In high school, I was a B student. My GPA upon graduating from college was 3.128. Where I lacked in academic performance, I more than made up for it with my work ethic. Show off your strengths. This post isn’t intended to brag or belittle anyone.

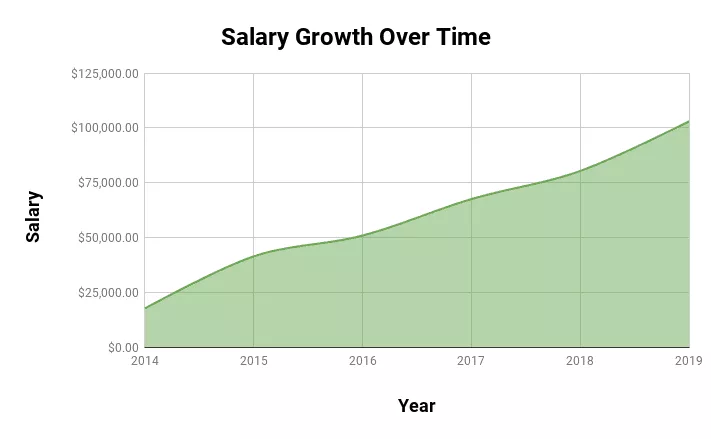

I think others could learn from my experiences as I increased my gross income by over $85,000 in 5 years. Making six figures at 24 is humbling, to say the least, but I didn’t get to this level without a lot of hard work and applying myself.

Table of Contents

2014: <20k

Let’s take a walk down memory lane for a minute and look back all the way to 2014. No, this isn’t a reflection back to the Ebola outbreak or the disappearance of Malaysian Airlines Flight 370.

In the spring of 2014, I was a sophomore in college. I was working my first job other than cutting grass, living at home with my parents. I was making $11.80/hr at Job 1, working 32/hr a week (the most they allowed part-time employees). It was a big year for us because we got engaged in March and moved into an apartment together in September, putting us closer to school and work.

Right after we moved in together, we realized that we were barely making ends meet and needed to find a solution. In October, I picked up Job 2 working for the same start-up my wife was working for. I struggled through finals week in December, but still managed a 50+ hour work week and going to school full-time.

The week after finals, I started working 80-ish hours a week between the two jobs. The owner saw how hard I was working, loved my drive, and soon offered to match my hourly rate at my other job if I quit and came to work for him full-time. The new job would allow me to work as many hours a week as I’d like, not restricted to 32.

This was around the time we started following Dave Ramsey’s advice, and soon after we found the FIRE community. We had some student loans at this point, and car loans so we knew we wanted to start cash flowing tuition and start eliminating debt.

The best perk of Job 2: Work provided all meals while we were there so we didn’t have much of a food budget for 2 years. Talk about a life hack 😀

This was the first time I had an opportunity to negotiate my pay, and immediately asked for $13.50. He was reluctant at first, but saw my talents as an asset to his small team of five, including the two of us. I put in my two weeks’ notice at Job 1 before Christmas and finished the first week of 2015.

My Gross Income for 2014 was $17,628

2015: 40k

Three months later, I began managing our new warehouse and three more employees (we started in his basement). With this added responsibility came another $0.50 raise.

Now this doesn’t sound like a lot, but I went from bringing home ~$535 every 2 weeks to over $850. However, the best part was that he allowed me to work as many hours as I’d like. During breaks and the summer that year I was bringing in $1400+ biweekly working an insane number of hours.

In the fall of my senior year, I knew it was time for me to start looking at what jobs I could land after college. In November, I applied to one job and landed my first and only interview. The same week, on my one-year anniversary with Job 2, I asked for a raise (we now had about a dozen employees). The owner agreed to give me an additional $1 per hour plus a bonus of a couple thousand.

Shortly after my interview, I accepted a job offer: Software Engineer Associate. I would be working for a defense contracting company with a starting salary mid to upper $60K after graduation. (I won’t disclose these actual amounts, since I am still employed here and you can check Glassdoor)

My Gross Income for 2015 was $41,404

Increasing my gross income by $23,776, more than doubling the previous year’s income.

2016: 50k

The spring of 2016 was my last semester of college, and I had no core classes left to take. With a light semester, I started working even more hours. Sometimes working 90-100 hours a week, you could say we focused on earning as much as possible.

I broke the news to the owner that I landed a new job and anticipated leaving that summer. He didn’t take the news well to say the least. We had brought his company out of his basement and into a few thousand square foot warehouse which was grossing over a million dollars a month on average at that time. We were his most valuable assets. He immediately begged me to decline the software engineer (SWENG) position I had accepted.

