Most people’s lives follow a similar path. You grow up, learn some skills, get a job, work 30 years or more, and then you retire in your 60’s to enjoy the twilight of your life. While the 30-year career has been the standard for decades, a growing number of people have dared to challenge the status quo when it comes to retirement. What if you didn’t have to wait until your 60’s or 70’s to enjoy your life? With the FIRE method, you don’t.

The FIRE acronym means- financial independence retire early. So what is FIRE finance, and what does the FIRE community do differently than others? Read on to learn why more people strive to achieve independence and early FIRE retirement, and more importantly, their plan for how to retire early.

Table of Contents

What Is the FIRE Method?

FIRE stands for financial independence, retire early, and encompasses a movement of people looking to take back control of their time and money. The movement advocates aggressively saving and FIRE investing to retire much earlier than the typical retirement age. The crux of this method is delayed gratification. One must live below their means and invest a significant portion of their income until they reach the amount they need to save to sustain their lifestyle.

Once you reach the point where you don’t have to work and can instead meet your needs through your savings, you’ve reached financial independence. Those able to save enough to achieve financial independence can then choose whether to continue their career, work a part-time job, pursue passions, or fully retire. Many who have FIREed have been able to retire from their career years and even decades before they reach their 60’s.

How Does the FIRE Method Work?

While the idea of FIRE might sound outlandish and whimsical to some, there is a lot of careful planning that goes into working toward FIRE. Nearly everyone can cut their years to retirement. Simply put, the main goal is to save and invest as much as you can as early as you can. It isn’t unheard of for people pursuing FIRE to save 50-75% of their income.

Over time, that money will grow, compound, and eventually, build into a large nest egg that can be used to live on for the remainder of your life. This work-optional state is known as financial independence. Although that sounds simple, many factors are at play when building your FIRE plan: when you want to retire, your savings rate, how many years you’ll need your savings to sustain you, and your estimated yearly expenses, to name a few.

Despite the many factors involved, the FIRE method is essentially a way to plan your finances so that you can reduce expenses, save and invest more, and eventually, take more control over how you spend your time at a much earlier age.

Reasons to Work Towards Financial Independence Retire Early

Financial freedom should be a goal for everyone. Still, there are many more benefits to working toward FIRE than simply retiring early. The benefits of following FIRE principles and pursuing FIRE include:

Learning to Live Within and Below Your Means

A central pillar of FIRE is living within and even below your means. Often, as people make money and advance in life, an increase in lifestyle accompanies this growth. For most, as your income increases, so does your spending. With FIRE, the focus is on saving and investing as much as possible, which forces people to dedicate themselves to a more frugal lifestyle.

Flexibility

While you may work extra hard during your saving years to increase your income and save money, once you’ve reached FIRE status, you gain flexibility over your time. Retiring even a few years earlier than you usually would mean you have more of your life to pursue and enjoy things of your choosing. Those who reach FIRE sooner have more flexibility for longer.

Building a Meaningful Life

We only have one life to live. Unfortunately, many people feel chained to their careers and the constant need to make money. When earning money is no longer the focus, you become free to pursue things that genuinely bring meaning to your life.

Financial Security

Even if you don’t end up retiring early, following the principles of the FIRE movement will lead to more financial security. FIRE involves increasing your income, decreasing your spending, and investing in retirement accounts and other ventures so that your money works for you. These are sound financial principles and will help ensure financial security throughout your journey.

Reduce Stress

Money is the top source of stress for Americans. Working toward FIRE not only results in you having enough money to meet your needs but having a plan for your money and your life also significantly reduces stress. With a light at the end of the tunnel and a strategy for reaching it, a considerable weight can be lifted and lead to a more enjoyable and healthy life.

Freedom

While all of the above are excellent reasons to pursue FIRE, the main one is freedom. What would it be like having complete freedom to choose what you want to do each day? Once you’re financially independent, you have that choice.

Gain access to all of our free resources!

- eBooks

- Spreadsheets

- Printables

- Other great Freebies!

Who Is the FIRE Method For?

Although it may be hard to picture yourself becoming financially independent, the truth is that almost anyone can implement the FIRE method successfully and retire early. Of course, your income and several other factors will significantly impact how soon you might be able to reach early retirement. Still, given enough time and discipline, anyone can become financially independent.

Common Misconceptions About FIRE

Although the FIRE movement has grown in popularity, a focus on the high-income earners who have achieved it has resulted in several misconceptions about what it means to pursue financial independence retire early.

