You might know Empower (formerly Personal Capital) as the net worth and budgeting tracking tool, but it’s so much more!

Empower serves as both a money tracking app and a hybrid wealth management service, offering both free tools and paid investing services. Today, we will review the ever-popular personal finance app in our complete Empower review below!

Track all of your account balances and your net worth in one place. Get access to a Retirement Planner, Fee Analyzer, Portfolio Checkup, Contribution Calculators, and so much more with, Empower!

- Early pay and cash advances

- Easy account linking

- Earn cash back

- Budgeting tools to monitor spending and expenses

- An inexpensive way to borrow funds

- The amount borrowed is non-customizable

- Requires a subscription

- Low APY

- Need an Empower card to receive free and instant cash advances

Table of Contents

Empower at a Glance

At first glance, Empower might seem like most budgeting apps where you link your accounts and track your finances. The app gives you a complete overview of your accounts broken into categories such as cash and investments.

Unlike most personal finance and budgeting apps that make money selling products or through affiliate marketing, Empower makes their money when they sell investment advice to users. Some of the features include their cash flow tracker, networth tool, and their free analyzer are complimentary. Other services such as wealth management are paid for – something we will cover later.

What Is Empower?

The first time I heard about the Empower app I won’t lie, I was simply looking for budgeting tool. Items such as investing, wealth management, and even net worth tracking were the furthest thing from mind.

Since its establishment in 1891 as part of the Great-West Lifeco, Empower has experienced a century of growth and change in the services it offers. This culminated in 2014 with the merger of the retirement businesses of Great-West Life with JPMorgan Chase, Putnam Investments, and Great-West Financial to form the present company. In 2019, Empower signed a 21-season deal to have their name used for the Denver Broncos stadium. By June 2020, they had acquired Personal Capital for $825 million and administered more than $1.0 trillion in assets for 12.0 million individuals.

This was followed by the September 2020 purchase of the retirement plan business of MassMutual for $4.4 billion. On September 29 of the same year, they announced their acquisition of Fifth Third Bank’s retirement plan recordkeeping business. Later that year, on April 4, 2022, Empower bought Prudential’s full service retirement plan business and changed their public-facing brand name from “Empower Retirement” to “Empower” on February 1 of the same year.

How Does Empower Work?

Empower has a very simple way of offering services:

- Free

- Paid

Put another way, you can use the app for free to track things like your cash flow, net worth, take advantage of their fee analyzer tools, view long-term retirement plans, and keep track of your overall budget. These things are all free and well worth exploring, even if simply for the financial dashboard (more on those exact features later).

On the other hand, the paid side of things refers to the Empower Wealth Management Services in which those who elect to use these services pay a small annual fee to have complete investment management. As stated, a minimum of $100,000 is required to take advantage of their team of financial advisors.

If you’re interested in seeing whether you would like their simple tracking tools or perhaps you want to learn about using an investment advisor, you can start by simply downloading the app for free here.

Track all of your account balances and your net worth in one place. Get access to a Retirement Planner, Fee Analyzer, Portfolio Checkup, Contribution Calculators, and so much more with, Empower!

- Early pay and cash advances

- Easy account linking

- Earn cash back

- Budgeting tools to monitor spending and expenses

- An inexpensive way to borrow funds

- The amount borrowed is non-customizable

- Requires a subscription

- Low APY

- Need an Empower card to receive free and instant cash advances

Pros and Cons

Like any personal finance app, Empower has its pros and cons.

Pros

- Best for high net worth investors who are more hands-off

- The financial dashboard is motivating (seeing net worth grow)

- The spending and cash flow tracker is great & free!

