Are you struggling to make ends meet? Living paycheck to paycheck? Are you getting by but finding yourself with little to no money left at the end of the month, with no savings? Maybe you don’t know how to budget at all. Perhaps you’re making ends meet but you aren’t satisfied with the progress you’re making each month.

Society considers all of these scenarios to be “normal,” so please don’t be discouraged. We’re here to help you break these societal norms and get you on your way to meeting your financial goals!

Even if this is your first budget ever, we’ve outlined simple steps to follow in this chapter. By tracking every dollar and starting to analyze your bank statements you will tackle this feat!

Budgeting Misconceptions

Before we get too deep into this, we wanted to make sure we’re all on the same page. There are a lot of misconceptions that surround the word “budget”. In fact some people won’t even try to learn how to budget because of these misconceptions. Let’s put them to rest once and for all.

“Having a budget will restrict me from doing what I want.”

WRONG – Budgeting gives you the flexibility to plan ahead for the things you want to have and activities you want to do. Because you planned ahead, you will be able to pay in CASH and have no guilt. It is actually very freeing.

“Making a budget is difficult, and I don’t have the time.”

WRONG – Once you have the correct tools, it is easy to set up a budget based on your income and spending. After your budget is set up, it will only take a few minutes to make minor adjustments on a month-to-month basis.

“Budgeting is checking to see what I spent at the end of the month.”

WRONG – Budgeting is spending based on how much income you bring in. You can’t spend or save more than you make. Looking at how much you spent at the end of the month can be a sure way to put yourself in a bind if you didn’t have a plan.

“As long as my card doesn’t get declined – I’m good”

WRONG – Oh boy, this one just makes me anxious. Hopefully you’re not spending recklessly with your credit card like that. If you are – we hope you learn why that’s very reckless. You need to be more intentional with your spending habits. Who knows, making a budget may just change your life. At a minimum, your bank account will thank you next month when it’s not negative or sitting empty.

How can you break these societal norms? By understanding how to budget your money. Budgeting involves making a monthly plan for your money. It shows how much money is coming in, going out, and how much you are saving. If you’re doing it right, hopefully, your balance is zero at the end of the month and you’re not overspending.

Budgeting can be an overwhelming word. It can summon fear and anxiety for many reasons. Such as, being unfamiliar with how to go about it, or being uneasy about analyzing spending habits. Others simply don’t have the right tools.

On this page, we are going to debunk the myths surrounding your monthly financial plan. Consider this a clear guide for implementing budgeting into your life. We’ll help you make your own budget so that you can fully understand where your money is going each and every month. Once you get started and see how easy managing your money is, you’ll never go back.

What Am I Budgeting For?

Budgeting is an important part of the FIRE journey because it is a means toward reaching a goal. Whatever that goal is, seeing where your money is going each month will definitely help you get there.

There are many goals that budgeting can help with, such as:

- Financial stability

- Better money management skills

- Emergency funds

- Creating a smarter spending plan

- Managing discretionary spending

- Debt payoff / Debt repayment

- Retirement savings

- House downpayment

- Education savings

- Car savings

- Traveling

- Items that are important to you

Understanding How To Budget

Let’s get started!

- Make a commitment between you and your spouse, if applicable, to stick to your new monthly budget.

- Calculate your take-home income.

- Set your goals and prioritize them.

- Determine your spending categories and how much money you spend on them.

- Make sure your budget equals 0!

- Review and adjust throughout the month, as needed.

- Repeat each month.

We are going to walk you through the budgeting process step-by-step with examples.

Want to follow along? Sign up below to receive our budgeting resources. You’ll get our budgeting worksheet + budget spreadsheets.

Analyze Your Income

The first step requires you to consider how much money you bring home monthly from each income source. In other words, add up your paycheck amounts for each job.

In the income section at the top of the spreadsheet, enter your take home pay for each month by the source.

Example:

Income 1: Company A – $2,418.14

Income 2: Company B – $1,729.37

Side Hustles: $497.24

How To Budget with Variable Income

Whether you have multiple sources of income that varies, or a single source that isn’t steady, budgeting can be frustrating. Those with an irregular income or variable income should create a budget that leaves some cushion. We know first hand that budgeting with variable income can be difficult, as we’ve done it for several years. It takes some practice, but after a few months you will get the hang of it.

Our suggestion is rather than guessing what your next month’s income will be, take your lowest pay from the previous six months and use that number as if it is a fixed income. Budgeting with your lowest month’s income leaves you room to breathe and removes added stress on lower earning months. This also allows you to never run short, and any additional income you may get can be added to your budget. Having more take-home pay than expected is never a bad thing!

