If you’re stuck in your financial goals or think you’ll never reach financial independence, the 7 Levels of Financial Freedom may be just what you need.

Think of them like a roadmap to achieve the financial picture you have in mind and to be one of the biggest success stories regarding your finances.

Table of Contents

7 Levels of Financial Freedom Definition

Financial freedom is a somewhat subjective term, but for most, it means having enough money for bills, savings, short and long-term goals, and enough cash for living life how you want.

When you reach financial freedom, you don’t have such worries as, “Can I make rent this month?” or “Can I afford my insurance?”

When you’re financially free, you can pursue your goals, whether it means you want to retire early or start a different career without worrying about paying the bills.

The seven money levels gradually walk you through the steps to achieve financial freedom. You won’t achieve it overnight, but with time and good habits, you’ll have more money security and room for more robust financial decisions.

Financial Freedom vs. Financial Independence

Financial independence means you have enough passive income to cover your living expenses. When you are financially independent, you don’t have to work to make sure you can cover your daily costs.

Financial freedom, however, means you can do what you want without worrying about having enough money.

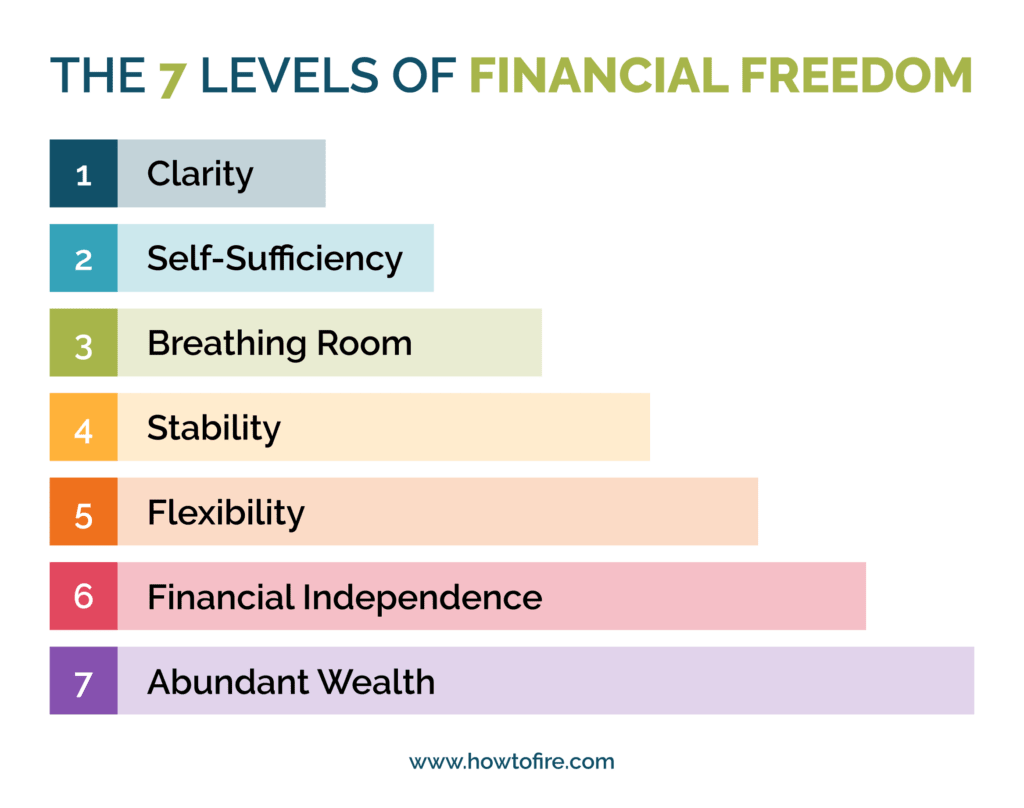

The 7 Levels of Financial Freedom

Earning financial stability or freedom means taking stock of what you have, assessing your financial habits, and making changes wherever possible to maximize the money going to your savings and investment accounts.

As you work toward your way to money security, you’ll reach different levels of wealth, as discussed below.

Gain access to all of our free resources!

- eBooks

- Spreadsheets

- Printables

- Other great Freebies!