Cons

- Fees are higher compared to other similar services providers when it comes to wealth management

- Must meet the minimum threshold of $100,000 buy-in

Features, Benefits & Services

It’s important to understand all the features Empower has to offer (it is A LOT!), which is why we give you a complete breakdown of each feature and service they have to offer. Let us first start with our favorite feature Empower offers:

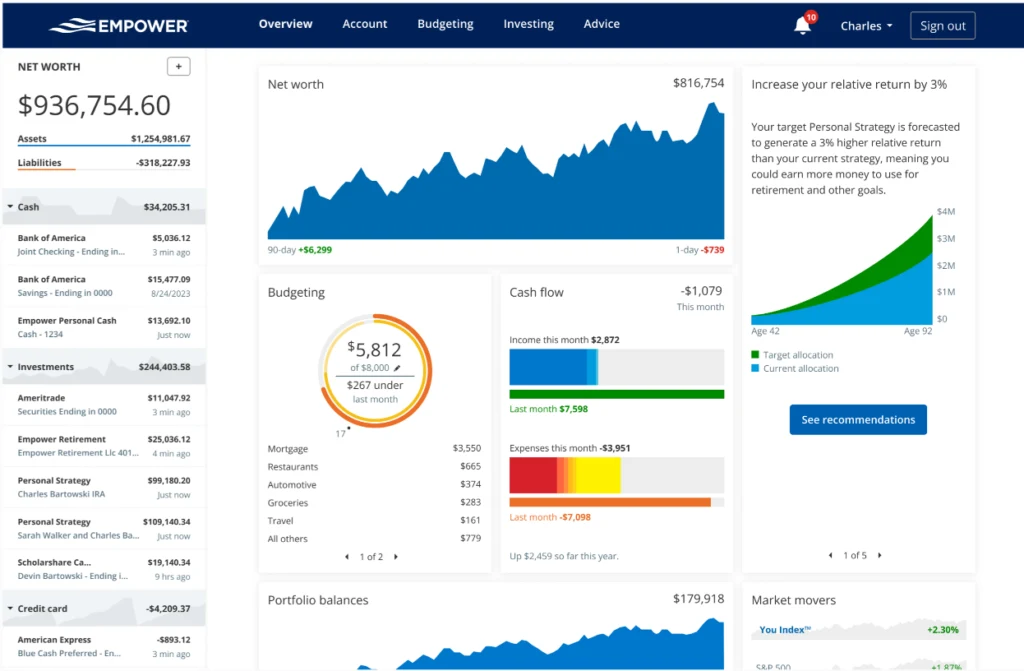

The Virtual Financial Dashboard

One of our favorite features that Empower offers is its free financial dashboard. Whether you’re on the app or using the desktop platform, the dashboard is organized efficiently and the visuals are outstanding.

The dashboard is broken up into the following categories:

- Net Worth (assets and liabilities)

- Cash

- Investment

- Credit Card(s)

- Loan(s)

- Mortgage

- Other Assets

You have the flexibility to toggle between multiple date ranges for tracking purposes or set a custom date range. What we love about this dashboard is that it is all in one place.

Paid Empower Services (Investment Accounts)

Investment Services

Empower specializes in managing your assets. That is how they make their money, by offering investment management services for high net worth clients. They are able to do this with three different options for paying clients:

- Investment Services ($100,000 minimum AOM)

- Wealth Management ($200,000+ AOM)

- Private Client ($1,000,000+ AOM)

Their investment services are tailored for the individual, and they put it this way when pressed on how they manage investments for clients, “We consider current interest rates and equity valuations and their likely impact on future returns.”

Based on the previous statement and paired with historical risk data, the Empower management team is able to determine an optimal mix for asset allocations. The “Investment Services” with Empower starts at $100,000 assets under management and includes:

- Access to live financial advisors

- Live customer support

- Funds are managed by Empower robo advisors

- You can personally access all of their paid investing tools

- Funds are invested in to ETFs or Exchanged Traded Funds (small pieces of stocks, bundled together)

Wealth Management

Do you have $200,000 or more in assets under management? If so, you can consider taking advantage of Empower’s wealth management feature which includes two personalized financial advisors.

Unlike the investment service which offers access to human financial advisors, for those with $200,000 AOM you have a personal team of two advisors overseeing your Empower account. Empower’s thought on this is that they want their clients to succeed, so they’re incentivized to help client accounts perform (what financial advisors don’t want performance?).