In our case, this resulted in more savings! That being said, if paying off debt is one of your goals, you can allocate the extra cash accordingly.

How Do You Survive A Low Income Budget?

Budgeting with a low income is really no different than budgeting with a high income. The major differences will be, you have to work a lot harder to keep your expenses low so they fit within your budget. Get creative with your meals.

Eliminate all unnecessary expenses from your budget. Learning to cut back, can be very difficult at first. Work to create a realistic budget strategy that works for you. Learning to be more frugal, eating out less, getting a budget in order and giving up smaller luxuries lets your dollars stretch further.

Working on increasing your income through career advancement, continuing your education, getting additional training, taking some courses, or even picking up a side hustle would help.

Analyze Your Spending

What do you spend your money on?

The second step involves thinking about what you spend your money on every month. As you can see in the template, there are many different categories. We’ve listed groceries, gas, utilities and your mortgage, to name a few. These are all expenses that you should include in your budget and subtract from your net income.

In the template you will also find many different line items for potential expenses. Is anything missing? Feel free to add any additional items to the budget. Likewise, feel free to delete any rows that do not apply to you.

Budget Categories and Percentages

Next, fill in the amount you will spend in each category in the appropriate cell of the template.

Example:

Electric: $110

Water: $55

Sewer: $49

Cable/Internet $95

You will notice that as you add expense and savings amounts to each category, it will subtract them from your net income and give you a ‘balance’. The goal is to attain a zero-based budget.

Income = Expenses + Savings

You cannot spend or save more than you earn.

So, let’s say that your household brings in $4,000 per month. The totality of your expenses and savings should also be $4,000 per month. The ‘balance’ at the end of the month should be zero.

Sometimes items fall into a grey area and are hard to categorize, especially when you only have that expense every once in a blue moon. We normally put these into a miscellaneous or other category of our budget. If that throws things off a little bit, we just make adjustments as necessary.

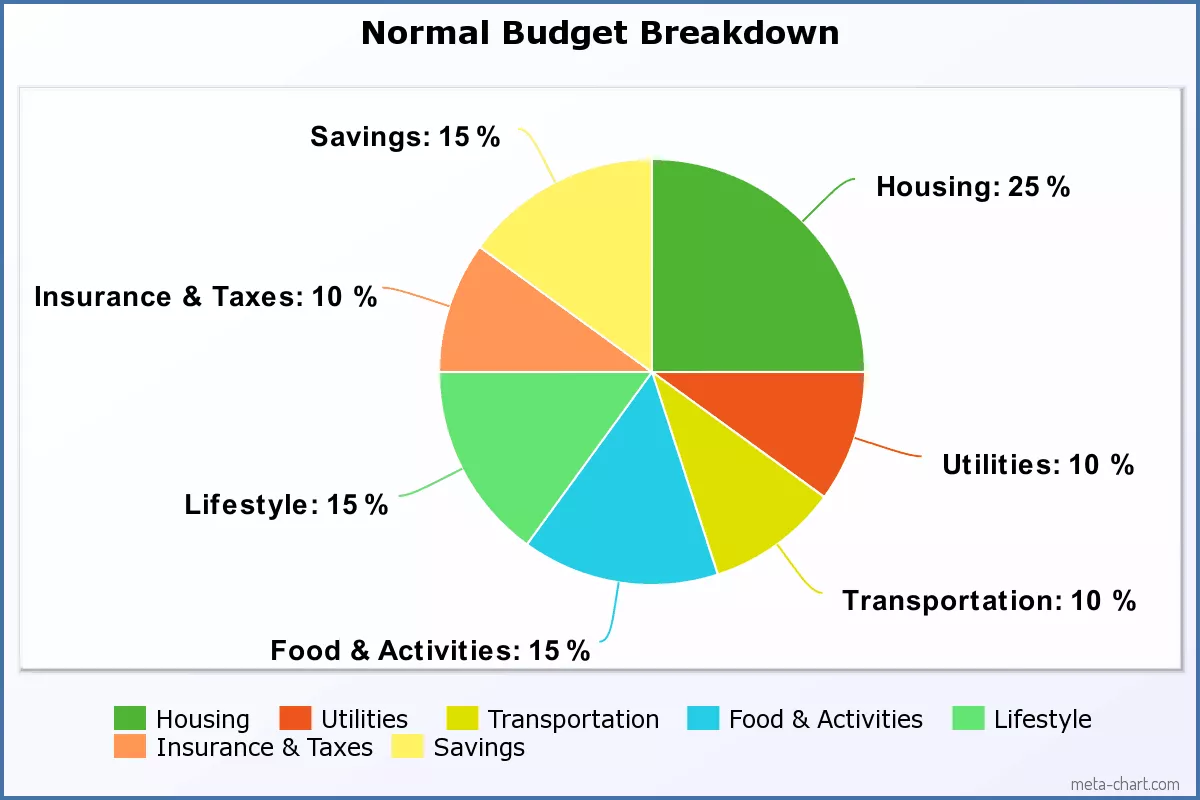

Below is a guideline detailing how to allocate your monthly expenses and savings.

