The key to money management is having a good budget. Since most people live on their mobile devices, finding user-friendly budgeting apps that provide what they need is a significant factor in achieving financial wellness.

If you’re searching for the perfect budgeting app, we’ve reviewed the top two, YNAB and the Quicken app.

Check out how they compare, the good, the bad, and which is right for you.

Table of Contents

What Is YNAB?

YNAB, or You Need a Budget, is a budgeting app. It tracks your income and spending to help you better control your financial health. The app’s point is to help you understand where to reduce expenses to save money and reach your financial goals.

YNAB uses the zero-based budgeting model and promotes the theory that you should live on ‘old money’ or money you earned in previous months versus waiting for your next paycheck to be able to pay bills.

In YNAB, every dollar has a ‘job.’ This means you account for every dollar you bring in, giving it something to do so you don’t leave any money for unnecessary spending. It’s the key to proper money management and works for thousands of people.

Manage your finances on one platform using real-time data. Make budgeting easier than ever with four easy rules and the help of YNAB. Available on Windows, Mac, iOS, and Android.

- Free Trial for 34-Days

- Available on Multiple Platforms

- Connects Multiple Accounts into One Platform

- No Alerts

- Learning Curve for New Users

What Is Quicken?

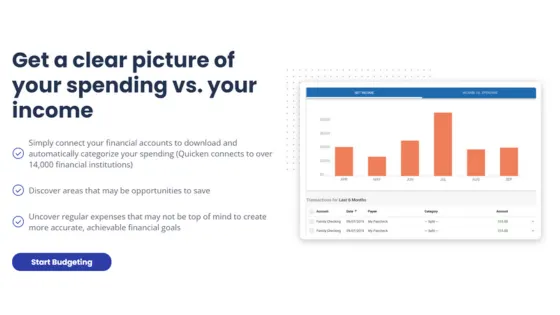

Quicken is more than budgeting software. It began as desktop program but has since evolved into an online resource with many features.

Quicken provides a holistic view of your financial accounts in one place while also focusing on a comprehensive budget. Quicken has many versions depending on what you want to focus on, whether it is strictly budgeting tool options or more robust features that include investment tracking or managing business funds.

Depending on the version you choose, with Quicken data, you can see your complete financial picture, manage your spending, track and pay bills, manage financial goals, and monitor and manage investments, rental properties, and small business finances.

YNAB Features – How Do They Compare?

To truly compare Quicken vs. YNAB, you must understand each offer’s features. So here’s what you might expect from the YNAB tools.

Account Linking

Linking accounts from your financial institutions is the key to tracking your budget and goals. When you link your bank accounts to YNAB, the YNAB direct import tool syncs your transactions in real time. You’ll know up-to-the-minute your bank account balance, the highest spending categories, and how much money you have to pay your bills.

By linking your accounts, YNAB tracks your tendencies and helps you learn where to cut back so you start living on ‘old money’ versus recently earned income.

The older your money is, the better you’re doing with balancing your budget and spending.

Real-Time Syncing

You can access your YNAB app from any device and get real-time updates. In addition, the information syncs across all devices, so whether you’re looking on your phone, computer, or tablet, you’ll have the same information about your finances.

Tracking Goals

Setting goals is one thing, but tracking them is the key. Whether your savings goals are for vacation, an emergency fund, or paying for college, you can set your goal, track its progress, and budget monthly payments toward it to ensure you reach your savings goals. YNAB does a great job breaking your goals down so you can see your progress.

Loan Calculator

If you have extra cash flow and wonder what the most effective debt paydown plan is, consider the YNAB loan calculator. In the calculator, you can play with the numbers to put your extra money where it belongs, getting you out of debt and helping you reach your financial goals.

Reports

If you love visuals, you’ll love the reports YNAB offers. It’s one of the most robust financial tools other budgeting apps don’t provide. You can isolate the data that means the most to you, whether it’s specific spending categories, dates, or you want to see the growth of all your accounts.