In addition to the above-mentioned services in the investment service, having two dedicated financial advisors is a real selling point. This means two people are familiar with your account and you have a personal relationship, similar to having 1-2 doctors or visiting a large practice and never seeing the same doctor.

Additionally, you have the option to speak with consultants for sector-specific investments such as options trading or real estate. Once you pass the $200,000 threshold you can also invest in individual stocks with Empower in addition to ETFs.

Private Client

If a team of financial advisors isn’t enough and two dedicated financial advisors aren’t cutting it for you, Empower really steps it up with their Private Client feature in which you have access to their highest level of health management.

That said, you must have $1,000,000 in assets under management in order to use the private client feature. In addition to financial and retirement planning, financial decision support, and investment planning, private clients have access to:

- Wealth planning services (estate, taxes, legacy)

- Private equity and hedge fund review

- Private banking services

- Trading of individual bonds

- Private equity investments

Not only are the benefits nicer at the private client level, so are the fees (we discuss fully later), as they drop from .89% to .79% once a user crosses the $1,000,000 threshold. Within the private client and wealth management side of things there are notable features worth reviewing below:

Tax Optimization Features

Efficient tax management is one of the essential reasons why financial advising is necessary for heavy hitters.

According to the Empower website, “We deploy strategies such as tax location (placing higher-yielding securities in tax-sheltered accounts) and proactive, year-round tax-loss harvesting.” What most financial advisors will tell you is that losing money in the stock market sometimes has more to do with taxes than it does your returns.

Socially Responsible Investing

Similar to the Vanguard ESG fund, Empower offers a Socially Responsible Personal Strategy account that lets you invest with companies that you align with. For example, let’s say you are big on green energy, you could elect to no investment in oil companies or fossil fuel companies by leveraging this feature.

Cash Management

Empower offers a high-yield savings account called Empower Personal Cash. The Empower Personal Cash is worth considering simply because there is no account minimum or monthly fees. In fact, if you use their cash management system, you will receive 4.1% APY which is comparable to most online savings platforms in 2023. Be sure to stay updated on their website for any changes regarding APY and more information.

Other Financial Tools You Might Like

Track all of your account balances and your net worth in one place. Get access to a Retirement Planner, Fee Analyzer, Portfolio Checkup, Contribution Calculators, and so much more with, Empower!

- Early pay and cash advances

- Easy account linking

- Earn cash back

- Budgeting tools to monitor spending and expenses

- An inexpensive way to borrow funds

- The amount borrowed is non-customizable

- Requires a subscription

- Low APY

- Need an Empower card to receive free and instant cash advances

Investment Checkup

The Investment Checkup tool is great as it suggests opportunities for better investing.

You might be able to get more bang for your buck as they say in another account or leveraging a different strategy. The investment checkup is a great feature to take advantage of here.