You Need a Six-Figure Income

Most fire people featured in media are white men in the technology industry or other similar high-income earning fields. The focus on this demographic has been partially responsible for the notion that you need a six-figure income to retire early. But, while a high income certainly helps make early retirement easier to achieve, it is not the main factor that allows people to FIRE.

You Can’t Do FI Without RE

Another common misconception is that you can’t be part of the fire movement if you don’t plan to retire fully. There has been much debate about what it means to be “retired.” Still, no matter how you define retirement, the point of FIRE isn’t necessarily to retire, but rather to have the choice to do so. Whether you plan to leave your career and never work again, change jobs, pursue passions, or continue working in your current field, the main goal of FIRE is to reach financial independence. Once you’re there, you can choose how to live your FIRE life best.

You Need to Save Every Penny

Saving and investing a significant portion of your income is a pillar of FIRE, but it doesn’t mean you have to save every single penny you make. Each individual will need to decide how to spend their money and whether or not they want to have a bare-bones budget on their way to FIRE, but it is not a requirement of the FIRE movement.

You Can Never Have Fun Until You’re FIRE

Proponents of the YOLO frame of mind think you should always enjoy life to the fullest. On the other hand, FIRE practitioners aim to delay gratification by focusing a larger portion of their annual income on their retirement accounts. While extreme saving certainly is a choice one could make, FIRE is more about shaping your desired lifestyle than sacrificing all fun. Especially for those on the long road to FIRE, it’s best to strike a balance and ensure you allocate some of your disposable income to having fun.

FIRE is Only For Escaping a Job You Hate

Many people see the FIRE movement as an escape from a job they hate. Of course, plenty of people are pursuing FIRE to leave a career they don’t like, but that isn’t the core of the movement. Instead, FIRE is about gaining more control over your money, time, and life.

Retirement is Just About Sitting Around

When many think of retirement, they think of an elderly person puttering around their house. Although some may choose to relax in retirement, most FIRE devotees aren’t grinding to meet financial goals so that they can sit around all day. Gaining financial independence means you have the freedom to choose how you spend your early retirement, whatever that means to you.

You Need Millions to Retire Early

The last major FIRE misconception is that you need millions to retire. How much you’ll need to retire will depend on your anticipated annual expenses and your ideal lifestyle, but as long as you have enough money to cover your yearly costs for as long as you think you’ll live, you can take the leap into retirement.

FI/RE Strategy Variations

While the term FIRE means you’ve accumulated enough money that you no longer need to work and can retire, several variations of the FIRE movement have developed over the years. These four main variations have different goals that depend on your lifestyle and how you wish your life to look once you achieve FIRE.

Lean FIRE

Lean FIRE is for the frugalists of the movement. These individuals focus on a minimalist lifestyle and strive to have annual living expenses of $40,000 or less. Those willing to live lean also won’t need to make as much or save as much and may retire earlier.

Barista FIRE

Another variation on the movement is barista FIRE. People pursuing barista FIRE can withdraw a percentage of their savings but must work part-time to cover the rest of their expenses. This variation is perfect for those looking to leave a high-stress job before having enough passive income to fully FIRE. Instead, they use low-stress part-time jobs to fill in any financial gaps and cover things like healthcare.

Coast FIRE

Coast FIRE is a bit different than other iterations. Individuals who build up considerable retirement savings at an early age may be able to forego contributions and still have enough money when they reach retirement age to cover all their living expenses. In other words, you’ve invested so much early on that you can just coast to your retirement.

Fat FIRE

Fat FIRE is for those who wish to maintain a more luxurious lifestyle after retiring. These individuals will need to aggressively save additional income to support a large retirement budget.

How to Use the FIRE Method to Retire Early

1. Formulate Your Ideal FIRE Lifestyle and Number

The first step in creating your FIRE plan is deciding on your ideal post-retirement lifestyle and how much you’ll need to save to achieve it. Once you’ve determined your perfect lifestyle and how much money you’ll need to support it, you’ll calculate your FIRE number based on your anticipated yearly expenses.

2. Make Realistic Savings Goals

While everyone would like to reach financial freedom and have the option of retiring quicker, you’ll want to make sure your goals are realistic for your situation. It simply isn’t practical for many people to save 50-75% of their income. So first, start with a manageable savings goal and regularly increase it or look for ways to increase your income.Yes, you’ll get to FIRE more quickly if you save every penny and increase your savings amount every year, but will that be realistic for you? Will you get burnt out and lose motivation? Remember to create a balance.