Related article: YNAB vs EveryDollar

Quicken Features – How Do They Compare?

When comparing Quicken vs. YNAB, it’s essential to look at Quicken’s features. Right off the bat, we’ll mention that Quicken has multiple products. Unlike YNAB, with one plan, Quicken has several, each based on different needs and available on your desktop or mobile device. The Quicken data directly impacts your financial decisions and helps you handle your overall net worth.

Quicken Simplifi

Simplifi by Quicken is a basic budgeting program. They claim you can budget in under five minutes a week, making it great for people who want a basic budget and don’t want to spend much time dealing with it.

The features of Quicken Simplifi include the following:

- Link all accounts for automatic updating

- Save for multiple goals

- Track bills and cash flow

- Automated spending plans

Starter

The Starter program offers a more customized way to handle your budget and personal expenses and gives a more in-depth look at your financial goals, progress in reaching them, and more detailed ways to organize your spending.

The features of Quicken Starter include the following:

- Connect all accounts, including checking, savings, and credit cards

- Automatically downloads transactions

- Track bills and spending in one place

- Track, contribute, and withdraw from your goal accounts

Deluxe

If you want something more robust, such as tracking loans and investments or creating a 12-month budget, the Deluxe program is a good option.

The Deluxe program includes the following:

- Connect all accounts and see your total net worth

- Monitor tax-related spending and income to make tax time easier

- Automated 12-month budget so you stay on track with bills

- Make and track savings goals

- Create fully customized views and reports

Premier

Quicken Premier is great for investors, and it includes Quicken bill pay to help you stay on top of your bills.

The Premier program includes the following:

- Connect all personal and investment accounts to track your portfolios

- Use analysis tools to make intelligent investing decisions

- Pay bills for free

- Handle tax reports and deductions

- Plan for retirement

Home and Business

If you run a business or own rental properties, use Quicken Home and Business to easily track expenses, tax deductions, and rental documents and properties.

The Home and Business program includes:

- Manage personal and business income in one program, tracking your total net worth

- Prepare all tax-related reports

- Easily manage rental properties

- Create customized views of all income and expenses

- Automatically update all accounts, including home values, in real-time

- Handle all bills from Quicken

YNAB vs. Quicken – The Cost

When comparing YNAB vs. Quicken, the cost is a common determining factor. YNAB has one plan, but you can pay month-to-month and cancel anytime. You can also choose to prepay for 12 months at a discount. The monthly plan is $14.99/month, and the annual plan is $99 or $8.25/month. The only downside of prepaying is you can’t cancel and get your money back.

Quicken pricing ranges from $3.99/month to $9.99 per month, which equates to $47.88 to $119.88 per year, and all Quicken plans are billed annually; however, they offer a 30-day money-back guarantee.

YNAB vs. Quicken – Security

Security is essential when using any financial tools or apps. Fortunately, YNAB and Quicken use bank-level security and encryption when storing and transferring data. In addition, both programs link to thousands of financial institutions to automatically sync data, and Quicken will sync past information, whereas YNAB only populates financial information moving forward.

To further the security of any financial app, never share your personal information, including your ID and password. Also, only use the app on trusted internet connections; avoid using them on public Wi-Fi or other untrusted internet connections.

YNAB vs. Quicken – Customer Service

When considering a paid service for financial health, you must consider customer service. YNAB lacks in this area. They don’t offer phone support. However, there is an option for live chat, but the wait times can be lengthy.

Quicken offers phone conversations and live chat and has much shorter wait times. In addition, if you pay for the Premier or Home and Business plan, you can prioritize customer support.

If you don’t have time to sit on the phone or wait for live chat, both platforms have a community that can answer questions or a robust FAQ page.

Is YNAB or Quicken Better?

When comparing programs for money management, you probably wonder if YNAB or Quicken is better. It’s not a one-size-fits-all answer, though.