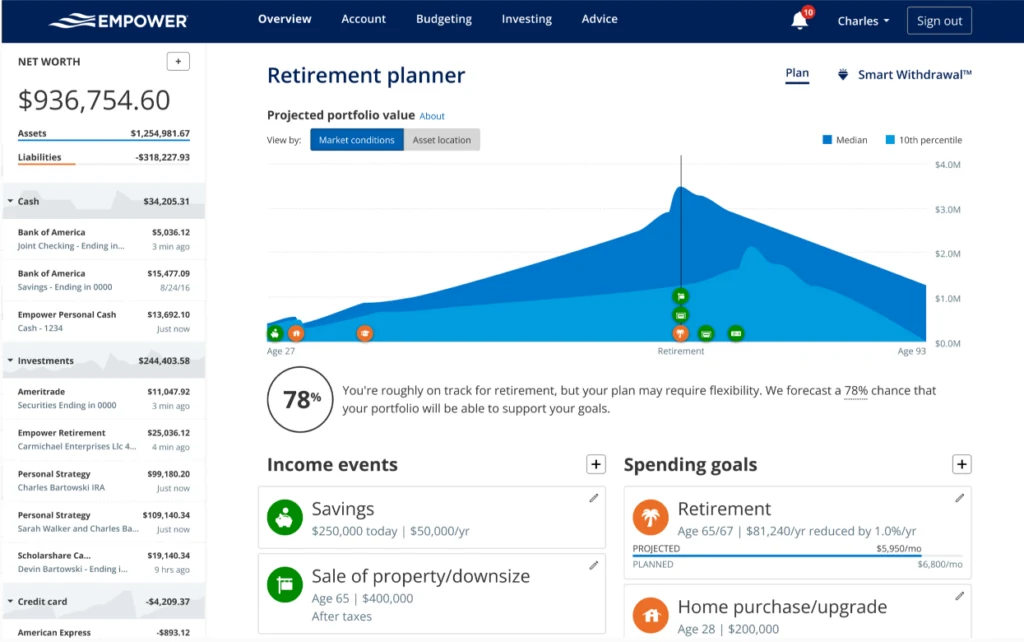

Retirement Planner Tool

Retirement planning goes beyond just having your accounts set up and making your monthly contributions. You have to be aware if you’re on track or not. The retirement planner tool makes this easy as you can answer the question of whether or not you have enough saved for retirement.

The retirement planner offers free financial advice and if 2020 showed us anything, it’s best to dig your well before you’re thirsty. In our analysis of the retirement planning tool, it is one of the most comprehensive tools out there, and here are a few highlights:

- Analyzes risk

- The retirement planning calculator allows you to toggle and adjust numbers for scenario purposes

- Can adjust your ideal risk tolerance

- Able to factor age, social security into the equation

- Plan accordingly with their retirement spending feature

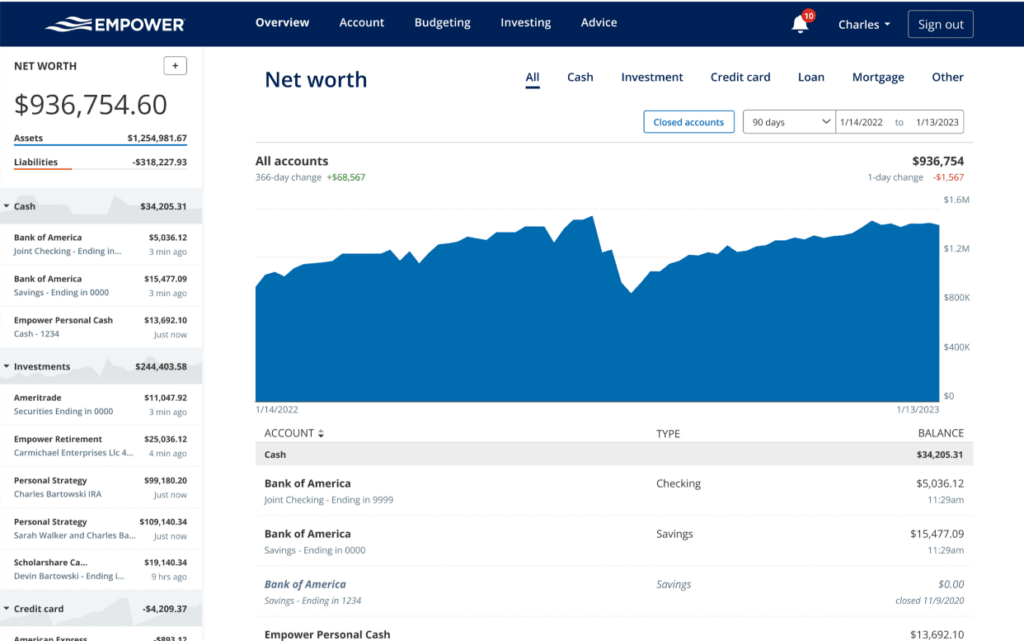

Net Worth Tracker

Tracking our net worth has always been important to us, and it’s a pretty simple process if you want to do it yourself. But constantly updating your net worth is time-consuming, and not to mention it’s free to do with Empower.