Level 1: Clarity

The first step is awareness of how much money you have and how much you need. In this step, you’ll plan your short and long-term goals, take stock of your debts and income, and create a plan.

Think of this as the planning stage. You can only reach your goals with a strategic plan or map. This step also tells you what level of financial freedom you already have before taking any steps.

Level 2: Self-Sufficiency

When you’re self-sufficient, you can cover your bills and living expenses without depending on loved ones. Some people are living paycheck to paycheck at this stage. You may also have loans to handle unexpected circumstances or a little money set aside for small emergencies.

Level 3: Breathing Room

As you get more established and earn more money, you create breathing room in your budget, leaving more money available after paying your monthly bills and living expenses.

You use your extra money for goals like an emergency fund and retirement savings. At this level, you have more money to cover unexpected occurrences.

Most people aren’t debt-free at this point and would experience financial strain if they lost their jobs, but they have enough money to see progress on some of their financial goals.

Level 4: Stability

When you reach the stability level, you’ve started making progress on paying down your high-interest credit card debt and have a fully stocked emergency fund, meaning you have your living expenses saved.

This means you have at least six months of monthly expenses saved, won’t have to borrow money to make ends meet, and can continue moving forward with your goals.

If you experience job loss or become ill at this stage, you won’t slide backward in the 7 Levels of Financial Freedom because you’ll be able to handle your expenses for the short term.

When calculating your six months of expenses, think about what life would look like if you lost your job or couldn’t work for other reasons. You’d likely cut back on specific expenses, so consider that when planning your budget for life during emergencies.

Level 5: Flexibility

At level five, you have some flexibility in how you live your life. You have a couple of years of expenses saved in an investment portfolio, including cash or savings that are accessible.

Retirement savings don’t count in this figure because they aren’t readily accessible, at least without a hefty penalty. Consider the funds you have saved in taxable investments, savings, CDs, bonds, and cash when determining how much time your money buys you.

For example, if you were to take a year off work, would you be able to cover the costs and not feel financial strain?

Level 6: Financial Independence

As we said earlier, financially independent folks live off their investments. They don’t have to actively work to pay the bills and cover their living expenses.

You can achieve financial independence with your investment portfolio income or income from real estate investments such as rental properties.

Most people who achieve financial independence plan it by living a modest lifestyle throughout their income-earning years so they can save and invest a large percentage of their income. You could stop working and not worry about your finances at this level.

Level 7: Abundant Wealth

The final level of the 7 Levels of Financial Freedom is abundant wealth, meaning you have more money than you’ll need to carry out your financial dreams.

Many people use the 4% rule for retirement, which states to remain financially stable, you should only withdraw 4% of your retirement savings annually.

You don’t have to live by this rule when you’ve reached abundant wealth. You have more than enough money to live how you want without the risk of running out of money.

Steps To Achieve Financial Freedom

Reaching financial freedom may sound like a fantastic dream, but anyone with goals and a plan can achieve it. Here’s how.

Establish Clear Goals

People who achieved financial independence did so because they established clear goals.

They had a plan, and they followed it. Your plan should include short and long-term goals with a clear idea of how you’ll reach them. Your goals should consist of clear timelines so you can properly budget.

Create a Budget and Track Spending

When you know your goals, how much you must save, and when, you can create a budget that includes these amounts. Treat them like any other bill; the amounts are non-negotiable so you can reach your goals.

After creating your budget, track your spending and progress on your goals. Don’t assume you’re on track; keep track of how you’re doing by revisiting your budget monthly and tracking your spending and expenses.

Build an Emergency Fund

Emergency savings helps ensure you don’t have to use up your savings during times of crisis. Having at least six months of expenses saved ensures you can handle whatever life throws your way. It’s also a fund to cover unexpected home, auto, or medical expenses.

It takes time to build emergency savings, but regularly contributing to the account can help ensure you are on your way to having some financial leeway.

Reduce and Manage Debt

A key to achieving financial freedom is not to have debt. If you already have credit card debt, create a plan to pay it off as quickly as possible. This eliminates excessive interest costs and allows more money for retirement planning and achieving overall financial freedom.