He even went as far as offering me a salary that most kids in college can only dream of, $100,000. I told him to give me a few days to think it over.

Backstory: There were no retirement benefits or medical coverage (we were still such a small company). So, I had to analyze this offer and compare it to my SWENG offer, which did have a 401k, good health coverage, several weeks of vacation, many holidays off, etc. I estimated that medical coverage would cost us ~$1,000 per month. My 401k match as a SWENG was 10%, so I had to factor that in as well. Then I predicted job growth, and potential raises/increases based on Glassdoor. I didn’t go to school to manage a company, even though I absolutely loved my job there. Ultimately, we decided it would be best for our future to stick with the SWENG job.

In the end, I decided to turn down the $100,000 offer he made me. It was a very tough decision, and one that I often look back and reflect on. I don’t regret my decision at all though, I love my current job as a SWENG (Job 3).

Knowing that my new job was on the horizon, we decided we wanted to get out of our crappy apartment. We looked into apartments closer to work. Renting a nicer apartment closer to Job 3 was more expensive ($1k+ more than our previous rent, and $5-700 more than our current mortgage). So, we decided that we would look at purchasing a home instead. We also knew that this would allow us to begin building equity.

With a goal in sight, we kept raising our savings rate by working more hours. We set aside a down payment for our home, saved an emergency fund, payed cash for any tuition expenses we had, and contributed to our wedding. We had already thrown over $35,000 at student and car loans in the prior year, paying off one car and knocking out half the student loan debt we had.

A stressful summer doesn’t begin to define that year. We got a puppy (our girl is a yellow lab, named Simba), lost a loved one, I graduated from college (wife changed majors, had an extra year), I started Job 3, we bought a house, and we got married all between May and July of that year. Looking back, I have no idea what we were thinking cramming all of that into a short period of time.

My Gross Income for 2016 was $50,915.

Increasing my gross income by $9,510 compared to 2015.

2017: 70k

I began mentoring interns in the summer of 2017, which allowed me to help them with their job offers at the end of the summer. This made me realize they were going to be starting with a higher pay than myself. I began asking questions about that, and doing more research on what the market value had changed to over the past two years.

Determined to find answers, I kept asking questions which lead me nowhere. Surprisingly, our company announced a few months later that everyone was getting a pay adjustment. This came with an increase of about 14% which brought me to about what the interns would be coming in at.

In the fall, I began my Master’s Program in SWENG. My employer has a generous tuition reimbursement program, covering about 90% of the costs assuming I pass the class with a B.

My Gross Income for 2017 was just shy of $70,000.

Increasing my gross income by $15-20k compared to 2016.

2018: 80k

After the nice pay increase, I was feeling more confident about my compensation. I continued improving my skills as I approached my two-year anniversary. At the two-year mark, I started researching what others were making at competitors and surrounding companies. I identified a salary range I was hoping for with my in-line promotion, prepared to discuss this with my manager at my review.

Having proved myself, I soon received said promotion but was unable to negotiate up to what I thought was market value. I was overpaid already as it was, so they said. It was out of my manager’s control (HR decides this). Even though I didn’t receive what I thought was market value, I still received a salary increase of 15% for my promotion.

In 2018, I also began doing e-commerce and business consulting on the side (Job 4). I started diving into whatever a small business might need help with. Most of these skills came from Job 2, where I ran almost the entirety of day-to-day operations, but Job 3 allowed me to improve the programming side of things. This side gig has allowed me to make a few hundred extra dollars each month, while still gaining valuable experience.

I continued mentoring interns during the summer of 2018, and again I realized their starting salaries were increasing. This only affirmed that my data from a few months’ prior was accurate. To my surprise at the end of the year, our company did another salary adjustment which came with an increase of 12% to my pay.

My Gross Income for 2018 was just shy of $80,000.

Increasing my gross income ~$10,000 compared to 2017.

2019: $100,000+

Enter the current year. My salary from Job 3 is now right around the six-figure mark. When you combine that with Job 4, I will more than exceed $100,000 this year. This increases my gross income by a little more than $20k compared to 2018.

Reflecting back to my offer from Job 2 in 2016 – it makes me feel like I know I made the right choice. My total compensation is over $130,000 if you include all aspects of benefits I receive (401k match, medical, tuition reimbursement, vacation, etc).

You might be thinking, how did a B student land such a great job (Job 3) while still in college? Glassdoor taught me a lot about how their interview process worked. I networked with people who had already applied and interviewed there. I fine tuned up my resume to best represent the skill-set they were looking for. This set me up for a great interview experience that I felt over prepared for going in.