Using Empower for the simple fact that their net worth tracker is top-notch is enough to download the app. After linking your accounts and subtracting liabilities from assets, you will have a comprehensive net worth that is front and center each time you logon into your virtual dashboard.

Something about seeing this number grow will keep you motivated to keep the needled moving in the right direction!

Fee Analyzer

We once met with a financial advisor who wanted to charge 1.25% to manage our mutual funds and retirement plans. While we kindly said no thanks, the Empower Fee Analyzer tool would have tracked the fees paid within our investment accounts.

The upside to this feature is that it alerts you when you are paying ABOVE the national average (this is a really cool feature if you ask us!) when it comes to financial fees. Empower uses their proprietary algorithm and

Cash Flow Monitoring

Somewhat similar to YNAB, Empower offers a cash flow monitoring tool for free when you link your bank accounts. On the desktop platform or the app, you can track your income and outgo each month and even use the charts to help you coordinate your retirement plans/retirement accounts.

Education Planner

Just as you read it, the education planner tool helps you plan for college and education costs for your kids, or even yourself. With the education planning tool, you can strive to save enough to hopefully avoid having to need student loans in the future, though college is getting more expensive every year!

Empower Fees & Pricing

Empower management fees exist, but not like YNAB or Quicken.

To simply download the Empower app and track your net worth and cash flow, you don’t have to pay a single dollar. The app is free to use and the money management side of things is free.

In fact, as you will see below, the app only offers paid services to those who have at least $100,000 under management. Translation = if you don’t have $100,000 or more invested, you couldn’t pay for Empower even if you wanted to!

After that, if you decide to leverage some of the investor capabilities, tax harvesting concepts, and so on, the break down for Empower’s fees are as follows:

- 0.89% from $100,000 to $1 million

- 0.79% from $1 million to $3 million

- 0.69% $3 million to $5 million

- 0.59% $5 million to $10 million

- 0.49% $10 million and up

In order to pay for and use the Empower’s wealth management services, you must have at least $100,000 of assets under management (AOM). The services speak for themselves as you have access to both human financial planners and robo-advisors. Empower’s free analyzer tool also allows you to see how existing retirement accounts and mutual fund fees might be impacting you negatively.

How to Sign Up for Empower

Track all of your account balances and your net worth in one place. Get access to a Retirement Planner, Fee Analyzer, Portfolio Checkup, Contribution Calculators, and so much more with, Empower!

- Early pay and cash advances

- Easy account linking

- Earn cash back

- Budgeting tools to monitor spending and expenses

- An inexpensive way to borrow funds

- The amount borrowed is non-customizable

- Requires a subscription

- Low APY

- Need an Empower card to receive free and instant cash advances

Signing up for Empower is simple, download their free app and get started immediately!

After landing on an easy-to-use page requesting some simple information (email, password, phone number) in order to create an account, you will answer a questionnaire that will determine the best path for you from there.

In order to populate, organize, and track your finances, you will link all of your accounts to Empower to get a real-time view of your net worth. After that, the path to take is endless from accessing their recession simulator to learning about their personal asset allocation tools. You should find the user experience pleasant and simple to navigate.

Empower Alternatives

Like anything, Empower has its fair share of alternatives and competitors. When it comes to money management, there is no shortage of options/tools out there, here are a few to compare the popular app and wealth management platform to:

Empower vs YNAB

YNAB, short for You Need a Budget, is designed to help users manage their finances, track their spending, and stay on a budget.

Keep in mind that YNAB charges a monthly fee of $14.99 or $8.25 a month if paid annually to use their app, and the emphasis is placed on a “Zero Based Budgeting” philosophy, meaning every dollar should be working for you! Very little emphasis is placed on things like investing or investor news, which happens to be what Empower offers.

As stated throughout this Empower review, the app and platform truly shine when it comes to their dashboard and wealth management team/concepts. Very little emphasis is placed on things like investing or investor news, which happens to be what Empower offers.

As stated throughout this Empower review, the app and platform truly shine when it comes to their dashboard and wealth management team/concepts.