3. Plan an Investment Strategy

Investing can be scary, and with so many options, it can be hard to know where to start. The good news is that investing is easier than ever before, and there is a lot of great information and resources available for free. No matter your investment plan, you should look to take advantage of employer-sponsored retirement plans and other tax-advantaged accounts like IRAs. Mutual funds, ETFs, and other broad stock market funds are also good options. Whatever retirement account or accounts you choose, make the goal to invest as much as you can for as long as you can so that the magic of compound interest begins working in your favor.

4. Keep Expenses Low

A significant portion of following the FIRE method is keeping your expenses low so that you can allocate more to retirement savings. While this doesn’t mean you need to have a bare-bones budget and severely restrict yourself, it does mean you should avoid lifestyle inflation and debt.

5. Avoid Debt and Lifestyle Creep

With the high-interest rates that accompany it, consumer debt can significantly detour your financial goals. Any money paid toward interest is taken away from your savings account and goals. Furthermore, it’s essential to avoid the temptation to spend more as your income increases. As you make more money, strive to live the same lifestyle as when you had less and simply allocate that extra money toward savings. Set up automatic withdrawals so that your money goes into your investment accounts before you have a chance to spend it.

6. Find Ways to Boost Your Income

While you can only cut so much from your spending, you have unlimited opportunities to increase your income. Boosting your income is one of the best ways to improve your savings rate and FIRE faster. You can increase your income through a second job or side hustle, or you can boost the income from your current job through bonuses, training, extra assignments, or overtime. Look for ways to hack your 9-5 first, then look for other ways to increase your income. Eventually, your investment portfolio will also serve as a source of passive income.

How to Calculate Your FIRE Number

What Is a FIRE Number?

Once you decide to pursue FIRE, one of the first things you should do is calculate your FIRE number. Your FIRE number is the amount of money you need to save to sustain your retirement lifestyle. You want to make sure you have enough savings to support you for the rest of your life.

FIRE Number Calculator

There are a plethora of factors to consider when calculating your FIRE number. For example, you’ll need to consider your savings rate, expected retirement age, expected yearly retirement expenses, withdrawal rate, and the number of years you anticipate being retired. You’ll also need to consider inflation, annual returns, and your current income. There are a lot of pieces to calculating an accurate and safe FIRE number. Luckily, we’ve already done the work for you and put together the ultimate FIRE movement calculator to help you quickly determine how much you’ll need to retire.

Savings Rates and FIRE

Your savings rate is how much of your annual income is contributed to investments and other savings. It is the most crucial factor in determining how fast you reach FIRE. The higher your savings rate, the sooner you’ll reach FIRE.

Want to learn one of the many methods the FIRE community uses to access their money before traditional retirement age? Read our article on the roth conversion ladder!

FIRE Method FAQ

When Do You Need to Start Saving to Retire Early?

You should start saving for retirement as soon as you’re able. Time in the stock market is better than trying to time the market or waiting for the next trendy thing. Start by saving as much money as you comfortably can and increase your savings over time.

How Much Money Do You Need for FIRE Financial Independence?

How much you’ll need for financial independence will vary depending on your lifestyle and the annual expenses required to sustain it. Once you have enough money saved that you no longer need to work to support yourself, you’ve reached financial independence.

What Is the 4% Rule in FIRE?