Invest and Grow Wealth

You must invest your money to grow your wealth to reach financial independence. Passive income allows you to increase your income without giving up hours of your life. A balanced portfolio allows the opportunity to grow your wealth without depending on one source.

The 5 Levels of Personal Finance

When trying to achieve the 7 Levels of Financial Freedom, it’s essential to understand the different wealth levels and everything that goes into it to achieve your goals.

- Income: Track how much money you bring in monthly, including all sources. Consider starting a side gig or earning passive income by investing.

- Spending: Track your spending on fixed and variable expenses. Focus on where you can cut back, especially variable expenses, like a gym membership or eating out.

- Savings: Focus on how much you save monthly. Consider setting up automatic deposits so you always pay yourself first, ensuring you reach your savings goals.

- Investing: Pay attention to how much money you’ve invested, how the investments perform, and how close you are to reaching your financial goals.

- Protection: Consider how you are protecting your finances and estates. Look at products such as life or long-term disability insurance.

How Much Money Do I Need for Financial Freedom?

How much money you need for financial freedom is different from the amount your neighbor or even sibling needs. It depends on your living expenses and lifestyle.

The key is to have more than enough money to cover your ‘must-haves’ while providing plenty of room for other decisions, should you decide to take a couple of years off work, pursue a new career, or something else.

FAQs

What Is the Purpose of These Levels?

The 7 Levels of Financial Freedom help you understand how to work your way up to financial freedom. No one achieves it overnight, even people making hundreds of thousands of dollars annually.

Financial freedom takes time because you must pay off your debt, manage your expenses, save, and invest. Each level helps you see progress and motivates you to move forward.

How Do I Determine Which Level I’m At?

Always start with level 1, financial clarity. Determine where you are at financially, considering your income generated and expenses. Take inventory of your savings and investments, and assess which level you are in regarding financial security.

Is It Necessary To Go Through Each Level in Order?

Some people may skip levels of financial freedom. Everyone should start at Level 1, Clarity.

However, after taking inventory of your financial situation, you may already be a Level 3 or 4. You can create a plan based on your current situation while focusing on your future goals.

Can I Skip Levels if I Already Have Some Financial Knowledge?

Skipping levels of financial freedom doesn’t have anything to do with having financial knowledge. Instead, you should base your levels of financial freedom on your financial situation.

For example, if you already have some breathing room, you can focus on achieving stability by paying down your credit card debts.

Can I Achieve Financial Freedom After Completing All 7 Levels?

The idea is to achieve financial freedom after completing all levels; however, it requires you to focus on your financial situation moving forward.

For example, if you achieve financial freedom level 7 but then give up on your habits and spend needlessly, you could spiral backward into a lower level. The key is consistency.

Can the Levels Be Customized To Individual Goals?

As with any personal finance decision, all rules can be customized. Determining your financial situation and seeing how it fits into the levels is essential.

For example, you may not have any credit card debt, so once you achieve some breathing room, you’ve also achieved financial stability and can move on to flexibility.

What Is the One-Third Rule in Personal Finance?

The one-third rule can help you get on track to reach financial freedom. It states that you should allocate one-third of your income to fixed expenses, one-third to wants, and one-third to savings.

This allows you room for your everyday expenses and wants and to save for the future, such as achieving the FIRE movement.

The Bottom Line

The 7 Levels of Financial Freedom guide you to help avoid the need to live paycheck to paycheck and to help you achieve financial security. It happens at a different timeline for everyone.

The key is to get on your own two feet, get out of credit card debt, and save or invest enough money to trade your time for your heart’s biggest desires.

Samantha Hawrylack is a personal finance expert and full-time entrepreneur with a passion for writing and SEO. She holds a Bachelor’s in Finance and Master’s in Business Administration and previously worked for Vanguard, where she held Series 7 and 63 licenses. Her work has been featured in publications like Grow, MSN, CNBC, Ladders, Rocket Mortgage, Quicken Loans, Clever Girl Finance, Credit Donkey, Crediful, Investing Answers, Well Kept Wallet, AllCards, Mama and Money, and Concreit, among others. She writes in personal finance, real estate, credit, entrepreneurship, credit card, student loan, mortgage, personal loan, insurance, debt management, business, productivity, and career niches.