Earning an hourly wage makes it hard to budget unless you annualize it or at least look at it on a monthly basis. Knowing how much you bring in each month is important; otherwise, how do you set up a budget? You need to know how much you can commit to expenses like housing, utilities, insurance, food, and savings.

If you make $27 an hour, check out our guide to make the most of it. So $27 an hour is how much a year? Continue reading to also see the equivalent annual salary based on how many hours you work.

Table of Contents

$27 an Hour Is How Much a Year?

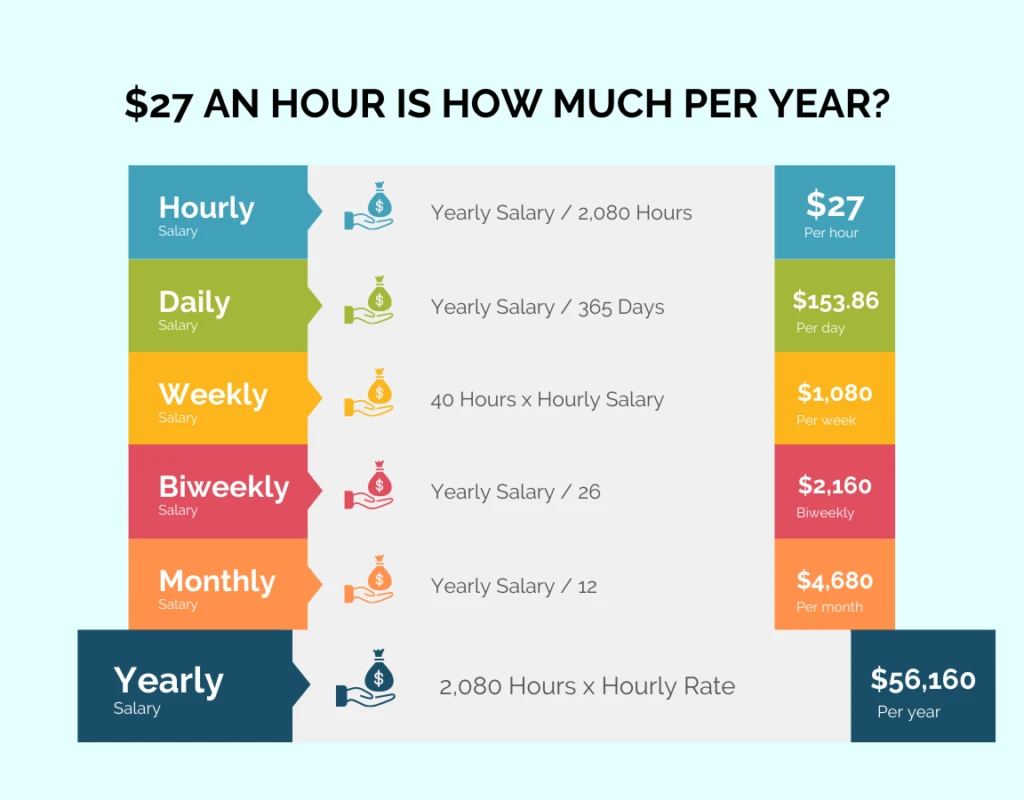

You may find yourself asking how much is $27 an hour annually? If you work 52 weeks per year (or get two weeks of paid vacation), you will make around $56,160 assuming you work 40-hour weeks with no overtime pay.

If you don’t get paid time off and you take it, you’ll work around 2,000 hours per year, bringing your salary down to $54,000 even. But if we’re honest, there are 260 weekdays in 2023. If you worked every weekday, you’d work 2,080 hours and make $56,160 annually.

Let’s convert your hours worked to salary based measurements:

Check out our free Hourly to Salary Calculator to further dive into your hourly pay.

For both salaried and hourly employees, the fair labor standards act, and the department of labor standards provides you with a level of protection. Federal minimum wage (minimum rate of pay for a given nonexempt job role) and for overtime hours on time-spent if an employee meets compensatory requirements are just two examples of how labor laws help you.

