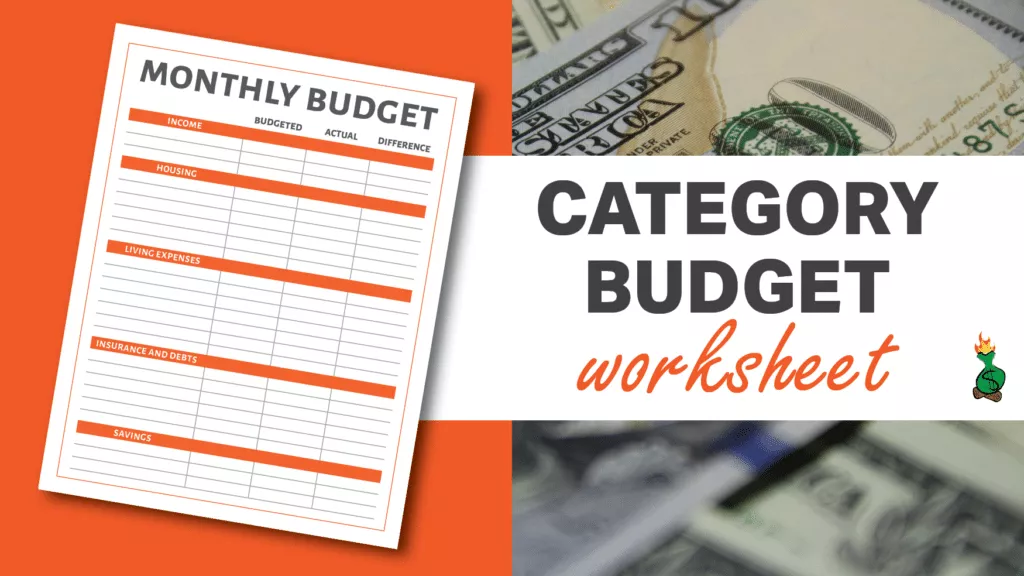

3. Monthly Budget Category Worksheet

This printable budget worksheet offers another layout for tracking your money throughout the month. It has the best of both worlds in terms of structure and flexibility.

There are separate categories for income, housing, living expenses, insurance & debts, and savings. Housing includes costs like mortgage/rent, utilities, and home upkeep. Living expenses include groceries, phone and cable bills, and entertainment.

You can write down your own expenses in each category to customize it to your personal bills and saving goals. There is also space to record budgeted, actual, and difference amounts.

4. Financial Goals Colorable Tracker

Our financial goals tracker is a great tool if you have specific objectives in mind. This colorable printable lets you visualize your progress as you work toward paying off debt, increasing savings, or reaching financial independence.

Use the tracker to write down each goal, start date, and target end date. Then, color in the percentage boxes as you make progress toward your goals.

This is a great one to keep on your fridge so you see it often and stay motivated!

5. Yearly Savings Tracker

Our yearly savings tracker helps you visualize long-term goals and stay on schedule to reach them. Choose a savings goal, such as an emergency or retirement fund, to keep track of throughout the year.

At the end of each week, write down the amount you saved, and then add it to your total. Your desire to see that number increase every week will keep you motivated to save more!

6. Debt Overview Worksheet

Many Americans feel trapped by debt and don’t know how to get out from under it. The first step is to list all of your debt and corresponding interest rates.

This debt overview worksheet will help you do just that. It offers space for your balance, creditor, APR, minimum monthly payment, and estimated payoff date.

Once you have listed all of your debts, you can identify which ones are costing you the most in interest. Those ones should be given extra attention first.

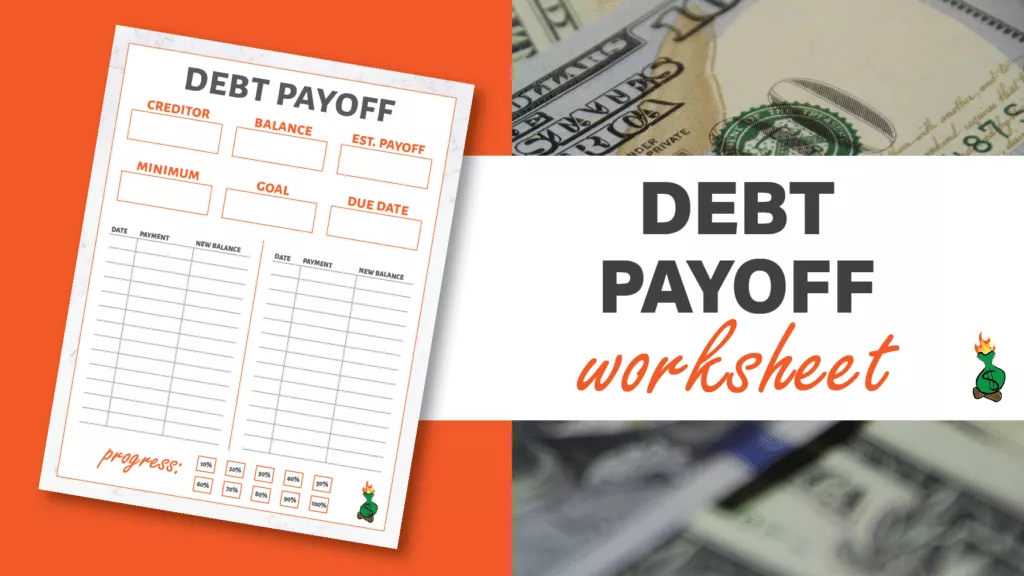

7. Debt Payoff Worksheet

Our debt payoff worksheet helps you track individual debts. Use this printable for each debt you are currently focusing on wiping out.

