Earning an hourly wage makes it hard to budget unless you annualize it or at least look at it on a monthly basis. Knowing how much you bring in each month is important; otherwise, how do you set up a budget? You need to know how much you can commit to expenses like housing, utilities, insurance, food, and savings.

If you make $35 an hour, check out our guide to make the most of it. Continue reading to also see the equivalent annual salary based on how many hours you work.

Table of Contents

$35 an Hour Is How Much a Year?

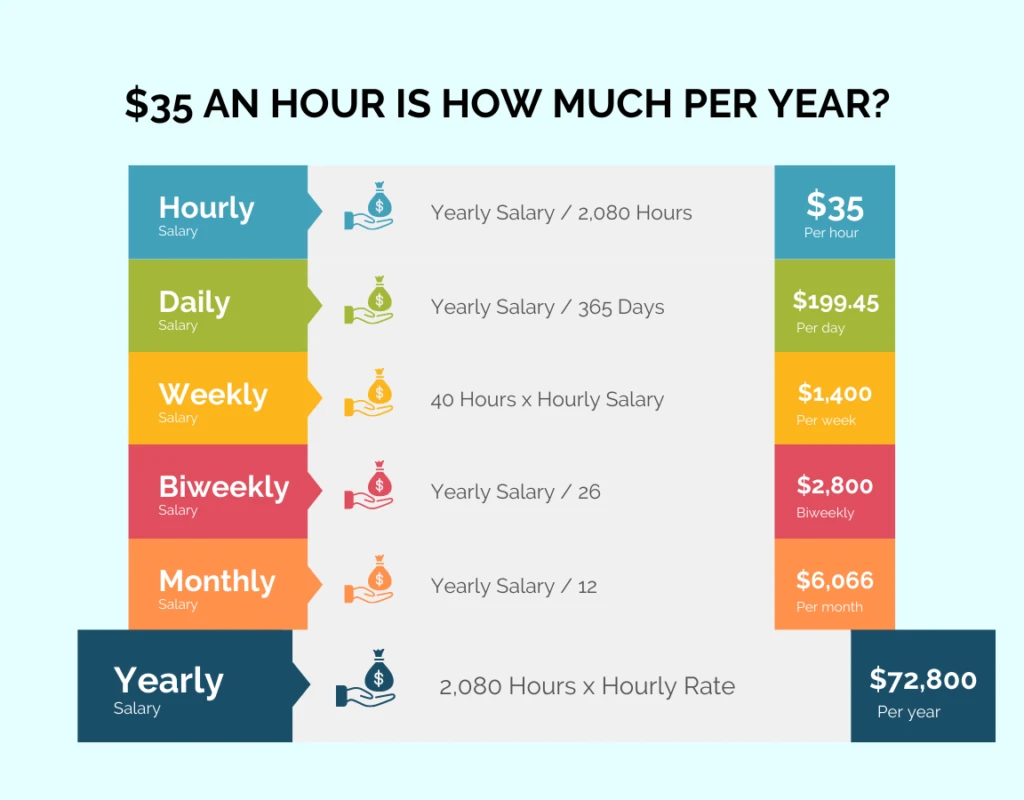

You may find yourself asking how much is $35 an hour annually? If you work 52 weeks per year (or get two weeks of paid vacation), you will make around $72,800 assuming you work 40-hour weeks with no overtime pay.

If you don’t get paid time off and you take it, you’ll work around 2,000 hours per year, bringing your salary down to $70,000 even. But if we’re honest, there are 260 weekdays in 2023. If you worked every weekday, you’d work 2,080 hours and make $72,800 annually.

Let’s convert your hours worked to salary based measurements:

Check out our free Hourly to Salary Calculator to further dive into your hourly pay.

For both salaried and hourly employees, the fair labor standards act, and the department of labor standards provides you with a level of protection. Federal minimum wage (minimum rate of pay for a given nonexempt job role) and for overtime hours on time-spent if an employee meets compensatory requirements are just two examples of how labor laws help you.

How Much is $35 an Hour per Month?

It helps to know how much $35 an hour earns you per month. You’ll have a better idea of your monthly budget and what you can spend. Using the full 365 days in 2023, the average hourly wage earner works 175 hours per month.

At $35 an hour, you’d make $6,125 per month, assuming you work all the weekdays in the month. If you take time off unpaid, the amount drops.

How Much is $35 an Hour per Week?

Do you prefer to budget weekly? Many people do; it’s easier to break it down than look at a month at a time and get overwhelmed.

$35 an hour per week means $35 an hour for 40 hours or $1400. If you work overtime or take time off, it will increase or decrease your weekly income accordingly.

How Much is $35 an Hour per Day?

Want to look at it from a daily standpoint? Maybe you want to give yourself a little incentive to keep going – and what works better than cold hard cash, right?

If you work full-time, that’s 8 hours a day on average. At $35 an hour, you’d gain $280 a day.

$35 An Hour Breakdown (Comparison Table)

Here’s a quick breakdown of what $35 an hour looks like for the average person.