How Much is $27 an Hour per Month?

It helps to know how much $27 an hour earns you per month. You’ll have a better idea of your monthly budget and what you can spend. Using the full 365 days in 2023, the average hourly wage earner works 175 hours per month.

At $27 an hour, you’d make $4,725 per month, assuming you work all the weekdays in the month. If you take time off unpaid, the amount drops.

How Much is $27 an Hour per Week?

Do you prefer to budget weekly? Many people do; it’s easier to break it down than look at a month at a time and get overwhelmed.

$27 an hour per week means $27 an hour for 40 hours or $1080. If you work overtime or take time off, it will increase or decrease your weekly income accordingly.

How Much is $27 an Hour per Day?

Want to look at it from a daily standpoint? Maybe you want to give yourself a little incentive to keep going – and what works better than cold hard cash, right?

If you work full-time, that’s 8 hours a day on average. At $27 an hour, you’d gain $216 a day.

$27 An Hour Breakdown (Comparison Table)

Here’s a quick breakdown of what $27 an hour looks like for the average person.

Tools You Need to Live on $27 an Hour

Empower

Knowing your net worth is half the battle, and Empower helps you understand yours. Track your assets and liabilities – see where you stand (and where you should make changes). It doesn’t cost anything unless you sign up for their Robo-advisor services, which we think is a great way to start investing, especially for beginners.

Track all of your account balances and your net worth in one place. Get access to a Retirement Planner, Fee Analyzer, Portfolio Checkup, Contribution Calculators, and so much more with, Empower!

- Early pay and cash advances

- Easy account linking

- Earn cash back

- Budgeting tools to monitor spending and expenses

- An inexpensive way to borrow funds

- The amount borrowed is non-customizable

- Requires a subscription

- Low APY

- Need an Empower card to receive free and instant cash advances

CIT Bank

Don’t waste your time (and moolah) in your local, brick-and-mortar banks. The interest is next to nothing – you’ll get the same result keeping things under your mattress. Instead, make it work for you at CIT Bank, where you make 11x the national average interest rates in their money market account.

Earn higher and more competitive APY with CIT Bank. As a top-ten online bank, they commit themselves to growing and preserving your savings safely and securely. Find saving, e-checking, money market, and CD options with CIT.

- Significantly higher APY than traditional banks

- 4.20% APY on Savings Connect Accounts

- Zero monthly fees

- Small deposit minimum requirements

- No physical locations are available

- Checks are not an available option

- NO IRAs, car loans, or credit cards

FlexJobs

Looking for a part-time gig to pick some additional work-hours up? Regardless of whether you want to extend your workweek into the weekends or extend past your normal eight hours per day – FlexJobs offers the best remote work and flexible positions available.

Find the best paying full time & part time remote work from home & flexible jobs available online!

Both employee & freelance positions available from some of the biggest companies!

- Advanced and easily refined job searches

- Saves time for job seekers

- FlexJobs screens the jobs they post

- 30-Day money back guarentee

- Requires a membership fee

- Salaries are not always listed with the job post

- Some jobs are not actually remote

Tiller

Do you love spreadsheets, but don’t have the time for manual data entry? Who does, right? Tiller automatically imports your transactions, working with over 20,000 banks. They even categorize for you (don’t worry you can customize) and send daily emails showing your balance and activities.

Easily automate spreadsheets with Google Sheets or Microsoft Excel and manage your finances today! Connect your transaction data, bank, credit cards, brokerages, loans, and other financial institutions and gain insight into your finances.

- Extremely Customizable

- Advanced reporting on personal profit, loss, and cash flow.

- Free for 30-days

- No mobile app - can only access via spreadsheet

- Basic knowledge of spreadsheets is required

- Only free for 30-days

Survey Junkie

Received gift cards or PayPal money just for providing your opinions and input on today’s products and services with Survey Junkie. Complete these in your free time and take home a little side money. Seriously, while you’re watching TV, waiting for the doctor, or while cooking dinner, answer a series of questions or two and acquire points for free prizes.