Manage your finances on one platform using real-time data. Make budgeting easier than ever with four easy rules and the help of YNAB. Available on Windows, Mac, iOS, and Android.

- Free Trial for 34-Days

- Available on Multiple Platforms

- Connects Multiple Accounts into One Platform

- No Alerts

- Learning Curve for New Users

Empower vs Quicken

A more accurate comparison might be comparing Empower vs Quicken considering the two offer similar services and capabilities. Unlike YNAB, which is primarily an a budgeting app, Quicken is also a budgeting service but also allows users to create personal plans. Both are ideal for the user who wants to manage their own money.

Particularly in the realm of wealth management, the two offer services such as;

- Investment tracking,

- Retirement planning,

- & home value tracking.

Quicken goes a step above when it comes to budgeting, planning out ways to get out of debt, and giving you access to your credit score. Empower does not offer free credit score checking. When it comes to pricing, Quicken charges every user starting at $34.99 per year whereas Empower is free to start. If you elect to enroll in wealth management services with Empower you will pay a percentage starting at .89%.

Empower vs Betterment

Unlike Empower who requires an AOM of at least $100,000, Betterment offers similar services, without requiring minimum investment. Betterment’s digital plan is also only .25% annually, compared to Empower’s .89% annual fee.

That said, the less expensive digital plan isn’t exactly comparing apples to apples. Betterment does not offer a personal advisor (Empower offers a team of two advisors for AOM over $200,000), hence the name “Digital Plan.” This means if you want accurately compare the two, you would want to look into Betterment’s premium plan which has access to real advisors and charges .40%. In this case, the less expensive option is Betterment.

Empower vs Wealthfront

Wealthfront is similar to Betterment in that it too charges .25% for assets under management annually, with only a $500 minimum to get started. Additionally, Wealthfront lets users access and create both savings and checking accounts while offering specialized investment portfolios.

One program Wealthfront offers – smart beta – is similar to hedge fund investing and they allow for more diverse wealth accumulation such as real estate investing bonds, and natural resources. That said, Wealthfront is ideal for someone who is just starting out or doesn’t have the $100,000 to begin using Empower’s investor services.

Empower vs Vanguard

Vanguard’s Personal Advisor plan also has a lower AOM requirement of $50,000, versus Empower’s $100,000, and their fee is lower at 0.35% of AOM. You can think of Vanguard Personal Advisor as a hybrid robo advisor with access to investment professionals as needed.

The Vanguard advisors all work as fiduciaries, so they always have your best interests in mind, while the robo-advisor technology uses top-notch financial planning and portfolio planning. You can set up goals to reach or take advantage of the automated tax-loss harvesting.

If you want something even cheaper, the Vanguard Digital Advisor requires only $3,000 AOM and charges $15 per $10,000 invested. This strictly robo-advisor won’t provide access to investment professionals like Empower, though. All support you receive is digital, but it’s a great hands-off (and cheaper) way to invest.

Empower vs Fidelity

Empower vs Fidelity is not like comparing apples to apples. Empower offers a hybrid approach to investing with access to a team of advisors. If you invest with them, that’s what you get. With Fidelity, you can access a true robo-advisor with Fidelity Go or wealth management services that provide a dedicated advisor.

Fidelity Go charges no advisor fees with assets of $25,000 or less and 0.35% of AOM if you have more than $25,000. When you reach the $25,000 level, you get access to one-on-one coaching too. There’s no account minimum to open an account, but you’ll need at least $10 to invest.

The advisory fee for the Fidelity wealth management services is much higher, as are the minimum balance requirements. You’ll need at least $500,000 to invest and pay a gross advisory fee of 0.5% – 1.5%.

FAQs

Is Empower Safe?

Managing over $10 billion in assets, it’s safe to say that Empower is safe. Like most large FinTech companies, Empower is legitimate and safe to use.

Is Empower Legit?

Empower is legitimate and safe to link your bank accounts to. They’re insured by the FDIC and they have been meaning assets totaling in the billions since 2009.

Is Empower Worth the Fee?