Tools You Need to Live on $35 an Hour

Empower

Knowing your net worth is half the battle, and Empower helps you understand yours. Track your assets and liabilities – see where you stand (and where you should make changes). It doesn’t cost anything unless you sign up for their Robo-advisor services, which we think is a great way to start investing, especially for beginners.

Track all of your account balances and your net worth in one place. Get access to a Retirement Planner, Fee Analyzer, Portfolio Checkup, Contribution Calculators, and so much more with, Empower!

- Early pay and cash advances

- Easy account linking

- Earn cash back

- Budgeting tools to monitor spending and expenses

- An inexpensive way to borrow funds

- The amount borrowed is non-customizable

- Requires a subscription

- Low APY

- Need an Empower card to receive free and instant cash advances

CIT Bank

Don’t waste your time (and moolah) in your local, brick-and-mortar banks. The interest is next to nothing – you’ll get the same result keeping things under your mattress. Instead, make it work for you at CIT Bank, where you make 11x the national average interest rates in their money market account.

Earn higher and more competitive APY with CIT Bank. As a top-ten online bank, they commit themselves to growing and preserving your savings safely and securely. Find saving, e-checking, money market, and CD options with CIT.

- Significantly higher APY than traditional banks

- 4.20% APY on Savings Connect Accounts

- Zero monthly fees

- Small deposit minimum requirements

- No physical locations are available

- Checks are not an available option

- NO IRAs, car loans, or credit cards

FlexJobs

Looking for a part-time gig to pick some additional work-hours up? Regardless of whether you want to extend your workweek into the weekends or extend past your normal eight hours per day – FlexJobs offers the best remote work and flexible positions available.

Find the best paying full time & part time remote work from home & flexible jobs available online!

Both employee & freelance positions available from some of the biggest companies!

- Advanced and easily refined job searches

- Saves time for job seekers

- FlexJobs screens the jobs they post

- 30-Day money back guarentee

- Requires a membership fee

- Salaries are not always listed with the job post

- Some jobs are not actually remote

Tiller

Do you love spreadsheets, but don’t have the time for manual data entry? Who does, right? Tiller automatically imports your transactions, working with over 20,000 banks. They even categorize for you (don’t worry you can customize) and send daily emails showing your balance and activities.

Easily automate spreadsheets with Google Sheets or Microsoft Excel and manage your finances today! Connect your transaction data, bank, credit cards, brokerages, loans, and other financial institutions and gain insight into your finances.

- Extremely Customizable

- Advanced reporting on personal profit, loss, and cash flow.

- Free for 30-days

- No mobile app - can only access via spreadsheet

- Basic knowledge of spreadsheets is required

- Only free for 30-days

Survey Junkie

Received gift cards or PayPal money just for providing your opinions and input on today’s products and services with Survey Junkie. Complete these in your free time and take home a little side money. Seriously, while you’re watching TV, waiting for the doctor, or while cooking dinner, answer a series of questions or two and acquire points for free prizes.

Get paid for taking online surveys!

All you have to do is build your profile, take surveys, earn points, and get paid!

Payouts are available via PayPal or e-Giftcards.

- Free to sign up

- Redeem for cash or gift cards

- Points have a long "shelf life" compared to other sites.

- Payouts for some surveys are low

10 Jobs That Earn $35 an Hour

There are a number of jobs that pay $35 an hour. Some of these jobs require schooling to be able to get hired, while others can be done with enough experience.

Here are 10 jobs that earn an hourly salary of $35.

1. Registered Nurse

If you like helping people and are interested in a full time job in the medical field, becoming a registered nurse may be the right job for you.

Education requirements vary by state, but you will need either an associate degree in nursing (ADN) or a bachelor of science in nursing(BSN). You will also need to pass a licensing exam to be fully licensed and able to practice.

A registered nurse does a variety of duties in relation to the care of a patient. It can range from observing and speaking with patients and coordinating care to drawing blood and performing other medical procedures.

According to the bls.gov website, the average salary of a registered nurse is $39.78 an hour or over $82,000 in annual income.

2. Chiropractor

Becoming a chiropractor is a lengthy process, with 3-4 years of undergraduate school and then another 3-4 years in a doctor of chiropractic program. To obtain the doctorate degree, they must complete a minimum of 4,200 instructional hours.

They must also pass exams to secure licensure in the state where they plan to practice.

Chiropractors see patients and help relieve pain in joints and muscles through spinal manipulations. This includes headaches, neck and back pain, and joint pain as well.

Chiropractors earn an average of $75,000 a year or $36.06 per hour.

3. Dental Hygienist

With a career as a dental hygienist, an associate degree and state licensure are the minimum requirements for this career. Although a bachelor’s degree may be worth it if someone wants to advance their career in this field.

Dental hygienists examine dental patients for signs of oral diseases. They also provide preventative care and educate patients about oral health.

Dental hygienists earn an average of $39.12 an hour or a yearly salary of $81,000.

4. Engineer

There are many different careers within the engineering field.

The first step would be to identify the niche in which you would want to be an engineer i.e. manufacturing, technology…

Then, you’ll need a bachelor’s degree in that particular field.