Get paid for taking online surveys!

All you have to do is build your profile, take surveys, earn points, and get paid!

Payouts are available via PayPal or e-Giftcards.

- Free to sign up

- Redeem for cash or gift cards

- Points have a long "shelf life" compared to other sites.

- Payouts for some surveys are low

5 Jobs That Earn $27 an Hour

1. Electrician

Electricians are always needed, so you’ll never be out of a job. It takes some schooling and several years of training (paid), but in the end, it’s worth it. Electricians often start at $27 an hour and quickly work their way up. You can also use your skills as an electrician to earn extra cash as a side hustle.

2. Sales Representative

Sales representatives are needed in almost any industry. Work in an industry you’re passionate about, and you’ll make at least $27 an hour. Many sales reps work on commission, so your income might vary, but overall, sales reps make $27 or so an hour.

3. Cardiovascular Technologists and Technicians

If you love healthcare but don’t want to go to school as long as doctors do, consider working as a cardiovascular tech. You’ll still need some schooling, but you’ll be out of school and earning a decent wage long before doctors.

Cardio techs play an important role in the healthcare industry as they help people with heart troubles get diagnosed and get the proper treatment.

4. Elementary School Teachers

Elementary school teachers make an average of $27 an hour but earn more as they gain more experience. Teachers work hard and earn every dollar they make, but working with children is also rewarding.

Of course, to be a teacher, you’ll need a bachelor’s degree in education and a teaching certificate for the grade you teach.

5. Landscape Architects

Landscape architects have an important job. They design parks, gardens, playgrounds, and other public areas.

You’ll need a degree in landscape architecture or something related, but then you can work in the rewarding field of designing and implementing landscaping throughout your city and others.

$27 an Hour After Taxes

Making $27 an hour is great, but you must consider your after-tax income when budgeting.

Everyone has a different tax situation, but let’s assume after federal and state taxes, you pay 25% of your pay to the government. That leaves you with $42,120 per year or $3,510 per month.

Of course, this varies by person, so always check your tax bracket and calculate how much you’d pay in taxes when making $27 an hour.

Paid Time Off Vs. No Paid Time Off

Hourly employees don’t always get paid time off; it varies by employer and makes a big difference in your yearly salary.

If you get paid time off, it’s like working 40 hours for 52 weeks. You’d pay $56,160 a year and enjoy a luxurious two weeks off, knowing you’re still getting paid.

If you don’t get paid time off, you lose 80 hours in pay if you take the two weeks. So while we’d all like to think life is perfect and you wouldn’t need the time off, let’s be realistic.

Even if life is ‘perfect’ and you don’t have to take time off, your brain and body will likely need the break. No one can work 52 straight weeks.

So let’s say you take the 2-week break. You’d make $54,000 a year, losing $2,160 in pay for those two weeks.

Additional Ways to Boost Your Hourly Wage

If you aren’t happy with making $27 an hour, there are ways to increase your hourly wage. Some are easy, and others take a little more work.

Negotiate a Raise

If you love your job, consider asking for a raise. You won’t know if you can get it without asking, right?

Choose the right time, and consider setting up a meeting with your boss. Explain to him/her the reasons you feel you deserve the raise. Compile a list of your accomplishments and how you’ve helped the company.

Also, consider checking out what others in the area make doing your job. If other companies pay more, use that leverage to negotiate your raise.

New Job

Look elsewhere if you don’t love your job or your boss won’t consider a raise. Chances are the job you do can be done somewhere else, or at least something similar.

Sometimes change is good. Before taking a new job, ensure you understand the salary and the job potential. Remember, the grass isn’t always greener on the other side, so make sure it will work in your favor, and you aren’t trading a job you like for a job that pays more but doesn’t offer a comfortable environment.