Some people benefit more from YNAB, while others benefit more from Quicken; here’s what to consider.

Who Should Choose YNAB?

When deciding whether to choose YNAB, you should consider the pros of YNAB and Quicken, such as:

- Great for users who want a simple budget that uses the zero-based budgeting rules

- Automatically syncs to most bank accounts

- User-friendly and easy to start

- Encourages you to stop living paycheck-to-paycheck

If you simply want basic rules to follow, access on mobile devices, and budgeting tools to get you back on track, YNAB may be perfect.

Manage your finances on one platform using real-time data. Make budgeting easier than ever with four easy rules and the help of YNAB. Available on Windows, Mac, iOS, and Android.

- Free Trial for 34-Days

- Available on Multiple Platforms

- Connects Multiple Accounts into One Platform

- No Alerts

- Learning Curve for New Users

Who Should Choose Quicken?

If you’re looking for something more advanced, you may want to consider the pros of Quicken, including:

More robust budgeting tools that don’t follow the ‘give every dollar a job’ method

- Investment tracking and business expenses

- Track rental properties

- Understand your net worth

- The business version can help you manage personal and business finances

If you want something more advanced, with advanced features and opportunities to make big decisions regarding your investments, business, or even personal finances, Quicken is a better option.

Comparing Quicken, YNAB, and Empower

Quicken and YNAB are commonly debated, but many people also compare them to Empower. Here’s how Empower (formerly Personal Capital) compares.

With Empower, you can link all financial accounts, investment portfolios, and retirement savings to get a holistic view of your finances for free. You also have the option to become an advisory client for a small fee, helping you to reach your financial goals.

FAQs

When comparing YNAB vs. Quicken, it’s important to consider these frequently asked questions.

Does Quicken Have a Free Version?

Unfortunately, Quicken does not have a free version. Instead, they are a subscription-based service and bill annually. However, they offer a 30-day money-back guarantee. So if you try the program and within 30 days decide you don’t like it, you can get your money back.

Does Quicken Help With Budgeting?

Yes, Quicken is one of the top budgeting apps, among other things. Even the most basic plan, Quicken Simplifi, helps users create and use a budget. The higher the tier you choose, the more features it provides, including tracking investments or, in the business version, tracking business income and expenses.

Is YNAB Worth It?

If you use YNAB the way it’s meant, learning to live on ‘aged money’ and not paycheck-to-paycheck, you’ll likely be on track to save an average of $600 by your second month, which they claim most of their users do. At just $100 a year, you’ll quickly make your money back if you follow their zero-based budget.

What Is a Good Age for Money in YNAB?

The older your money is, the better. However, YNAB states that even money that’s 30 days old is an excellent way to manage your funds. This means you aren’t relying on your current paychecks to pay the bills and instead have money saved from older paychecks to pay them.

YNAB vs. Quicken – Final Thoughts

When debating between YNAB and Quicken, it comes down to what you need. YNAB is a basic budgeting program that helps you get control of your finances and plan for the future. Quicken’s Simplifi and Starter programs are similar to YNAB without using the zero-based budget method. However, the higher-tiered plans offer more robust features to help you run your investments, pay bills, manage rental properties, and plan for the future.

Choose the budgeting app that works best for your finances. The budgeting app you’ll use the most is the one that’s right for you!

Samantha Hawrylack is a personal finance expert and full-time entrepreneur with a passion for writing and SEO. She holds a Bachelor’s in Finance and Master’s in Business Administration and previously worked for Vanguard, where she held Series 7 and 63 licenses. Her work has been featured in publications like Grow, MSN, CNBC, Ladders, Rocket Mortgage, Quicken Loans, Clever Girl Finance, Credit Donkey, Crediful, Investing Answers, Well Kept Wallet, AllCards, Mama and Money, and Concreit, among others. She writes in personal finance, real estate, credit, entrepreneurship, credit card, student loan, mortgage, personal loan, insurance, debt management, business, productivity, and career niches.