Engineers design, build, and maintain structures and systems. They troubleshoot and solve problems that develop by applying scientific and mathematical principles.

The salary for an engineer will depend on their specialty. For instance, the average salary for a civil engineer is $45.91 an hour, while a software engineer makes $52.41 an hour.

5. Electrical Lineman

The electrical lineman job is part of a career in trades. Tradespeople, like engineers, fall under a broad category. A tradesperson is someone who is trained in skilled labor. This includes plumbers, electricians, HVAC technicians, welders, machinists, and more.

The typical path for an electrical lineman starts with an apprenticeship. Some employers may require a technical degree, which usually lasts 2 years.

The average salary for an electrical lineman is $38.01/hour or $79,060 a year.

6. Web Developer

As more of life takes place on the internet, web developer jobs will need to be filled. Web development is a skills-based career. This means that while you can go and get an associate’s or bachelor’s degree in web development, it’s not always necessary to land the job.

If you teach yourself web development and can prove your skills, you can get hired just the same.

Web developers create and maintain websites. They take care of many of the technical aspects that make a website run smoothly.

Web developers make an average of $37.65 an hour or $78,300 a year.

This is a great option for someone who wants to change careers but doesn’t want to get a college degree.

7. Technical Writer

Technical writing is another job where it can be helpful to have a bachelor’s degree, but it’s not absolutely required. If you have strong writing skills and a background in the subject, it’s possible to land jobs without a degree if you have a strong portfolio.

Technical writers create training manuals, how-to guides, and other supporting materials to break down complex subjects.

The average salary for technical writers is $37.53 per hour or $78,060 a year.

8. Farmer

A farmer can get an associate’s or bachelor’s degree in various agricultural studies. This can help provide them with the knowledge of new technology and best practices. It is also very common for farmers to have only high school degrees, especially when they have grown up on a farm.

A farmer raises living plants and/or animals for food, raw materials, or animal products.

The average salary of a farmer is $35.12 an hour or $73,060 per year.

9. Social Service Manager

A career as a social service manager requires at least a bachelor’s degree. Some positions also require a master’s degree.

A social service manager plans, creates, and organizes social programs that will support the community.

The average salary of a social service manager is $35.58 an hour or $74,000 a year.

10. Food Scientist

A food scientist needs to have at least a bachelor’s degree, although advanced degrees are common.

Food scientists study the basic elements of food. They use chemistry and biology to analyze nutritional content and make sure processed foods are safe and healthy.

The average salary of a food scientist is $35.66 an hour or $74,160 per year.

Budgeting for $35 per Hour Pay

Depending on where you live and your lifestyle, you can have a comfortable budget making $35 per hour take-home pay.

If you make $35 an hour times 40 hours a week, you’ll make $1,400 a week or approximately $5,600 a month, minus some for taxes. This is assuming 8 hours per workday.

For a typical budget:

| Housing: | $1800 |

| Food: | $700 |

| Utilities: | $300 |

| Gas: | $200 |

| Health Insurance: | $500 |

| Entertainment/Subscriptions: | $150 |

| Debt: | $500 |

| Savings: | $500 |

| Transportation: | $700 |

The above totals $5,350.

Of course, these numbers are going to be different for everyone, but this should give you an idea of how you could live on $35 an hour.

FAQ

What’s the Total Number of Working Days in 2022?

There are a total of 260 working days in the calendar year for 2022. This is not including federal holidays, which many companies observe. This means there will be 2,080 working hours.

This is figured by taking the 52 weeks per year and subtracting 2 days for the weekend for each week. So 104 days of the year are weekends, leaving 260 work days.

How Do You Calculate Hourly Rate From Annual Salary?

To calculate your hourly rate for hours worked from your annual salary, take your annual salary for 12 months and divide it by the number of hours you will work, which is generally 2,080 hours in a year.

If you annual salary was $75,000, $75,000/2,080= $36.06 for an hourly rate.

What Is the Median Hourly Wage?

According to bls.gov, the median hourly wage is $22.00 an hour for hours worked.

The Bottom Line: Is $35 an Hour Good Pay?

You can make $35 an hour work if you’re responsible with your finances. If you accumulate a lot of debt, even $35 an hour may not be enough to cover your expenses. Make sure you create a budget and stay intentional with your spending and saving. If you work hard to reach your goals, you’ll achieve financial freedom in no time!

Financial independence has more to do with how you manage your money than how much money you make. Check out our Manage Money category for effective strategies to manage your money!

Samantha Hawrylack is a personal finance expert and full-time entrepreneur with a passion for writing and SEO. She holds a Bachelor’s in Finance and Master’s in Business Administration and previously worked for Vanguard, where she held Series 7 and 63 licenses. Her work has been featured in publications like Grow, MSN, CNBC, Ladders, Rocket Mortgage, Quicken Loans, Clever Girl Finance, Credit Donkey, Crediful, Investing Answers, Well Kept Wallet, AllCards, Mama and Money, and Concreit, among others. She writes in personal finance, real estate, credit, entrepreneurship, credit card, student loan, mortgage, personal loan, insurance, debt management, business, productivity, and career niches.