Things Not Mentioned Earlier In This Post

As if going to school, working a full-time job, and one side gig isn’t enough – we decided to start a blog last year! The reason I didn’t include that in this post, or any details about it is because I don’t expect to make any money from it, at least not for a while. But, I chose to mention it here because I’m still grinding 70+ hours a week, sometimes much more. Not because I “need to” but because I have a true passion for the work that I do.

I’m also a strong believer of front-loaded sacrifices. DiverseFi has a great mini-series of articles on Front-Load the Sacrifice that I recommend you check out. In this article he mentions “The harder you work as a young person, the less you will have to, as you get older.”

I also didn’t include any information about my yearly salary increases. They weren’t very sizable, and averaged 1-3% each year.

Why Did I Only Apply to One Company?

Some of you may disagree with my strategy here, but I’ll explain my thought process. I researched what jobs my degree would allow me to apply for and made a list of the ones I thought I would enjoy. I had no interest in working in a poor environment. Next, I spent time reading reviews of the companies that made the final cut and eliminated any with horror stories. I wasn’t interested in moving too far away from family and friends, so all tech start-ups were out of the question. Last but not least, I looked up how much each of them paid, eliminating jobs that were lower than average.

I ended up with a list of only a few companies that I felt would allow me to receive a good salary and have job growth potential. That meant looking at larger companies, with plenty of data points on Glassdoor. I researched what my salary look like in 2, 5, or 10 years. What other positions would become available to me after my time spent in an entry level role?

A few of my friends had already accepted job offers from companies on my list. They shared their salary details with me, so I had a good idea of what to hope for. I ended up applying to only one company (Job 3). Once I got a job offer from them, I didn’t need to spend time applying and interviewing elsewhere. I had already vetted them as one of my top choices.

How Can Others Do The Same?

- Look at your current situation. Are you maximizing your job growth potential? Could you be applying elsewhere to get a higher paying job?

- Do you have the opportunity to work overtime, or pick up a second job? Consider starting a side hustle.

- Do a TON of research to see what opportunities are out there. Get on PayScale, Glassdoor and Salary.com.

- Know what salary potentials are out there for people with similar skill-sets in the field you’re in. Ask your coworkers what they’re making (if you feel that is appropriate).

- Don’t be afraid to ask for a raise, especially when you have data that supports your claim. Understand that the data found online is usually lagging behind by a year so expect MORE than those sites are suggesting you should be making.

Final Notes

Understand your strengths and weaknesses. Know your worth to your employer, and if you don’t get where you’re going with that company – consider applying elsewhere. Remember I’m only 24 and not even three years out of college. Hard work and determination go a long way.

Hi, I’m John Hawrylack! I’m a husband, dog dad and FIRE enthusiast. My love and passion for personal finance started when I was a teenager and grew as I worked in the finance industry. My goal is to help others discover their version of FIRE. I have a BS in Computer Science and MS in Software Engineering. Our blog has been mentioned in Forbes, MSN, Yahoo, Fox Business, U.S. News & World Report, Ladders, GOBankingRates, Debt.com, VOYA, ChooseFI and many more!

Menard Solve

Friday 24th of May 2019

Stopping by from Twitter... I just realized that you're the same couple in the Choose FI Philadelphia group :) Congratulations! Earning six figures in a relatively short time is very impressive. It took me almost a decade to reach that milestone.

How To FIRE

Friday 24th of May 2019

Haha yes that's me! Thank you for the kind words

10 Tips for Negotiating Your Salary | Financial Impulse

Thursday 21st of March 2019

[…] and work satisfaction depend on the outcomes. But done well, negotiating can double, triple, or even quintuple your […]

Tracey

Thursday 28th of February 2019

This is so impressive! You are well on your way to an early FI "finish line" - keep up the great work!

How To FIRE

Friday 1st of March 2019

Thank you for the positivity! While we've done well increasing our income and savings rate - we still have a long road ahead of us :)

admin

Monday 25th of February 2019

Thank you for the kind words & encouragement! Declining the first 100K offer caused me a lot of sleepless nights for a week or two. It was daunting and definitely a very hard decision for me to make.

Bob

Sunday 24th of February 2019

Wow that's incredible progress in a really short time! Congratulations on keeping your eye on the prize. I'm not sure I would have had the intestinal fortitude to decline the first 100K offer but you've clearly made the right decision! You're on the FIRE fast track now! Keep up the great work and thanks for sharing!