Fees are not always a bad thing when it comes to investing, however, this really boils down to your goals. At $100,000, you can qualify to pay for a wealth management team at .89%. If you have a high net worth, there are discounts available and the standard industry for a typical financial advisor is 1.25%. On the other hand, the average robo-advisor fee hovers around .30% making the Empower wealth management services slightly higher. That said, they do combine both robo algorithms and human planners.

Can Empower Be Hacked?

Like any other company/website providing financial services, Empower is just as likely/not as likely to be hacked. Protection is always at the forefront of any financial service companies mind, and Empower has a vigorous safety protocol for protecting user information and data.

How Does Empower Make Money?

Unlike other apps that make money selling products through affiliates, Empower makes their money by offering their financial planning services to those users with $100,000 or more under management who need help with tax optimization and don’t want to deal with investors.

Does Empower Sell Your Information?

Directly from their website, Empower’s core business is wealth management. This means that our objective is to win you over as a Empower Advisory Client. We do not rent, sell or trade your Personal Information.” Put another way, they do not sell user data or information.

How Do I Find My Empower Login?

Simply search for “Personalcapital login” on a search engine, open your app, or visit personalcapital.com in order to log in. If you are using a new device OR if you forgot your login information, you can follow the prompts to recover your password which may include having a temporary validation code sent to you.

Who Is Empower For?

A quick list of who Empower is ideal for includes:

- Likes to see their portfolio all in one place

- Isn’t opposed to paying fees for financial services (optional)

- Has 1 million in investments

- Like a nice mobile app that is user friendly

- Wants to have a free investment checkup

- If you want to assess management fees

- Help with asset allocation

- Need a financial advisor and don’t know where to start

- If you need financial management help

Paid Empower features are not for those who:

- Like to manage individual stocks

- Do not want to pay for investment advisory services

- Has less than $100,000

- Wants to avoid management fees

- Has access to their own tools for investing, wealth management, etc

- Likes to manage their own portfolio without the help of an advisor

Is Empower Right For You?

Growing up, it was common to hear financially savvy people say things like, “The best investment tool is the one that makes you money.” This statement couldn’t be more spot on. In this 2021 Empowerreview here is what you should know:

- Empower is worth having

- Consider the investment accounts features and assess their management fee carefully

- Have a goal for your investments if you’re over $100,000

Depending on your goals as it pertains to investing and tracking your money, using Empower is very beneficial for most people. The visual net worth tracking features made possible by the financial dashboard is extremely beneficial – no matter what you are looking for!

Determining whether or not Empower is right for you really boils down to your need for paid financial services. If you are someone in need of financial services, the combination of robo-advisors and human advisors is a pro to Empower.

Keeping in mind of course, that if you’re not at $100,000 in investments, you would need to first reach this threshold prior to using Empower’s dedicated financial advisors and paid services. With regards to fees, depending on who you ask the.89% account management fee can be seen as pricey.

Either way, it’s worth giving Empower a shot and finding out for yourself!

Looking to get started investing in real estate? Here are the 11 Best Real Estate Investing Apps

Samantha Hawrylack is a personal finance expert and full-time entrepreneur with a passion for writing and SEO. She holds a Bachelor’s in Finance and Master’s in Business Administration and previously worked for Vanguard, where she held Series 7 and 63 licenses. Her work has been featured in publications like Grow, MSN, CNBC, Ladders, Rocket Mortgage, Quicken Loans, Clever Girl Finance, Credit Donkey, Crediful, Investing Answers, Well Kept Wallet, AllCards, Mama and Money, and Concreit, among others. She writes in personal finance, real estate, credit, entrepreneurship, credit card, student loan, mortgage, personal loan, insurance, debt management, business, productivity, and career niches.

steveark

Monday 1st of March 2021

We've got an account managed by Personal Capital and I like their approach which is very different than cap weighted index funds. Since the rest of my investments are in index funds I find it gives me some useful diversity. The fees are 0.79% for my sized account, which is arguably higher than a robo but they also provide me individual tax and retirement advice.