New Career

Consider a new career if you’re tapped out at your job, meaning you can’t make more than you do.

Even if you went to college for your current job or you worked your way up the ladder; change can be good.

A new career means new possibilities. First, see what your current experience and education allow you to do. If you have the skills to change careers, go for it. If you don’t, consider what you must do to change. Should you go back to school or attend a certain type of training?

Do your research and see what a newbie to the industry will make. Even if the job’s potential is $27 an hour or more, that doesn’t mean that’s what you’ll earn right off the bat. So do your due diligence before changing careers.

Side Hustles

Consider starting a side gig or two if you’re happy at your job but wish you made extra cash. They don’t have to be anything stressful, either. You can do fun things like pet sit, take surveys, or help people organize their homes.

There are thousands of ways to do side gigs, including working from home as a freelancer or doing something outside the home, so you get to socialize and have fun. If you’re looking for something more ‘on demand’ so you can work when you want, consider downloading the

Passive Income

Passive income is a must for everyone, no matter how much money you make. Passive income is money you earn without actively working.

Common examples include investing in stocks or real estate, but you can also earn passive income from selling products online, such as digital planners, photos, or ebooks. You create the product one time and sell it as many times as people will buy it. So you can still make money from products you made years ago.

Budgeting for $27 per Hour Pay

Budgeting for $27 an hour is easy because you make a decent wage. As long as you don’t live in a high-cost area, you should be able to make your salary work.

Consider using 50% of your salary for most expenses. If you figure you’ll make $21 an hour after taxes, that leaves around $1,820 for your expenses. The remaining 50% of your take-home pay should cover savings, charitable giving, and entertainment.

Consider putting 20% of your income away in savings, giving 10%, and leaving 20% for that fun stuff that makes life a little easier.

$27 an Hour Is How Much a Year FAQ

Can I Live Off $27 Per Hour?

You can live off $27 per hour. But, like any salary, you must budget carefully and live within your means. You can likely live on your own, but if you have a second income in the household, it will help you reach other financial goals.

Can You Make $27 per Hour Without a Degree?

There are jobs you can work and make $27 without a degree, but most require some type of degree. If you didn’t go to college but want to earn $27 or more an hour, you may need to start your own business or work your way up the ladder at your job.

What’s the Total Number of Working Days in 2022?

There are 260 working days in 2022.

How Do You Calculate Hourly Rate From Annual Salary?

To calculate your hourly rate from an annual salary, you’ll take the salary and divide it by 52 weeks. Next, you’ll divide that number by 40 hours, and you’ll have your hourly wage.

For example, if you make $50,000 annually, here’s the calculation.

$50,000/52 = $961.53

$961.53/40 = $24.04 an hour

What Is the Median Hourly Wage?

The median hourly wage in the United States is $10.93 an hour.

Is $27 an Hour Good Pay?

You can make $27 an hour work if you’re responsible with your finances. If you accumulate a lot of debt, even $27 an hour may not be enough to cover your expenses. Make sure you create a budget and stay intentional with your spending and saving. If you work hard to reach your goals, you’ll achieve financial freedom in no time!

Financial independence has more to do with how you manage your money than how much money you make. Check out our Manage Money category for effective strategies to manage your money!

Samantha Hawrylack is a personal finance expert and full-time entrepreneur with a passion for writing and SEO. She holds a Bachelor’s in Finance and Master’s in Business Administration and previously worked for Vanguard, where she held Series 7 and 63 licenses. Her work has been featured in publications like Grow, MSN, CNBC, Ladders, Rocket Mortgage, Quicken Loans, Clever Girl Finance, Credit Donkey, Crediful, Investing Answers, Well Kept Wallet, AllCards, Mama and Money, and Concreit, among others. She writes in personal finance, real estate, credit, entrepreneurship, credit card, student loan, mortgage, personal loan, insurance, debt management, business, productivity, and career niches.