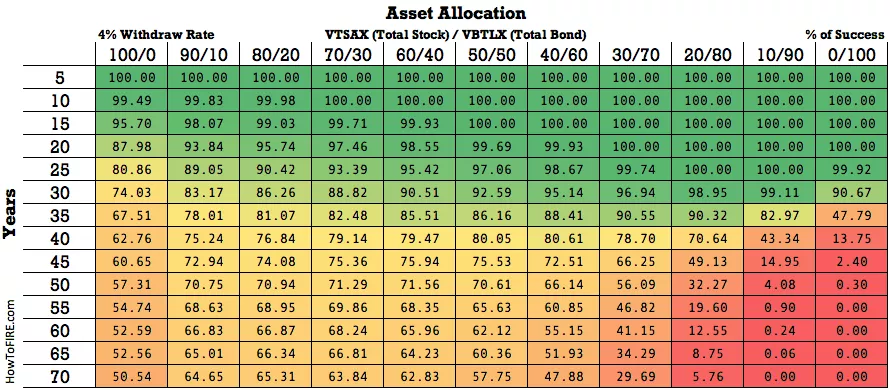

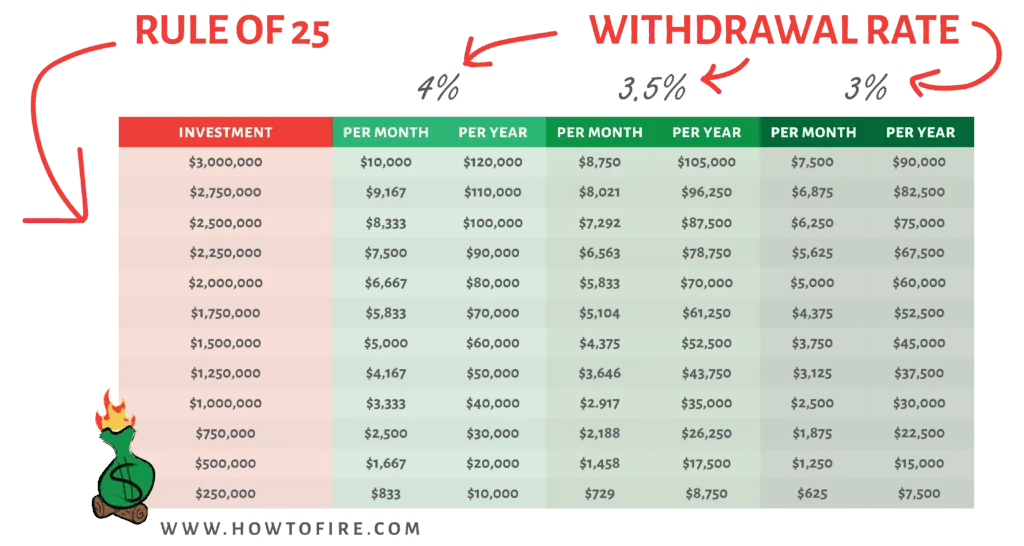

The 4% rule has been proposed as a safe withdrawal rate for a 30-year retirement. This rule says that you can safely withdraw 4% of your portfolio the first year and then 4% adjusted for inflation in future years. However, note that this rule was based on a portfolio comprised of 60% stocks and 40% bonds and may not work for everyone pursuing FIRE.

What Is the 25x Rule?

The 25x rule provides another general rule for how much you’ll need to save for a 30-year retirement. This rule states that you’ll need 25 times your yearly expenses saved to maintain your current lifestyle in retirement without running out of money. But, again, this rule is a generality and may not apply to all FIRE followers.

How Much Sacrifice Does the FIRE Method Involve?

Sacrifice is often presented as a significant drawback to FIRE, but it isn’t the movement’s core. Yes, the focus will need to be on saving and investing to reach financial independence, but your choice is how much you choose to cut to save and invest is your choice. Some may decide to stick to a bare-bones budget and work tirelessly for 5-10 years to reach FIRE sooner, while others may choose to have more balance and take the scenic route. Again, it is entirely up to you how much you want to sacrifice.

Which Is the Biggest Expense for Most Retirees?

The biggest expense for most retirees is housing, with the average retiree spending $1,455 a month (35% of expenses) on housing. The next largest expenses are transportation and healthcare.

Is the FIRE Method Realistic? (Conclusion)

With all of the above being said, is the How to Fire FIRE method realistic for you? The great news is that the answer is a resounding yes. FIRE financial independence retire early strategies can be used by anyone! This method of living below your means, saving, and investing for your future is possible for everyone and even necessary to live a happier life. Whether you’ll be able to retire early or simply have a more financially stable retirement will depend on your current situation. Still, with enough time and dedication to the process, everyone can achieve financial independence.

Samantha Hawrylack is a personal finance expert and full-time entrepreneur with a passion for writing and SEO. She holds a Bachelor’s in Finance and Master’s in Business Administration and previously worked for Vanguard, where she held Series 7 and 63 licenses. Her work has been featured in publications like Grow, MSN, CNBC, Ladders, Rocket Mortgage, Quicken Loans, Clever Girl Finance, Credit Donkey, Crediful, Investing Answers, Well Kept Wallet, AllCards, Mama and Money, and Concreit, among others. She writes in personal finance, real estate, credit, entrepreneurship, credit card, student loan, mortgage, personal loan, insurance, debt management, business, productivity, and career niches.