First, write down the creditor, balance, estimated payoff date, minimum monthly payment, goal monthly payment, and payment due date.

Then, keep record of each payment and your new balance. Color in the percentage boxes as you make progress.

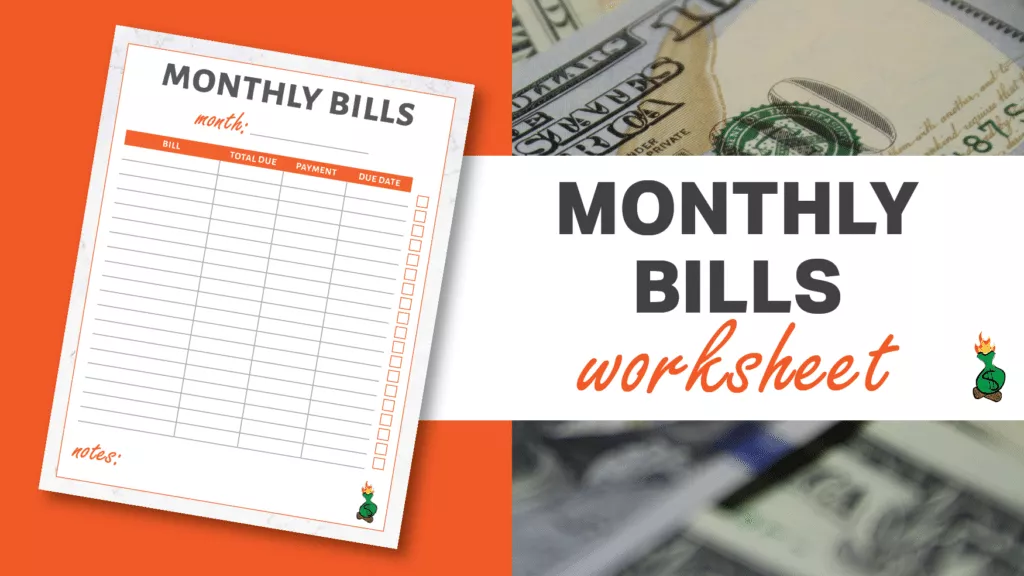

8. Monthly Bills Worksheet

Our monthly bills worksheet is another option for tracking your expenses. This printable offers a more comprehensive view of your recurring payments.

Use this monthly worksheet to write down your bill, the total amount due, your monthly payment amount, and its due date.

You can check off the bill once you have made the payment to keep track of your progress. The handy “month” and “notes” sections help keep you organized as well.

9. Monthly Income Worksheet

Our monthly income worksheet is a useful tool for individuals and families with multiple and varying income sources. This printable will simplify your budgeting process by offering an extensive overview of all incoming cash.

Fill out this worksheet by writing down the source of income, date received, total amount, and amount after tax. You can also pair it with the Monthly Bills worksheet to plan your budget with a full picture of your finances.

10. Budget Planner Worksheet

Before you plan your budget, you must understand what you value financially. Some people are willing to pay extra for entertainment, while others care more about fine dining.

Our budget planner worksheet asks the essential questions you must answer before assigning expenses to your cash. You will better understand what costs are important to you in light of your financial goals.

Budgeting with Budget Templates

No matter which worksheets or trackers you use, you are taking a step in the right direction. Take use of the budget templates available above, find what works best for you and your family.

These printable budget templates will give you a better understanding of your financial situation. They will also enlighten you as to what expenses you value and what action you must take to achieve your financial goals.

If you find these printable budget worksheets helpful, you can browse additional worksheets and templates at our Etsy store. We have colorable trackers, checklists, and more to help you on your journey to financial independence.

Samantha Hawrylack is a personal finance expert and full-time entrepreneur with a passion for writing and SEO. She holds a Bachelor’s in Finance and Master’s in Business Administration and previously worked for Vanguard, where she held Series 7 and 63 licenses. Her work has been featured in publications like Grow, MSN, CNBC, Ladders, Rocket Mortgage, Quicken Loans, Clever Girl Finance, Credit Donkey, Crediful, Investing Answers, Well Kept Wallet, AllCards, Mama and Money, and Concreit, among others. She writes in personal finance, real estate, credit, entrepreneurship, credit card, student loan, mortgage, personal loan, insurance, debt management, business, productivity, and career niches.