Each situation will vary, so don’t worry if they don’t match up exactly as shown.

If you’re still working on paying off debt, expect these categories to be shifted around. This is only a suggested guideline. Make sure your essential living costs are covered before working to pay off debt. You need to keep a roof over your head and feed your family first, then you can worry about your debt payments.

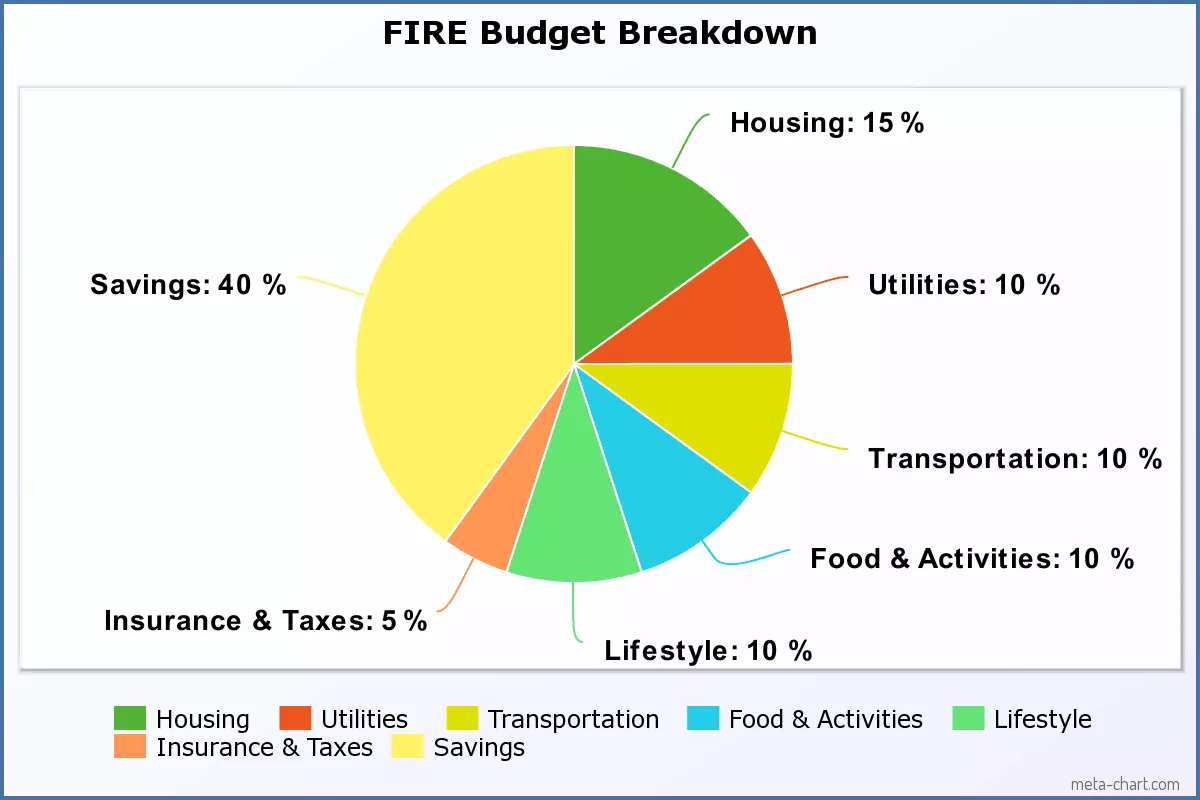

Fire Budget Example Percentages

Already know how to budget? Maybe you’re a high income earner/have a high savings rate. Here’s an example of a FIRE Budget breakdown. Most people pursing financial independence try to achieve a 40-60% savings rate.

How Do You Handle Debt Repayment While Budgeting?

Treat debt repayment just like any other line item in your budget. Make sure you’re already minimizing all expenses and working on increasing your income.

The type of debt doesn’t really matter whether you have student loans, credit card debt, auto loans, personal loans or payday loans they should be treated the same. We go over which method of debt repayment is best in the debt chapter of our FIRE guide.

To start make sure you’re able to meet the minimum payments each month.

Then take any extra money in your budget and pay it towards your principal. What matters most here is that you can get out of debt, regardless of your monthly income. Start to track your habits and craft a personal budget that fits your needs.

What About Expenses That You Don’t Pay Every Month?

You may have expenses, like car insurance or life insurance, that you pay on an infrequent basis (bi-annually, quarterly, etc). You should still include these expenses in your monthly budget. Calculate how much this expense costs you on a monthly basis and set that amount aside in a different account. These accounts are called sinking funds. When the bill is due, you will be able to pay it in cash.

Example:

The Smiths pay $1,500 for their vehicle insurance bi-annually.

$1500 / 6 months = $250 / month

The Smiths should be budgeting $250 per month for their insurance and setting it aside ensuring they have the cash to pay the bill once it’s due.

The Best Budgeting Resources

There are many different options for creating a budget. Many people choose to use programs that can automatically track spending from their checking accounts and/or their credit cards. Once a transaction is posted, they can simply drop it into a category. This allows them to see how much they have spent so far in a category, and how much they have left to spend from their budget with little effort.

Here are a few budgeting tools available to choose from:

- Spreadsheets (Microsoft Excel or Google Sheets) such as our FREE How To FIRE Budget Template

- Pen and Paper

- YNAB

- Mint

- Quicken

- EveryDollar

- Empower (our favorite way to track our finances)

The Best Budgeting Tools To Reach Financial Independence

The Best Budgeting Tools To Reach Financial Independence

Read our article on the best budgeting tools!

Read Now!

More Budgeting Tips

- It is important to be on the same page with your spouse/significant other. Make sure that the budget is something you do together, and all parties agree on it. Budgeting will not work if all parties are not keeping to the plan.

- We suggest sitting down to work on the monthly budget once, before the month begins. As you progress through the month, review your transactions to ensure that you are sticking to your set allocations. If necessary, make changes if all parties agree.

- It is important to be able to cover an emergency if necessary. You may choose to allocate some of your income towards an EF regularly.

- As mentioned in Step Two, remember to create a line item for any sinking funds you have. It is a good idea to set this money aside every month in a different account until that bill is due. This way, you are prepared to cover that bill in full with cash.

- At month end, you can analyze where you spent your money. This will help you decide if there is any particular category in which you need to cut down spending. Alternatively, it will help you know if you need to allocate additional funds toward a particular category on a monthly basis.

- Be forgiving and patient! Budgeting takes a few months to perfect. Don’t be discouraged if you feel like this process is mostly trial and error at first. You will get it!

- Consider starting a sinking fund for known future “unexpected expenses” such as car repairs. Set aside a small amount each month for these types of things, so when they do occur you have some buffer – rather than slowing down your progress towards your financial goals.

- Struggling to make budget tools work? You may need to try using something like a cash envelope system. This also helps make budget changes on irregular income easier, you only budget with the cash on hand.

How Can I Save Money On A Budget?

Saving money on a budget can be difficult, depending on your income and spending habits. Personal finance is very personal, and everyone has different financial goals. So you’ll need to make budget changes that align with your savings goal.

Pay yourself first by increasing your 401k/HSA contributions will give you pre-tax savings into your retirement accounts. These savings won’t be shown on your budget, because this money won’t be in your take-home pay.

Setting aside a little of bit of money each month into your savings account or checking account helps build some additional cash. This could be used either as an emergency fund or as a sinking fund.

Still Having Difficulty With Your Budget?

Budgeting is difficult! There are many reasons why someone may struggle with the concept and execution. If this is your first time budgeting, you will have to get used to it. Allow yourself time to adjust to this new way of life. Once you get the hang of it, you’ll never want to go back!

As we mentioned, there are many misconceptions associated with budgeting. These can bring up negative emotions. Remember that budgeting does not restrict you. It enables you to do the things you want to do and spend your money on whatever you want or need to. It can be hard to not have as much flexibility to buy things spontaneously. Just remember the goals you set for yourself and plan for fun things in your budget every month.

If you find the process of setting up a budget overwhelming, take it step-by-step. Break everything down into sections (income, categories, amounts).

If you set it up in our How To FIRE Budget Template, you can use that data every month moving forward.

Fixed expenses and sinking funds won’t change from month to month, so it is very likely that you will only have a few category amounts to adjust monthly. This brings your initial set up time for month 1 down to only a few minutes each month afterward!

Another aspect that can make budgeting difficult is if unexpected expenses come up. Life happens. It is inevitable that an emergency or an unexpected expense will need to be addressed at some point, no matter how much you plan. This is why it is important to make yourself a priority. Pay yourself first and put money away in an emergency fund. This will give you peace of mind, and allow your plan to stay intact.

You can overcome these difficulties with practice, patience, determination, and discipline.